Did Business Growth Power Carvana's (NYSE:CVNA) Share Price Gain of 205%?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Carvana Co. (NYSE:CVNA) share price had more than doubled in just one year - up 205%. Also pleasing for shareholders was the 36% gain in the last three months. We'll need to follow Carvana for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Carvana

Carvana isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Carvana grew its revenue by 109% last year. That's stonking growth even when compared to other loss-making stocks. Meanwhile, the market has paid attention, sending the share price soaring 205% in response. It's great to see strong revenue growth, but the question is whether it can be sustained. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

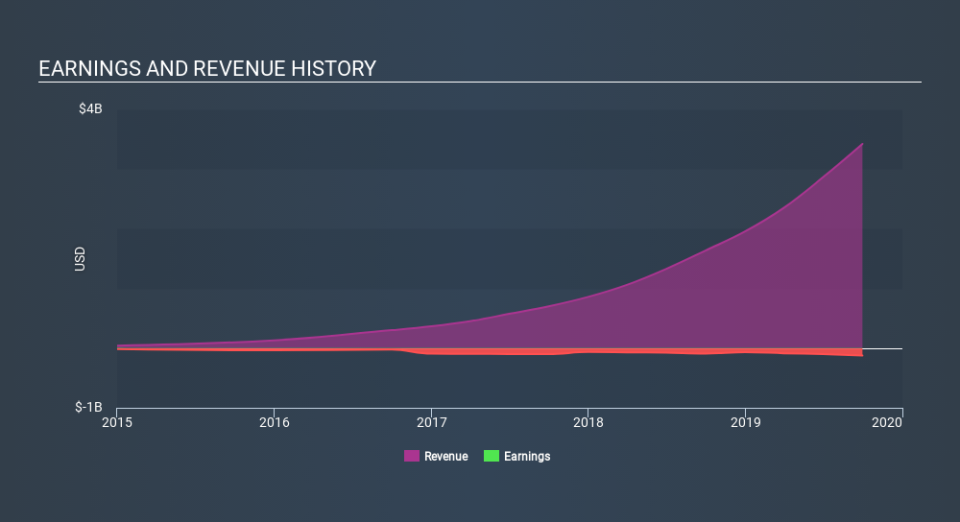

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Carvana

A Different Perspective

It's nice to see that Carvana shareholders have gained 205% over the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 36%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Carvana may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance