Despite Trump's promise of a China trade deal, farmers plan to grow fewer soybeans in 2019

When President Donald Trump was having the highly-anticipated dinner with China’s President Xi Jinping at the G20 summit, farmers in the Midwest had just finished harvesting their crops and were busy placing seed orders for next year.

Like many investors, they were closely watching the meeting, and as expected agricultural products came up in the discussions. According to the White House, China has agreed to buy agricultural products from the U.S. immediately. “Farmers will be a very BIG and FAST beneficiary of our deal with China,” Trump tweeted following the meeting.

But so far, farmers are hesitant to believe Trump and his cheerful promises. “I don’t think there is anyone changing their crops mix up for spring today from last week. Even if China starts to buy, the question is, how big the buy will be?” said Kristin Duncanson, a soybean farmer in Minnesota. “We’re hopeful, but we’ll be cautious.”

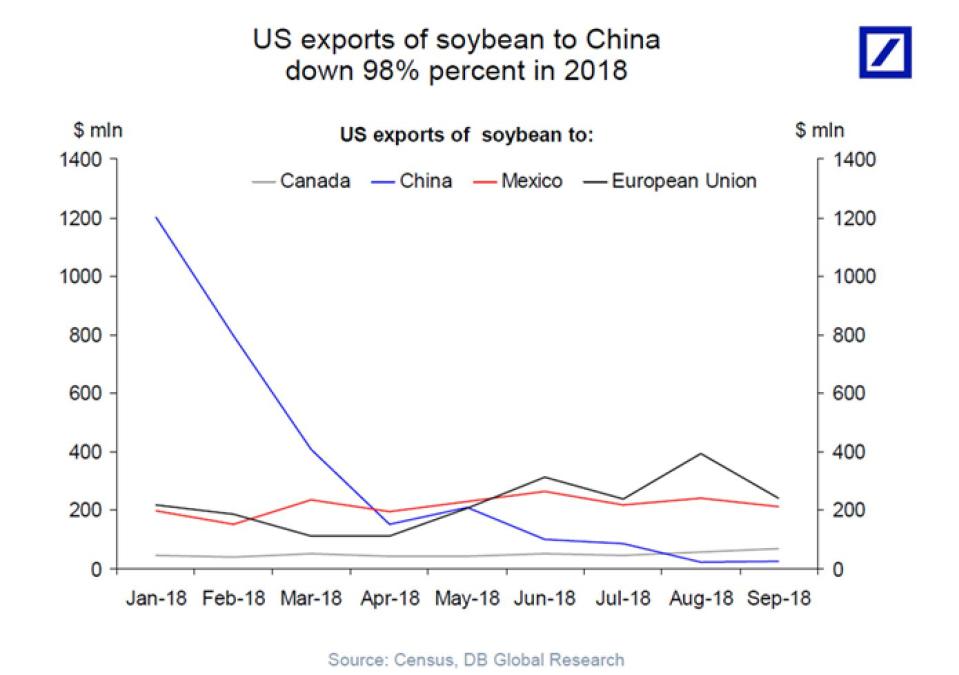

While the temporary U.S.-China trade war ceasefire is good news to many, some farmers have decided to grow fewer soybeans next year after a painful 2018. China used to be the largest purchaser of U.S. soybeans, but the market plunged 98% from the $1.2 billion imports in January. China levied a 25% tariff on U.S. soybeans in a retaliatory strike and turned to other soybean growers like Brazil.

Soybean plants in the U.S. hit a record 89.1 million acres planted in 2018. The U.S. Department of Agriculture expects it to drop 7.4% to 82.5 million acres in 2019 — the largest year-over-year decline since 2007.

“We do not see much promise in soybeans for next year as basis continues to reveal that the market does not want soybeans, and there is a lot of soybeans from 2017 that have not been moved,” Scott Henry, who runs a family farm named Long View in Iowa, told Yahoo Finance. “This will take a while to chew through and so we are continuing to anticipate higher corn acres on our farm next year.”

Farmers turn to corn for safety

Henry’s plan echoes many other farmers across the country. Blake Hurst, who has been a farmer for 40 years, usually grows half soybean and half corn, and rotates the two crops every year at his family farm in northwest Missouri. Having seen the disruption in the market by the trade war, he has purchased more corn seeds than in previous years and plans to shift 5%-10% of production to corn.

Most farmers don’t want to gamble by cutting all of their soybean production since they still sell soybeans to other countries, including Mexico, Netherlands and Japan. But the trade dispute with Beijing doesn’t just cause them to lose the big market, it also affects soybean prices, which has been down more than 5% since the beginning of this year.

Although Hurst has paid for his corn seeds, he is still waiting to see if any breaking deals happen. “Until planting on the ground in late March, we can make the changes if needed,” he said. The current deadline for China to strike a trade deal with the U.S. is March 1.

Until then, he will keep a close eye on the Trump’s Twitter feed, which sometimes sends mixed messages. “I do not like Mr. Tariffs man, that was not helpful,” said Hurst, referring to a tweet in which Trump called himself “a Tariff Man.”

Krystal Hu covers technology and trade for Yahoo Finance. Follow her on Twitter.

Read more:

White House keeps contradicting itself on U.S.-China trade negotiations

Here are the discrepancies between statements from U.S. and China on Trump-Xi meeting

Trump thinks tariffs are the only way to get China to change, some say no

Why you won’t feel much pain from Trump’s tariffs this holiday season

Amazon bought Whole Foods a year ago. Here’s what has changed

Yahoo Finance

Yahoo Finance