Despite currently being unprofitable, Wide Open Agriculture (ASX:WOA) has delivered a 404% return to shareholders over 3 years

Wide Open Agriculture Limited (ASX:WOA) shareholders might be concerned after seeing the share price drop 12% in the last week. But that doesn't displace its brilliant performance over three years. Over that time, we've been excited to watch the share price climb an impressive 404%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. The only way to form a view of whether the current price is justified is to consider the merits of the business itself.

While the stock has fallen 12% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Wide Open Agriculture

Wide Open Agriculture wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Wide Open Agriculture's revenue trended up 94% each year over three years. That's much better than most loss-making companies. And it's not just the revenue that is taking off. The share price is up 71% per year in that time. It's always tempting to take profits after a share price gain like that, but high-growth companies like Wide Open Agriculture can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

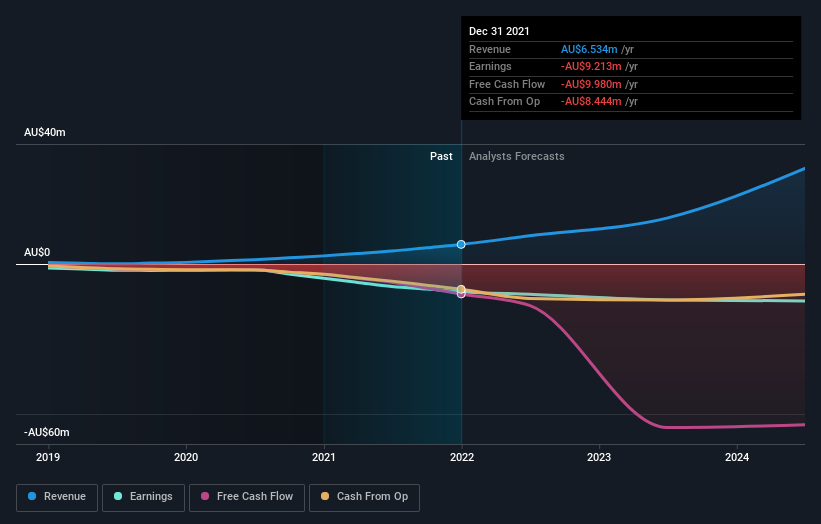

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The last twelve months weren't great for Wide Open Agriculture shares, which cost holders 23%, while the market was up about 4.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 71% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Wide Open Agriculture is showing 5 warning signs in our investment analysis , and 1 of those is concerning...

Of course Wide Open Agriculture may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance