Delta (DAL) Beats on Q3 Earnings Despite High Fuel Costs

Delta Air Lines, Inc. DAL kicked off third-quarter 2018 earnings season for the airline space on a mixed note. The company reported better-than-expected earnings per share but lower-than-expected revenues in the quarter.

In the reported quarter, earnings (excluding 11 cents from non-recurring items) of $1.80 per share surpassed the Zacks Consensus Estimate by 6 cents. The bottom line also expanded on a year-over-year basis despite high fuel costs. Results were aided by higher revenues.

Operating revenues came in at $11,953 million, marginally missing the Zacks Consensus Estimate of $11,956.9 million. However, the top line increased 8% from the year-ago figure. Strong demand for air travel boosted revenues.

In the quarter under review, passenger revenues, cargo revenues and others increased 8.2%, 18.5% and 4.4%, respectively, on a year-over-year basis. Average fuel price (adjusted) improved 32.1% to $2.22 per gallon. Meanwhile, fuel bill (on an adjusted basis) rose 35% year over year.

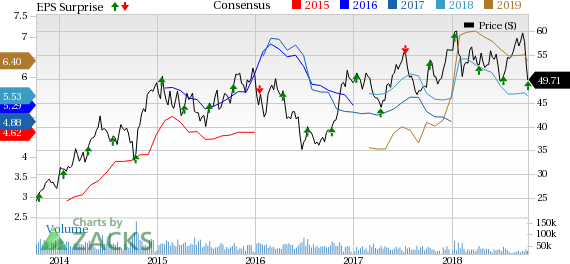

Delta Air Lines, Inc. Price, Consensus and EPS Surprise

Delta Air Lines, Inc. Price, Consensus and EPS Surprise | Delta Air Lines, Inc. Quote

Operating Statistics

Revenue passenger miles (a measure of air traffic) increased 3.8% on a year-over-year basis. Additionally, capacity or available seat miles expanded 3.9%. Load factor (percentage of seats filled by passengers) came in at 86.9%, flat year over year.

Passenger revenue per available seat mile (PRASM) was up 4.2% year over year. In addition, passenger mile yield grew 4.2%. Total revenues per available seat miles (TRASM:adjusted) also increased 4.3% (on a year-over-year basis) in the third quarter.

Operating Expenses

Total operating expenses, including special items, rose 12% year over year to $10,311 million. Adjusted cost per available seat mile (including profit sharing) was flat year over year.

Liquidity

At the end of the third quarter, Delta had $1,380 million in cash and cash equivalents, and $8,115 million long-term debt and capital leases. Operating cash flow and free cash flow in the quarter were $1.5 billion and $655 million, respectively.

Dividend and Share Repurchase

Delta returned $566 million to its shareholders through dividends ($241 million) and share buybacks ($325 million) in the quarter under review. The company’s board cleared a dividend hike to the tune of 15% earlier this year. The new quarterly dividend is 35 cents per share.

Guidance

For the fourth quarter of 2018, the carrier expects earnings per share to be between $1.10 and $1.30. The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $1.28 per share, toward the high end of the guided range. The carrier anticipates pre-tax margin in the 9-11% band. The estimated fuel price, including taxes, settled hedges and refinery impact, is envisioned in the range of $2.47-$2.52 per gallon.

Total unit revenue, excluding refinery sales, is anticipated to increase in the 3-5% band. System capacity is expected to be up approximately 4% on a year-over-year basis. Cost per Available Seat Mile, excluding fuel and profit sharing, is forecasted in the range of 0% to -1% (year-over-year change).

For 2018, total revenues are expected to grow approximately 8%, the high end of the previously forecasted 7-8% range. The earnings beat and improved revenue guidance pleased investors. As a result, shares of the company gained in early trading.

Upcoming Releases

Investors interested in the Zacks Airline industry are keenly awaiting third-quarter earnings reports from key players like United Continental Holdings, Inc. UAL, JetBlue Airways Corporation JBLU and Allegiant Travel Company ALGT in the coming days. While United Continental is scheduled to report on Oct 16, JetBlue and Allegiant are scheduled to follow suit on Oct 23 and Oct 24, respectively.

Zacks Rank

Delta carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Continental Holdings, Inc. (UAL) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance