DENTSPLY SIRONA (XRAY) Beats on Q3 Earnings, Ups '19 View

DENTSPLY SIRONA Inc. XRAY reported adjusted earnings per share (EPS) of 57 cents in the third quarter of 2019, beating the Zacks Consensus Estimate of 50 cents. The bottom line surged 51.4% from the prior-year quarter’s figure.

The Zacks Rank #2 (Buy) company’s revenues rose 3.6% year over year to $962.1 million and outpaced the Zacks Consensus Estimate of $944.9 million. Per management, internal sales growth was 7.5%.

Business Details

Net sales Excluding Precious Metal Content

Net sales, excluding precious metal content, came in at $950.6 million. The figure increased 3.3% on a year-over-year basis.

For investors’ notice, DENTSPLY SIRONA’s precious-metal dental alloy products — used by third parties to construct crown and bridge materials — are subject to price fluctuations.

Technology & Equipment

Per management, Technology & Equipment revenues rose 5.1% year over year in the third quarter to $534.5 million. Per management, growth came on the back of Digital Dentistry and Healthcare, offset partially by weakness in Equipment & Instruments sales and competitive pressures in Imaging business.

Consumables

DENTSPLY SIRONA Consumable revenues rose 1.8% year over year to $427.6 million in the reported quarter. Per management, the upside was driven by growth in sales of Restorative and Endodontics products.

Revenues by Geography

In the United States, revenues moved up 2.5% to $337 million and 4% internally. Rest of World revenues increased 5.1% year over year to $263.7 million. Revenues in the geography grew 10% on an internal sales growth basis. European revenues climbed 3.6% year on year to $361.4 million. On an internal sales growth basis, European revenues increased 8.4%.

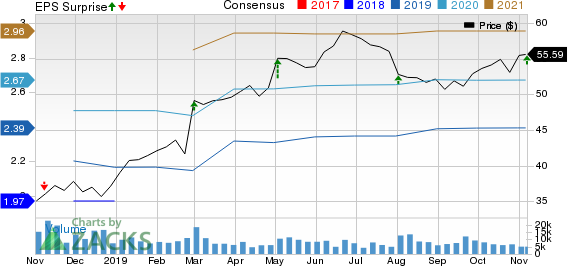

DENTSPLY SIRONA Inc. Price, Consensus and EPS Surprise

DENTSPLY SIRONA Inc. price-consensus-eps-surprise-chart | DENTSPLY SIRONA Inc. Quote

Margin Analysis

Adjusted gross profit in the reported quarter amounted to $547.9 million, up 7% on a year-over-year basis. Adjusted gross margin was 53.6%, up 60 basis points (bps).

Adjusted operating income totaled $172.3 million, which surged 43.4% year over year. Adjusted operating margin in the quarter was 18.1% that skyrocketed 510 bps.

Financial Condition

DENTSPLY SIRONA exited the third quarter with cash and cash equivalents of $226.1 million.

Guidance Updated

For 2019, DENTSPLY SIRONA continues to expect revenues between $3.95 billion and $4.05 billion, representing internal sales growth of 4% and 5%. The Zacks Consensus Estimate is pegged at $3.99 billion, within the guidance.

However, portfolio-shaping initiatives and continued acquisitions are expected to reduce 2019 revenues by $60 million.

The company also raised the 2019 guidance range for adjusted EPS in the range of $2.42-$2.48 from the previous expectation of $2.35-$2.45. The Zacks Consensus Estimate is at $2.39, below the company’s projected range.

Adjusted operating margin is expected between 18% and 19%.

Foreign exchange is expected to negatively impact revenues by $135 million in 2019.

Our Take

DENTSPLY SIRONA ended the third quarter on a solid note. Significant increase in the company’s bottom line bodes well. The company gained from its core Technology & Equipment unit that witnessed year-over-year upside in the quarter. Overall sales grew on an internal basis. Internationally, revenues surged on an internal basis. Raised guidance for EPS indicates bright prospects. Significant expansion in margins is another positive.

Meanwhile, sales of Restorative and Endodontics products and Laboratory Dental product witnessed some softness in the quarter. Additionally, unfavorable foreign currency exchange and restructuring costs are expected to exert pressure on DENTSPLY SIRONA’s top line in 2019.

Earnings of Other MedTech Majors at a Glance

Some other top-ranked companies, which posted solid results this earnings season, are Edwards Lifesciences EW, Thermo Fisher Scientific Inc TMO and ResMed Inc RMD. Each stock carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Edwards Lifesciences delivered third-quarter 2019 adjusted EPS of $1.41, outpacing the Zacks Consensus Estimate by 15.6%. Net sales of $1.09 billion surpassed the Zacks Consensus Estimate by 5.5%.

Thermo Fisher delivered third-quarter 2019 adjusted EPS of $2.94, which surpassed the consensus mark by 2.1%. Revenues of $6.27 billion outpaced the same by 1.3%.

ResMed reported fiscal first-quarter 2020 adjusted EPS of 93 cents, which beat the Zacks Consensus Estimate of 87 cents by 6.9%. Revenues were $681.1 million, surpassing the Zacks Consensus Estimate by 3.6%.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance