CyberArk (CYBR) Q1 Earnings Beat Estimates, Revenues Match

CyberArk Software Ltd. CYBR reported first-quarter 2020 results, wherein the top line matched estimates and the bottom line surpassed the same. Non-GAAP earnings per share of 50 cents exceeded the Zacks Consensus Estimate by 35.1%. The bottom line, however, was lower than the year-ago quarter’s 56 cents.

CyberArk’s revenues grew 11% year over year to $107 million. Strong revenue growth across all geographical regions augmented the top line. Moreover, an expanding customer base was a tailwind.

Increasing demand for privileged access security on the back of digital transformation and cloud migration strategies was a key growth driver. Moreover, growing pipelines across verticals such as banking, insurance, healthcare, global government, pharmaceuticals and utilities, which are less affected due to the coronavirus outbreak, boosted revenues.

Additionally, CyberArk announced the acquisition of identity-as-a-service provider, Idaptive, to boost its strategy to develop an identity security platform.

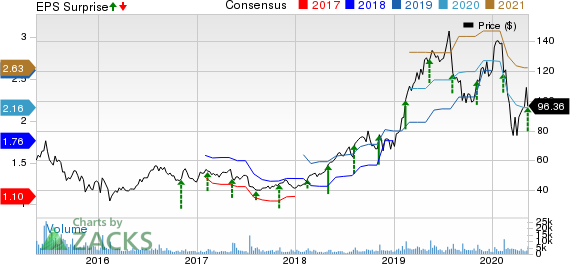

CyberArk Software Ltd Price, Consensus and EPS Surprise

CyberArk Software Ltd price-consensus-eps-surprise-chart | CyberArk Software Ltd Quote

Quarter Details

Segment-wise, License revenues (48.3% of total revenues) increased 2% year over year to $51.7 million. Add-on business jumped to 79% of license revenues in the first quarter, up from 63% for the entire 2019, reflecting strong a deal volumes rate.

The company’s products, Application Access Manager and Endpoint Privilege Manager, represented nearly 7% of license revenues, each.

However, the mix toward SaaS and subscription-based revenues reduced revenues by about $5 million.

Maintenance and Professional Services (51.7%) revenues rose 24% to $55.2 million. Within the segment, professional services revenues came in at $9.1 million, representing 8% of total revenues.

The company witnessed top-line growth in every region. On a year-over-year basis, revenues of $69.9 million from the Americas increased 13%. Revenues of $9.5 million from the APJ jumped 11%. EMEA revenues of $27.4 million rose 8%.

CyberArk’s new SaaS solutions — CyberArk Privilege Cloud and Alero — are also witnessing significant growth.

The company ended the quarter with more than 5,500 customers, adding around 116 new logos.

Operating Results

CyberArk’s non-GAAP gross profit was $92.5 million, representing year-over-year growth of 9%. Gross margin contracted 100 basis points (bps) to 87% due to lower license revenues.

The company reported non-GAAP operating income of $21.5 million compared with $25.5 million in the year-ago quarter. Non-GAAP operating margin contracted 650 bps to 20.1% due to higher operating expenses.

Balance Sheet & Cash Flow

CyberArk exited the quarter with cash, cash equivalents, short-term deposits and marketable securities of approximately $1.2 billion, up from $1.1 billion at the end of the previous quarter. The company’s balance sheet does not show any long-term debt.

The company’s cash flow generated from operations was approximately $33.8 million as of Mar 31, 2020, down from $141.7 million in the previous quarter.

Guidance

For the second quarter of 2020, CyberArk estimates revenues of $95-$105 million.

Non-GAAP operating income is expected in a band of $7-$16 million. The company projects non-GAAP earnings in the 17-35 cents range.

Cash balances are expected to be negatively impacted by approximately $70 million due to the acquisition of Idaptive.

CyberArk typically experiences a sequential revenue decline in the first quarter, moderate sequential growth in the second and third quarters and highest revenues in the fourth quarter.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

AudioEye AEYE, NVIDIA NVDA and Nutanix NTNX are some better-ranked stocks in the broader computer and technology sector. While AudioEye and Nutanix sport a Zacks Rank #1 (Strong Buy), NVIDIA carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AudioEye, NVIDIA and Nutanix are set to report quarterly results on May 14, 21 and 27, respectively.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

CyberArk Software Ltd. (CYBR) : Free Stock Analysis Report

Nutanix Inc. (NTNX) : Free Stock Analysis Report

Audioeye, Inc. (AEYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance