Devon Energy (NYSE:DVN) Seems To Use Debt Quite Sensibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Devon Energy Corporation (NYSE:DVN) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Devon Energy

What Is Devon Energy's Debt?

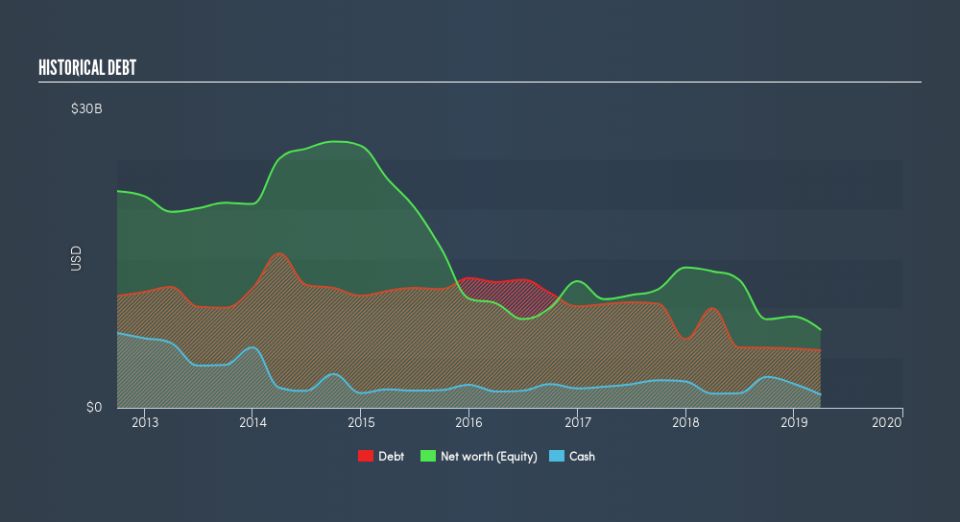

As you can see below, Devon Energy had US$5.79b of debt at March 2019, down from US$10.0b a year prior. On the flip side, it has US$1.33b in cash leading to net debt of about US$4.46b.

A Look At Devon Energy's Liabilities

Zooming in on the latest balance sheet data, we can see that Devon Energy had liabilities of US$1.97b due within 12 months and liabilities of US$8.25b due beyond that. Offsetting these obligations, it had cash of US$1.33b as well as receivables valued at US$1.04b due within 12 months. So it has liabilities totalling US$7.86b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its very significant market capitalization of US$11.2b, so it does suggest shareholders should keep an eye on Devon Energy's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Devon Energy has net debt worth 1.5 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 3.3 times the interest expense. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Importantly, Devon Energy grew its EBIT by 81% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Devon Energy can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last two years, Devon Energy's free cash flow amounted to 38% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

On our analysis Devon Energy's EBIT growth rate should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to cover its interest expense with its EBIT. Looking at all this data makes us feel a little cautious about Devon Energy's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. We'd be motivated to research the stock further if we found out that Devon Energy insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance