DaVita (DVA) Earnings Beat Estimates in Q4, Revenues Miss

DaVita Inc. DVA reported fourth-quarter 2019 adjusted earnings per share (EPS) of $1.86, beating the Zacks Consensus Estimate of $1.66. The bottom line indicates a massive surge from the year-ago quarter’s 90 cents.

Total revenues in the quarter moved up 2.7% year over year to $2.90 billion, which also lagged the Zacks Consensus Estimate of $2.92 billion.

Fourth-quarter adjusted operating income totaled $463 million, up 25.1% year over year.

FY19 at a Glance

The Zacks Rank #3 (Hold) company’s 2019 revenues were $11.39 billion, which missed the Zacks Consensus Estimate of $11.41 billion. Revenues inched down 0.1% year over year.

EPS of $4.60 lagged the Zacks Consensus Estimate of $5.31.

DaVita’s Net Dialysis Services revenues for 2019 were $10.90 billion (95.7% of net revenues), while Other revenues totaled $491,773 (0.3%).

Segment Details

Net dialysis and related lab patient service revenues in the fourth quarter totaled $2.77 billion, up 1.8% on a year-over-year basis. Other revenues were $132,575, up 26.2% from the year-ago quarter’s figure.

Per management, total U.S. dialysis treatments for the fourth quarter were 7,681,462, or an average of 96,744 treatments per day. The figure represents a per-day increase of 1.7% on a year-over-year basis.

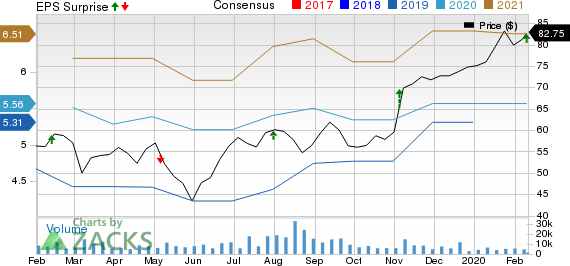

DaVita Inc. Price, Consensus and EPS Surprise

DaVita Inc. price-consensus-eps-surprise-chart | DaVita Inc. Quote

Per management, DaVita witnessed lower calcimimetics revenue in the quarter, which impacted its annual sales.

Also, the company provided dialysis services to a total of approximately 235,500 patients at 3,012 outpatient dialysis centers, of which 2,753 centers were located in the United States and 259 centers were in 10 countries outside the United States. During the quarter, DaVita opened a total of 31 new dialysis centers in the country. Outside the United States, the company launched three new dialysis centers and acquired seven dialysis centers.

Financial Condition

DaVita exited the fourth quarter with operating cash flow of $678 million.

Guidance

DaVita expects 2020 revenues between $11.50 billion and $11.70 billion. The Zacks Consensus Estimate for the same is pegged at $11.48 billion.

Adjusted EPS is projected between $5.75 and $6.25. This compares to the earlier projected band of $5.25-$5.75. The Zacks Consensus Estimate stands at $5.56.

Operating income margin is estimated in the band of 13-14%.

Free cash flow from continuing operations is projected between $600 million and $800 million.

Our Take

DaVita ended the fourth quarter on a tepid note. However, the massive surge in the bottom line is encouraging. Dialysis services in the United States showcased solid results during the quarter. Also, dialysis activities ramped up overseas. Further, the company is on track to acquire more dialysis centers in the United States. The recent divestment of the DMG unit to Optum is likely to enable the company to clear its debt. A solid guidance for 2020 is an added positive.

On the flip side, the company witnessed softness in calcimimetics in the quarter, which impacted annual sales.

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks, which reported solid results this earnings season, are Stryker Corporation SYK, Accuray Incorporated ARAY and IDEXX Laboratories, Inc. IDXX.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Fourth-quarter reported revenues of $4.13 billion surpassed the Zacks Consensus Estimate by 0.7%. The company carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Accuray reported second-quarter fiscal 2020 adjusted EPS of a penny, comparing favorably with the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the Zacks Consensus Estimate by 0.3%. The company sports a Zacks Rank #1.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%. The company carries a Zacks Rank of 2.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance