The Datametrex AI (CVE:DM) Share Price Is Up 860% And Shareholders Are Delighted

Datametrex AI Limited (CVE:DM) shareholders have seen the share price descend 14% over the month. But that doesn't change the fact that the returns over the last year have been spectacular. Few could complain about the impressive 860% rise, throughout the period. So the recent fall isn't enough to negate the good performance. While winners often keep winning, it can pay to be cautious after a strong rise.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for Datametrex AI

Datametrex AI isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Datametrex AI grew its revenue by 190% last year. That's well above most other pre-profit companies. But the share price seems headed to the moon, up 860% as previously highlighted. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. So this looks like a great watchlist candidate for investors who look for high growth inflexion points.

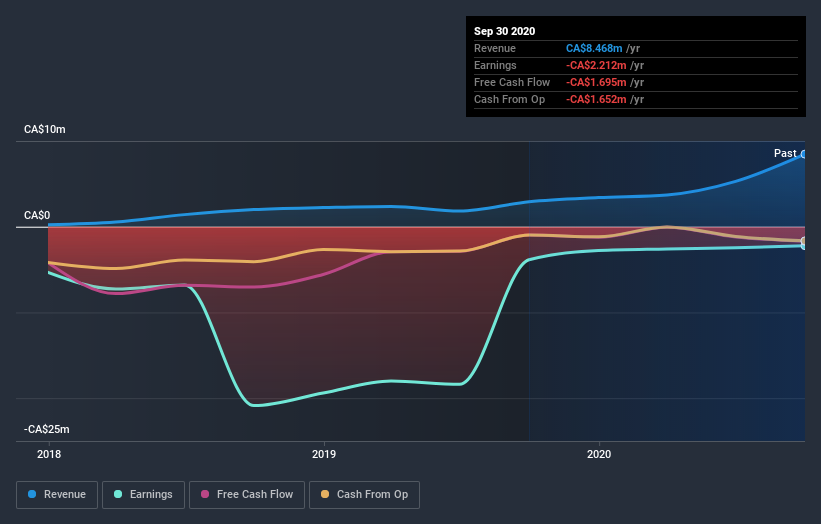

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Datametrex AI rewarded shareholders with a total shareholder return of 860% over the last year. That's better than the annualized TSR of 23% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Datametrex AI on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Datametrex AI better, we need to consider many other factors. Even so, be aware that Datametrex AI is showing 5 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Of course Datametrex AI may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance