Did Alexco Resource’s (TSE:AXR) Share Price Deserve to Gain 51%?

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the Alexco Resource Corp. (TSE:AXR) share price is up 51% in the last three years, clearly besting than the market return of around 15% (not including dividends).

Check out our latest analysis for Alexco Resource

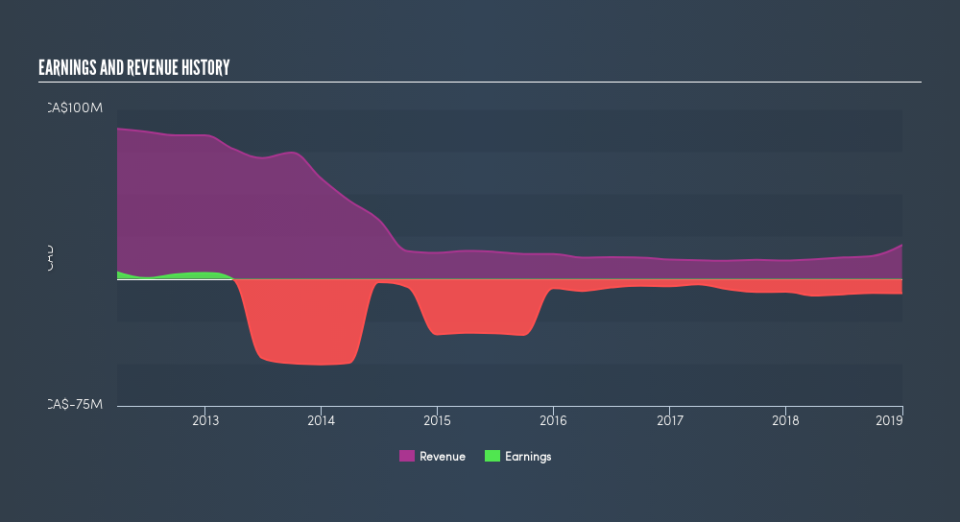

Given that Alexco Resource didn’t make a profit in the last twelve months, we’ll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years Alexco Resource has grown its revenue at 5.5% annually. Considering the company is losing money, we think that rate of revenue growth is uninspiring. In that time the share price is up 15% per year, which is not unreasonable given the revenue gorwth. The real question is when the business will generate profits, and how quickly they will grow. Given the market doesn’t seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

Depicted in the graphic below, you’ll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Alexco Resource had a tough year, with a total loss of 3.4%, against a market gain of about 3.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 4.8% doled out over the last five years. We’d need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Before spending more time on Alexco Resource it might be wise to click here to see if insiders have been buying or selling shares.

But note: Alexco Resource may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance