New Data Shows a Deeper Polarization of ‘Haves’ and ‘Have-Nots’ in Housing

Eight years after the mortgage crisis, the national housing market has healed.

But as with any trauma, some scars linger, and some regrowth is uneven.

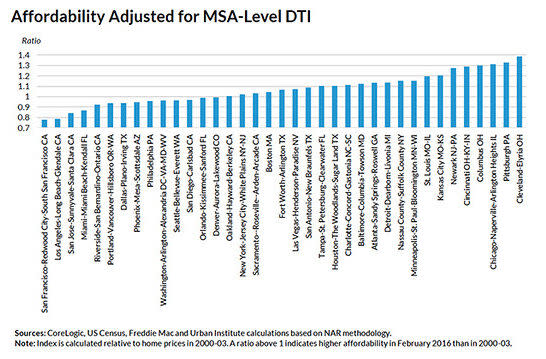

A report out Thursday from the Urban Institute offers a sobering reminder. Drawing on data from CoreLogic, Urban researchers show the median FICO credit score, and the median ratio of equity to the value of the home at the time of purchase for various cities in February.

It’s probably not surprising that the highest-flying metro areas also the highest for both those metrics. When demand is through the roof, sellers can be picky and buyers must compete. Those with the shiniest credit profiles and the most equity will do best.

But the scale is striking. San Francisco had the lowest purchase loan to value ratio, at 71%. (That means the median down payment was 29%.) The median priced home in San Francisco in the first quarter was $770,300 according to the National Association of Realtors. That means the average buyer put down $223,100.

San Jose metro had the second-lowest loan to value ratio, 75.2%. But the median priced home was so much higher, $970,000, that down payments there averaged $240,900.

Not surprisingly, it’s a completely different story in areas hit the hardest by the housing bust, where local economies have faltered, or both.

The highest loan to value ratio is in Detroit, a city for which the Realtors did not provide a median price. Just behind it is San Antonio, where a median loan to value of 90.6% and a median price of $195,500 gets an average down payment of $18,400. Other cities clustered around the 10% down payment average include Cincinnati, Cleveland, and Pittsburgh.

In some of the most beaten-down metros, any kind of investment is probably a good thing. But a bigger share of equity isn’t just an investment strategy. It’s also a cushion against downturns.

That’s why it’s so jarring to see such low levels of equity in localities that still haven’t recovered from the last housing bust. Ohio is the state with the third-highest share of “seriously underwater” homeowners—those who owe at least 25% more than their home is worth, according to data released recently by RealtyTrac.

Nevada is first on the RealtyTrac list. Down payments in Las Vegas averaged 13.8% in February, according to Urban’s records, but it had one of the lowest average FICO scores at origination, 730. In March, Nevada home prices were still 37% lower than their 2006 average, according to S&P/Case-Shiller.

The post New Data Shows a Deeper Polarization of ‘Haves’ and ‘Have-Nots’ in Housing appeared first on Real Estate News and Advice - realtor.com.

Yahoo Finance

Yahoo Finance