Dana Raises Cash Consideration to $1.8B for GKN Driveline

Dana Incorporated DAN announced that it increased the cash consideration to combine the driveline unit of GKN plc. Under the improved terms, Dana will be paying an additional $140 million (£100 million), leading to a total cash consideration of roughly $1.77 billion (£1.28 billion) for the deal. The total figure includes approximately $1 billion (£700 million) in net pension liabilities and 133 million of Dana shares to be issued to GKN's shareholders.

At the beginning of March, Dana announced its decision to create Dana plc, a United Kingdom-based leader in driveline systems by combining existing driveline division of GKN plc. Under the signed agreement, Dana will own approximately 53% stake while GKN will own 47%.

Per management, this planned deal will enable Dana to strengthen its footprint in the vehicle drive systems market and create a significant position in electric propulsion which is anticipated to be the future of vehicle drivetrains.

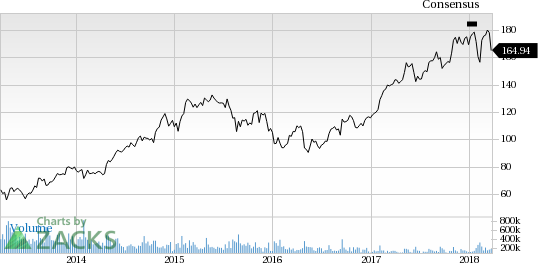

Dana Incorporated Price and Consensus

Dana Incorporated Price and Consensus | Dana Incorporated Quote

Further, strong interest and confidence shown by the investors in support of GKN Driveline combination have enabled Dana to increase the cash combination for the deal. In sync with this, the company has doubled the share repurchase program to $200 million (£145 million). This was done to maintain liquidity across all markets after the completion of the deal. The company has plans to repurchase shares in the open market or through private transactions. The buyback is planned to be funded via its liquidity and cash generation.

Price Performance

Over a year, shares of Dana outperformed the industry it belongs to. During the period, its stock rose 39% in comparison with the industry’s gain of 18.9%.

Zacks Rank & Key Picks

Dana carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the auto space are AB Volvo VLVLY, Volkswagen AG VLKAY and BMW AG BAMXF, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Volvo has expected long-term growth rate of 15%. Over a year, shares of the company declined 23%.

Volkswagen has expected long-term growth rate of 18.7%. Shares of the company gained 26.2% in the past one year.

BMW has expected long-term growth rate of 4.2%. Over a year, shares of the company gained 14.2%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Volkswagen AG (VLKAY) : Free Stock Analysis Report

Bayerische Motoren Werke AG (BAMXF) : Free Stock Analysis Report

Dana Incorporated (DAN) : Free Stock Analysis Report

AB Volvo (VLVLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance