Detroit's Big 3 Automakers Fall Flat With Low Sales

Detroit's big three automakers, Ford Motor Co. (NYSE:F), General Motors Co. (NYSE:GM) and Fiat Chrysler Automobiles NV (NYSE:FCAU), have all seen their values beaten down upon the release of second-quarter sales figures.

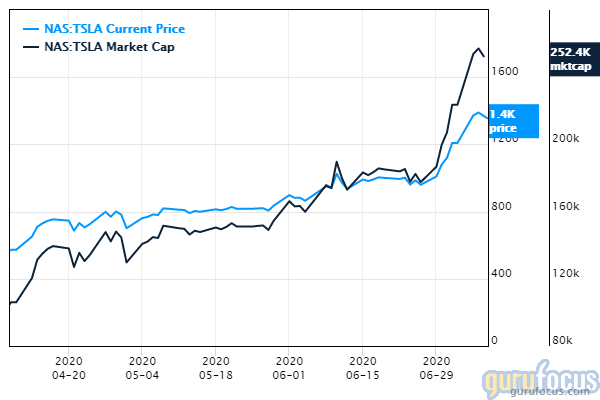

In stark contrast, electric vehicle producer and news superstar Tesla Inc. (NASDAQ:TSLA) has seen its price skyrocket throughout 2020 on the heels of first-quarter profits and consistent vehicle deliveries. In the last month alone, Tesla has increased its market cap by almost $70 billion, the combination of all three traditional automakers' market caps.

Ford

Compared to 2019, the 433,869 vehicles that Ford sold in the second quarter of 2020 was a decrease of 33.3%. The ongoing pandemic is claimed by Ford to be a clear problem for its sales. Ford's F-Seriestrucks, America's best-selling pickup trucks, saw sales decrease by 2% during the quarter, highlighting the company's struggle.

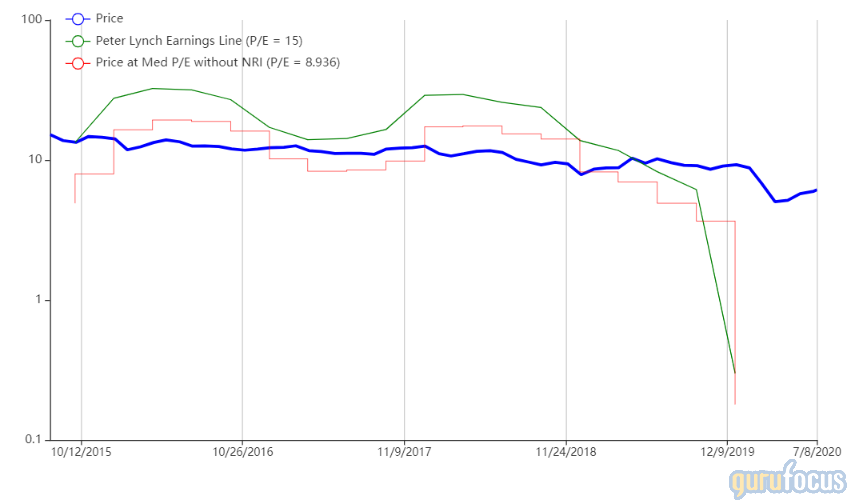

On July 8, Ford was trading at $6.08 per share, down 0.64%, with a market cap of $24.10 billion. According to the Peter Lynch chart, the stock was trading well above its intrinsic value at the end of 2019.

GuruFocus gives the company a financial strength rating of 3 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 8 out of 10. The company's cash-to-debt ratio of 0.28 places it lower than 63.55% of the industry. The price-sales ratio of 0.16 places it above 84.00% of the industry and the company has maintained positive free cash flow.

GM

For the second quarter, GM reported the sale of 492,489 vehicles. This was a decrease of 34% compared to the second quarter of 2019. GM also claimed problems with sales due to the pandemic, but has seen positive signs of recovery with deliveries to retail customers.

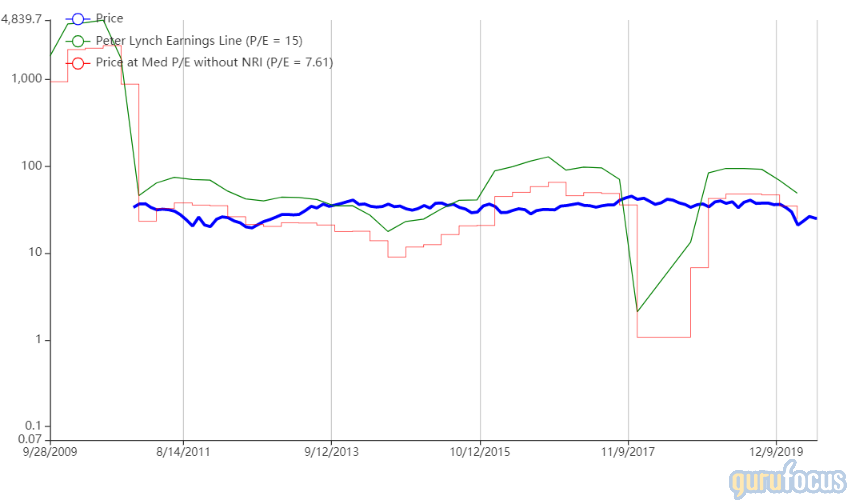

GM was trading at $24.90 per share on July 8 with a market cap of $35.51 billion. According to the Peter Lynch chart, the stock has historically traded close to its fair value.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rank of 6 out of 10. The company has issued increased levels of long-term debt over the past several years and the Altman Z-Score of 0.92 places it in the distress zone with bankruptcy a potential threat in the next two years.

Fiat Chrysler

Reported on July 1, Fiat Chrysler sold 367,086 during the second quarter. Compared to 2019, this was a decrease of a whopping 39% in overall vehicle sales. The company said sales had partially recovered during the months of May and June.

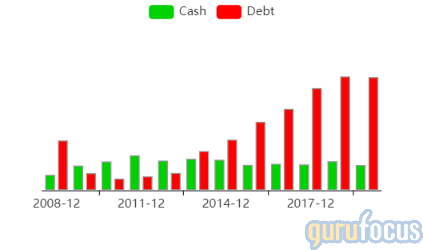

On July 8, Fiat Chrysler was trading at $9.93 per share, down 1.64%, with a market cap of $20.03 billion. The Peter Lynch chart suggests the stock was trading around fair market value when the pandemic set in.

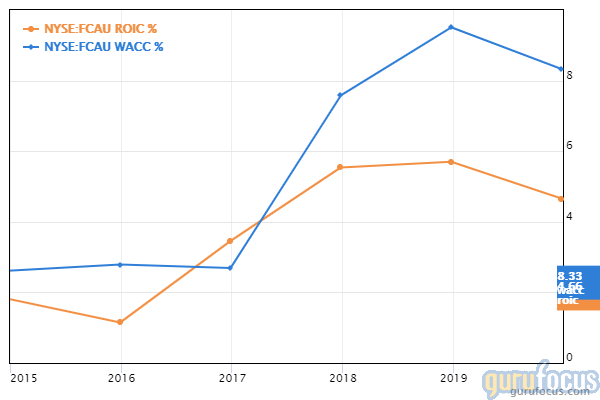

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rank of 6 out of 10. The company shows a severe warning sign of revenue per share declining in recent months. The cash-to-debt ratio of 0.94 is above 65.53% of competitors thanks to the company decreasing debt over time. The return on invested capital is heavily outweighed by the weighted average cost of capital.

Sales of automobiles reached historical lows in April of this year at 8.7 million vehicles sold. According to GuruFocus data, vehicle sales numbers were previously lowest in December 1981 at 8.85 million vehicles sold. Prior to the pandemic, sales had settled around 15 million to 18 million vehicles per year after the recession of 2008 to 2009.

Disclosure: Author owns no stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance