Did Changing Sentiment Drive DeepMarkit's (CVE:MKT) Share Price Down A Disastrous 98%?

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of DeepMarkit Corp. (CVE:MKT), who have seen the share price tank a massive 98% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 77%, so we doubt many shareholders are delighted. It's up 40% in the last seven days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for DeepMarkit

DeepMarkit recorded just CA$8,295 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that DeepMarkit can make progress and gain better traction for the business, before it runs low on cash.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. It certainly is a dangerous place to invest, as DeepMarkit investors might realise.

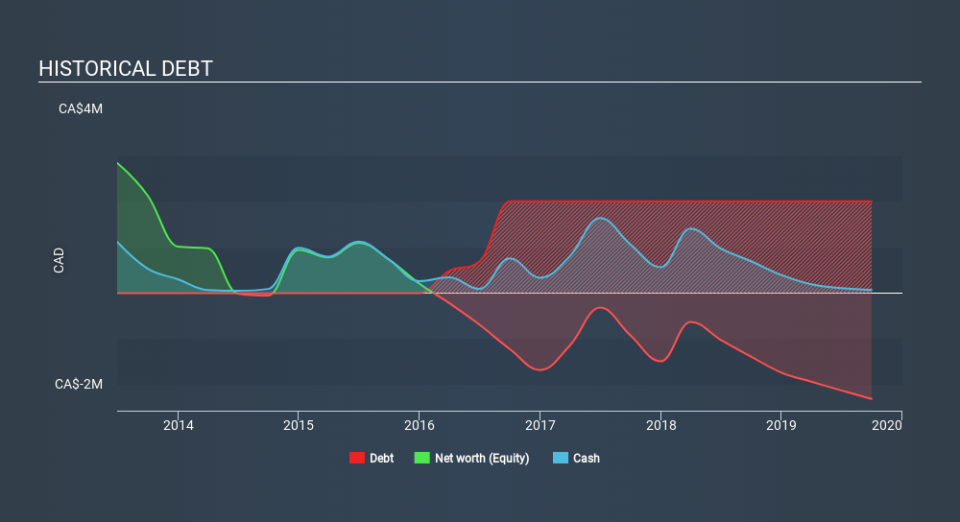

Our data indicates that DeepMarkit had CA$2.3m more in total liabilities than it had cash, when it last reported in September 2019. That makes it extremely high risk, in our view. But with the share price diving 72% per year, over 3 years , it's probably fair to say that some shareholders no longer believe the company will succeed. The image below shows how DeepMarkit's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

A Different Perspective

We regret to report that DeepMarkit shareholders are down 77% for the year. Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 52% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand DeepMarkit better, we need to consider many other factors. To that end, you should learn about the 6 warning signs we've spotted with DeepMarkit (including 4 which is are concerning) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance