Cummins (CMI) Tops Q1 Earnings Estimates, Revokes '20 View

Cummins Inc. CMI reported earnings of $3.18 per share in first-quarter 2020, surpassing the Zacks Consensus Estimate of $2.18. Higher-than-expected contribution from Components and Engine segments led to the outperformance. EBITDA from the said segments came in at $279 million and $365 million, topping the consensus mark of $208 million and $243 million, respectively.

The bottom line, however, declined from earnings of $4.20 a share recorded in first-quarter 2019. Cummins’ revenues also declined 16.7% year over year to $5,011 million in the reported quarter. However, revenues beat the Zacks Consensus Estimate of $4,946 million.

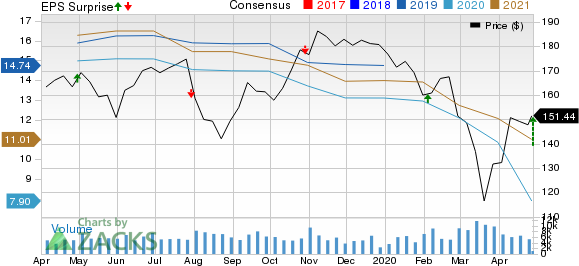

Cummins Inc. Price, Consensus and EPS Surprise

Cummins Inc. price-consensus-eps-surprise-chart | Cummins Inc. Quote

Segmental Performance

Sales for the Engine segment declined 19% year over year to $2,158 million. The segment’s EBITDA (excluding restricting actions) declined to $365 million (16.9% of sales) from $438 million (16.5% of sales) a year ago. Decline in global demand in truck and construction markets resulted in lower on- and off-highway revenues than the prior-year quarter.

Sales for the Distribution segment totaled $1,814 million, down 9% year over year. Revenues from North America declined 11% and international sales were down 6% from the year-ago quarter. The segment’s EBITDA fell to $158 million (8.7% of sales) from $171 million (8.5% of sales) a year ago.

Sales for the Components segment declined 19% from the prior-year quarter to $1,502 million. The segment’s EBITDA was $279 million (18.6% of sales) compared with the year-ago figure of $325 million (17.5% of sales). Sales in North America and international markets declined 24% and 12% year over year, respectively.

Sales for the Power Systems segment declined 18% from the year-ago quarter to $884 million. The segment’s EBITDA declined to $77 million (8.7% of sales) in first-quarter 2020 from $138 million (12.8% of sales) in the year-ago period. Power generation and industrial revenues fell 8% and 30%, respectively, from a year ago.

Sales for the New Power segment were $10 million. The segment recorded EBITDA loss of $43 million.

Financial Position & Outlook

Cummins’ cash and cash equivalents were $1,691 million as of Mar 29, 2019, up from $1,129 million on Dec 31, 2019. Long-term debt totaled $1,580 million.

Amid coronavirus-led uncertainty, Cummins scrapped its annual view. The company anticipates second-quarter results to take a severe hit due to disruptions across customer and supplier operations, and lower end-market demand. In a bid to conserve cash, Cummins is implementing various cost-cut initiatives including temporary reduction in salaries. The company targets 2020 capex to decline 25% from 2019 levels.

Zacks Rank & Stocks to Consider

Cummins currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the same sector include Douglas Dynamics, Inc. PLOW, Spartan Motors, Inc. SPAR and Modine Manufacturing Company MOD, each carrying a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cummins Inc. (CMI) : Free Stock Analysis Report

Douglas Dynamics, Inc. (PLOW) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

Spartan Motors, Inc. (SPAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance