CSX CEO explains why the rail business will win regardless of who becomes president

The transportation sector (^DJT) remains closely watched as a market leading indicator, as it reflects the underlying industrial economy of the country.

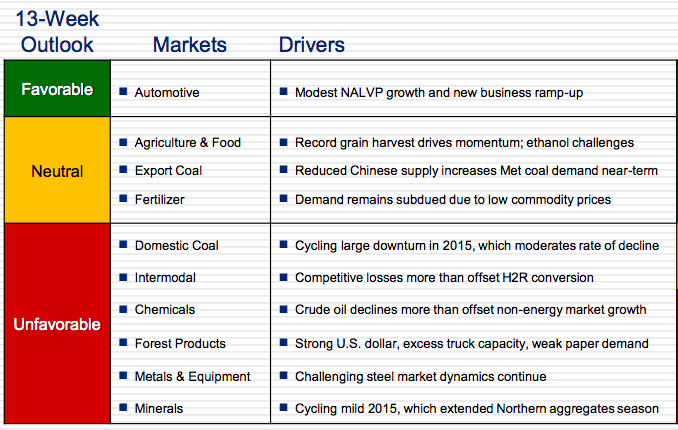

This week’s results from one of the major US rail operators, CSX (CSX), confirmed underlying struggles in the economy but demonstrated a tempering of declines.

CSX Chairman and CEO Michael Ward reiterated some of the headwinds to industrial growth.

“The strength of the dollar and the low commodity prices have really dramatically impacted the industrial sector of the United States,” he told Yahoo Finance.

But he added that declines are starting to moderate.

Infrastructure winner

When asked if his spending decisions have been impacted by the contentious election campaign cycle between Donald Trump and Hillary Clinton, Ward explained that CSX remains uniquely well-positioned.

“We’re very fortunate in our industry,” Ward said. “Transportation and infrastructure is a very bipartisan topic. There’s general recognition by both political parties that having a strong infrastructure is really key to having a strong economy.

In fact, both candidates have focused on expansionary fiscal policies from current levels.

Clinton has proposed a $275 billion infrastructure plan over five years. And Trump has proposed what he calls an even bigger plan—to spend $500 billion to rebuild US infrastructure—though he hasn’t provided many details.

Ward explained that the company invests 16%-17% of revenue every year on infrastructure.

“So for CSX that’s $2.3 billion to improve our infrastructure,” he said. “I think all the policymakers realize that’s critical and both support us continuing to invest”

One area of government that poses a challenge? Regulation.

Ward explained that regulation of his customers is impacting his underlying growth.

“When I talk with our customers, usually one of the top things that’s impacting their business and slowing their growth is all the regulations coming out of Washington, D.C.,” Ward said. “So we really have a regulatory onslaught in my view. It’s not just the rail industry but the industries we touch.”

Coal conundrum

The coal industry—which has come under pressure as a result of low natural gas prices on the domestic side and the strong dollar on the export side—has been a headwind for the rails and CSX specifically.

The Energy Information Administration (EIA) forecasts coal will be used for 20% of electricity generation in 2030, down 38% in 2014.

CSX has lost more than half of its coal business over the last five years—In 2011, CSX reported $3.7 billion of coal revenue compared to $1.7 billion this year. But this decline may be moderating at last.

“We don’t think it’s completely bottomed at this point but the rate of decline on a year-over-year basis has slowed down,” said CSX Chairman and CEO Michael Ward. Coal volumes were down 20% in the third quarter year-over-year versus a decline of 30-35% in the first half of the year.

While third quarter revenue down 8% was impacted significantly by declining coal shipments, Ward said he has emphasized diversifying the business and operating more efficiently.

While coal will remain an important part of the business going forward, it will become a smaller driver, according to Ward, who emphasized the company’s “CSX of Tomorrow” strategy.

“We’re reorienting the company to realize we need to grow our automotive and intermodal businesses as well as other merchandise more rapidly,” Ward said.

The company is making investments in facilities to aid this transition, specifically for intermodal, where Ward sees an opportunity of 9 million truckloads to convert to rail, as trucking faces hurdles including over-crowded highways.

A bet on rails, as Warren Buffett famously said when Berkshire Hathway (BRK-A, BRK-B) acquired Burlington Northern in 2009, is a bet on America.

Please also see:

How improved infrastructure could end America’s vicious cycle of poverty

People haven’t talked about fiscal stimulus this much since the financial crisis

Yahoo Finance

Yahoo Finance