Should Cymat Technologies (CVE:CYM) Be Disappointed With Their 52% Profit?

While Cymat Technologies Ltd. (CVE:CYM) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. But that doesn't change the fact that the returns over the last five years have been pleasing. After all, the share price is up a market-beating 52% in that time. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 27% decline over the last twelve months.

Check out our latest analysis for Cymat Technologies

Cymat Technologies recorded just CA$1,947,517 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Cymat Technologies will find or develop a valuable new mine before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Cymat Technologies has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

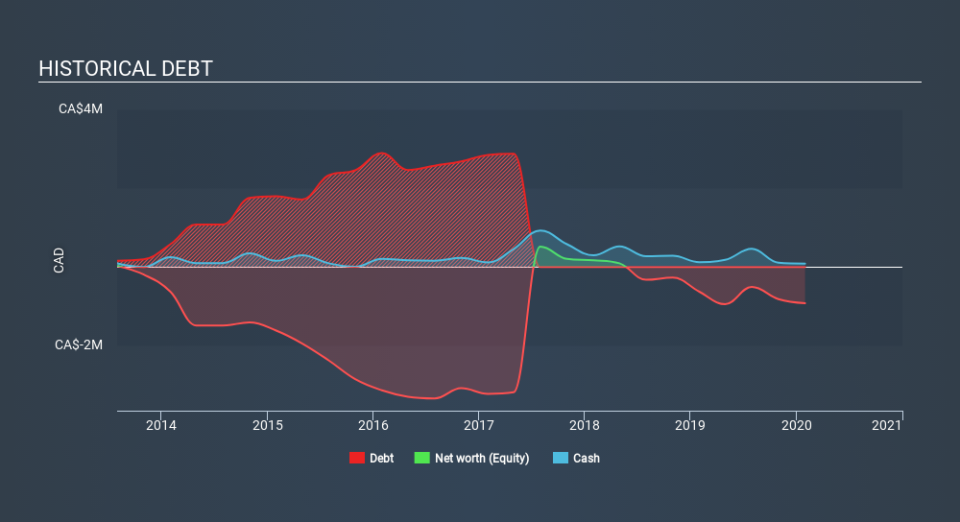

Cymat Technologies had liabilities exceeding cash when it last reported, according to our data. That made it extremely high risk, in our view. So the fact that the stock is up 124% per year, over 5 years shows that the cash injection was a welcome one. It's clear more than a few people believe in the potential. You can see in the image below, how Cymat Technologies's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. You can click here to see if there are insiders buying.

A Different Perspective

While the broader market lost about 11% in the twelve months, Cymat Technologies shareholders did even worse, losing 27%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 8.7% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Cymat Technologies better, we need to consider many other factors. Take risks, for example - Cymat Technologies has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Cymat Technologies is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance