Deutsche Bank (DB) to Cut Down Operations in South Africa

Deutsche Bank DB is closing corporate broking, advisory and sponsor-service operations at its South African unit in a period of six months, with a view to boost profitability. The bank, however, refrained from mentioning the number of jobs that will be impacted.

Through its office at South Africa, Deutsche Bank provides corporate-finance advisory, trading, foreign-exchange and fixed income along with global transactional banking services.

The Frankfurt-based lender is taking this step as part of a global review of its business conducted under leadership of its new CEO, Christian Sewing who aims to bring a speedy turnaround in the bank’s performance.

“There will be an orderly wind-up over a period of up to six months,” said the bank’s spokesman. He further added, “Our debt capital markets, fixed-income and treasury products in South Africa will not be affected. We remain committed to our South African clients.”

Recently, the bank was hit by troubles ranging from ratings downgrade by top agencies to being sued with criminal charges for alleged “cartel” conduct over the sale of ANZ Bank’s shares, back in 2015.

“Many of you are sick and tired of bad news,” Sewing had written to the employees recently amid all the stress. Though Deutsche Bank is undertaking steps to achieve various financial targets laid down by Sewing, stringent regulations and low interest rates environment might hamper its growth to some extent. Also, involvement in legal proceedings remains another concern.

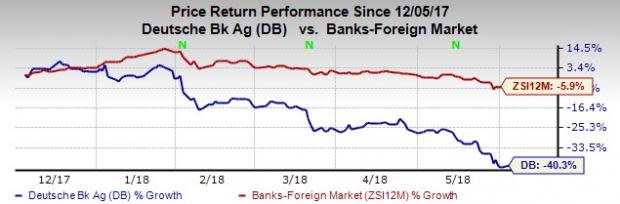

In six month's time, the bank’s shares have lost 40.3% on the NYSE compared with 5.9% decline recorded by the industry.

Deutsche Bank currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the same space are Credicorp Ltd. BAP, Banco Santander Chile BSAC and The Bank of N.T. Butterfield & Son Limited NTB. All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Credicorp has been raised nearly 1% for the current year, in the last 60 days. The company’s share price has jumped more than 33% in the past year.

Banco Santander Chile has witnessed stable earnings estimates for 2018, in the last 60 days. Its share price has risen more than 32% in the past year.

Bank of N.T. Butterfield & Son’s shares have gained more than 44% in a year. Its earnings estimates for 2018 have moved up 4.1% in the last 60 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

Banco Santander Chile (BSAC) : Free Stock Analysis Report

Credicorp Ltd. (BAP) : Free Stock Analysis Report

Bank of N.T. Butterfield & Son Limited (The) (NTB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance