CryptoStar (CVE:CSTR) Shareholders Booked A 11% Gain In The Last Year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. To wit, the CryptoStar Corp. (CVE:CSTR) share price is 11% higher than it was a year ago, much better than the market decline of around 20% (not including dividends) in the same period. That's a solid performance by our standards! CryptoStar hasn't been listed for long, so it's still not clear if it is a long term winner.

See our latest analysis for CryptoStar

CryptoStar isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

CryptoStar actually shrunk its revenue over the last year, with a reduction of 46%. Despite the lack of revenue growth, the stock has returned a solid 11% the last twelve months. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

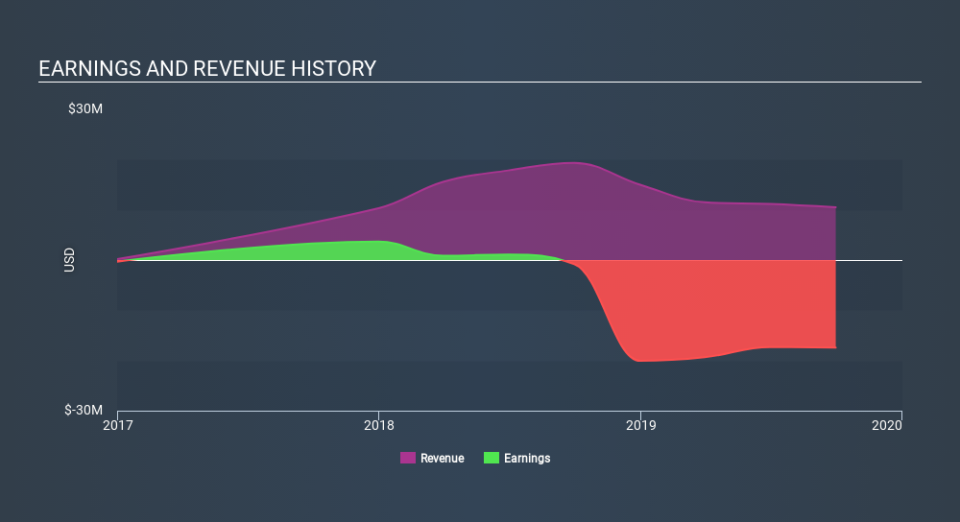

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling CryptoStar stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

CryptoStar boasts a total shareholder return of 11% for the last year. And the share price momentum remains respectable, with a gain of 67% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that CryptoStar is showing 5 warning signs in our investment analysis , and 3 of those make us uncomfortable...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance