Did Changing Sentiment Drive GBLT's (CVE:GBLT) Share Price Down A Worrying 53%?

GBLT Corp. (CVE:GBLT) shareholders should be happy to see the share price up 14% in the last week. But that isn't much consolation to those who have suffered through the declines of the last year. Like a receding glacier in a warming world, the share price has melted 53% in that period. Some might say the recent bounce is to be expected after such a bad drop. Of course, it could be that the fall was overdone.

View our latest analysis for GBLT

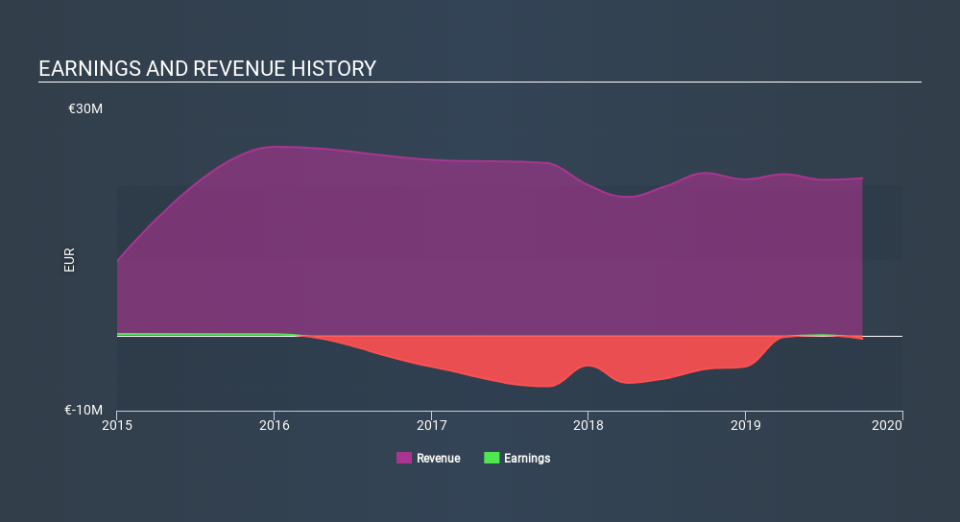

GBLT wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year GBLT saw its revenue fall by 3.2%. That looks pretty grim, at a glance. The share price drop of 53% is understandable given the company doesn't have profits to boast of. Having said that, if growth is coming in the future, the stock may have better days ahead. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on GBLT's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt GBLT shareholders are happy with the loss of 53% over twelve months. That falls short of the market, which lost 17%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 27%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand GBLT better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for GBLT you should be aware of, and 2 of them shouldn't be ignored.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance