Debt is causing young Canadians to lose sleep - retirement, not so much

Debt is keeping young Canadians up at night but retirement isn’t.

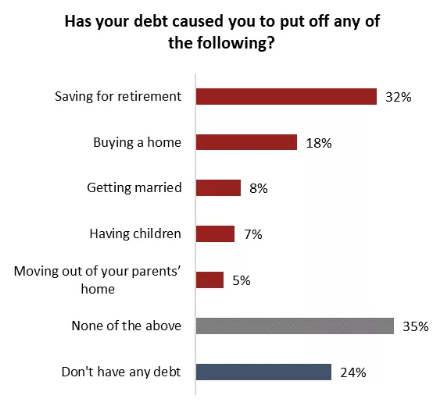

A new poll by Angus Reid finds one-in-three Canadians has put off saving for retirement because of debt. Though troubling, it’s hardly shocking considering we owe an average of around $1.78 for every dollar we earn.

“The results of this poll aren’t surprising and young people are facing more uncertainty than ever,” Kelley Keehn, personal finance author/educator, and FPSC’s consumer advocate told Yahoo Finance Canada.

“A degree doesn’t buy you what it used to but it does guarantee debt right out the gate.”

And yet, despite having little saved, young Canadians aged 18-25 have the rosiest outlooks for retirement of any age group. Many (34 per cent) say they expect to have enough money to do everything they want. At 8 per cent, they were the least worried about making ends meet.

Millennials might want to tamp down their expectations for their golden years, unless they are willing to put aside more money for retirement. Especially considering 68 per cent say their retirement savings will finance their golden years.

“Housing is beyond unaffordable for most Canadians and rapidly shrinking employer pension plans mean millennials need to plan now and for retirement – perhaps more so than any generation,” says Keehn.

Millennials seem to be more focused on the present. More than half say “I often worry about my ability to find or keep a good job.”

Do what I say not what I do

Almost nine-in-in ten respondents agree that “it’s stupid to go into debt if you don’t need to.” Meanwhile, more than three-quarters are carrying debt themselves. Only 16 per cent say their debt is difficult to manage.

Debt is also keeping a large chunk of respondents from buying homes (18 per cent), getting married (8 per cent), and having children (7 per cent).

“It’s important to remember that anyone can reach out to a pro like a certified financial planner – you don’t need assets and many are fee only,” says Keehn.

“A CFP will work with you to build a financial plan and will help to highlight blind spots along the way that may prevent you from reaching your financial goals.”

Almost a quarter of respondents say they have no debt.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance