Cryptos, Cobalt, And Cannabis: 5 Picks In Today’s Hottest Markets

The secret behind finding a high-value stock is locating the market sectors that are booming – and in 2017 there are four industries that are head and shoulders above the rest.

Cryptocurrencies, cannabis, cybersecurity and cobalt.

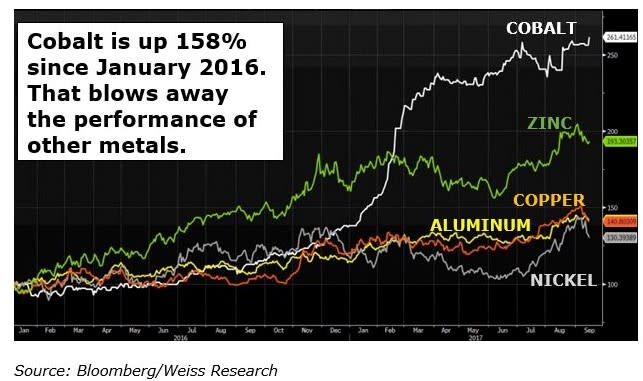

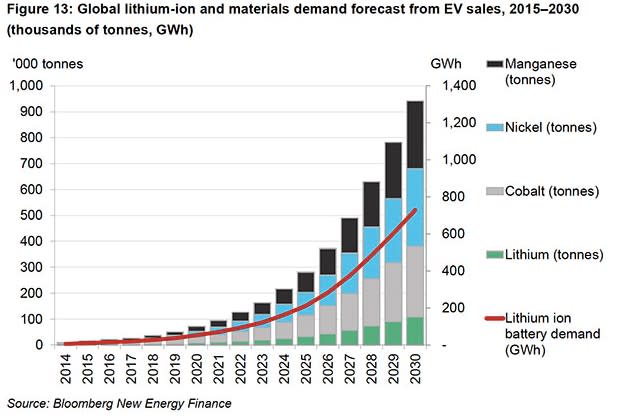

Cobalt demand is so strong and supply so uncertain that the scramble of major automakers and battery gigafactory bulls to secure a pipeline has sent prices soaring.

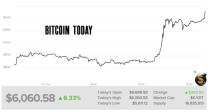

Investors who got left out of the first major cryptocurrency wave are feeling the pain but watching the next wave roll in with industrial-scale digital mining, while Bitcoin shoots past $6,000 per coin.

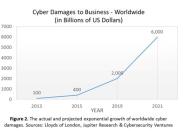

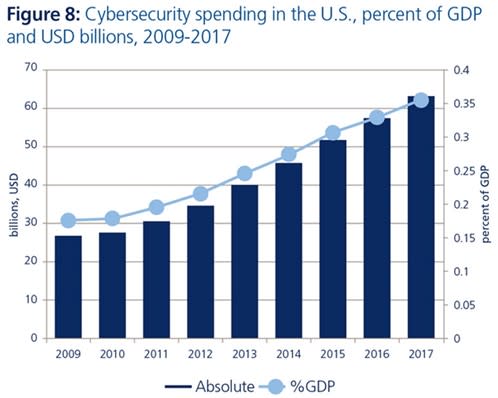

World War III is on – and cyber-attacks are set to cost us $6 trillion a year by 2021. High-tech cybersecurity companies are poised to soar as every industry in the world tries to protect their data against attacks that cost millions of dollars per single breach.

And on the lighter side, we have a U.S. cannabis market forecasted to reach $25 billion by 2020, with recreational use legalized in only two states. Additionally, the Canadian pot market is worth about $8 billion, and recreational use is expected to be legalized countrywide in less than a year.

These are the only charts you need to view the bull run in all four spaces.

Cobalt is surging …

And demand is facing a big supply problem…

Cryptocurrency prices are soaring, with massive gains from June 2016 to June 2017 and no sign of slowing down:

With bitcoin setting new all-time highs …

[NTD: The tag "bitcoin today" is a little misleading, as the information relates to prices on October 20.]

In cybersecurity, the big names are about to get bigger as cybercrime breaches pile on billions upon billions in damage:

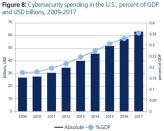

Cybersecurity spending in the U.S. alone over the past 8 years has steadily climbed by the billions:

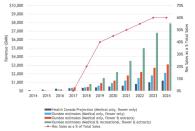

And then we've got cannabis, which is set to explode in North America with the biggest bang in Canada where recreational use is poised to become legal by next summer.

Analysts expect the Canadian pot industry alone to grow from $240 million in 2016 to $4.6 billion as soon as 2019.

Here are 5 of the hottest stocks in these 4 key sectors:

#1 Freeport-McMoRan (NYSE:FCX)

Trading as a $20.23-billion market cap company, FCX was one of the biggest producers of cobalt in the world until it sold its stake in Congolese Tenke Fungurume to China Molybendum for $2.65 billion. It's a pattern—getting out of Congo these days. But FCX still has its hands in the cobalt trade through a subsidiary called Freeport Cobalt.

FCX's stock has gained nearly 43 percent in a year, and it's outperformed the S&P 500. The best part is that this stock is still a cheap way to gain exposure to cobalt. As of November 1, shares were around $14.30.

FCX also topped earnings and revenues estimates in Q3 2017, with results were announced on 25 October. Revenues went up around 11.2 percent year over year to $4.3 billion, beating the Zacks Consensus Estimate of $4.1 billion.

Full-year guidance also looks promising, with operating cash flow around $4.3 billion and capital expenditures around $1.5 billion, while anticipated sales volumes is 3.7 billion pounds of copper, 1.6 million ounces of gold and 94 million pounds of molybdenum. Another catalyst to look out for will be positive progress in negotiations with the Indonesian government for long-term operating rights.

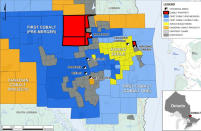

#2 Quantum Cobalt Corp. (CSE:QBOT; OTC:BRVVF)

With major consumers shifting away from 'conflict cobalt' mined under dubious circumstances in the Democratic Republic of Congo (DRC), one of the hottest new venue shares a name with one of the hottest metals in the world right now: Welcome to Cobalt, Ontario, North America's best chance at producing its own, safe cobalt that won't come under scrutiny for horrendous child labor practices or indirectly funding conflicts.

DRC may be the largest producer of cobalt in the world, and we may be desperate for cobalt, but it's too hot to handle.

Cobalt, Ontario was the site of a historic silver rush, and now it's the site of a new cobalt rush.

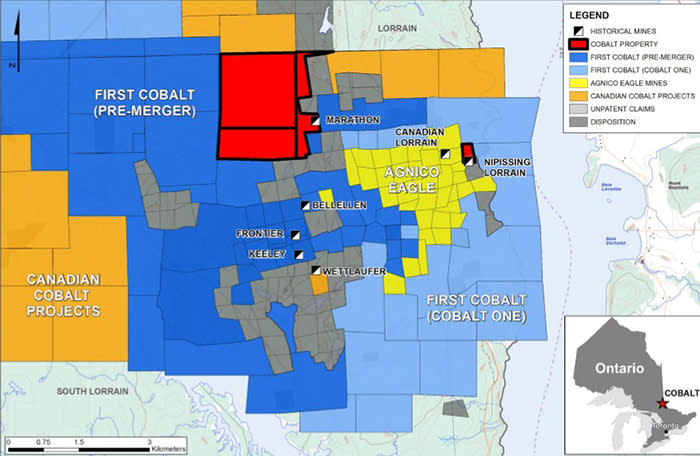

Right in the heart of this cobalt belt, Quantum Cobalt has set up shop with three prospective plays that are all historical producers.

The company's Nipissing Lorrain Cobalt Project has in the past produced over 16,500 tons of the critical metal.

And then, just 55 kilometers north of Ontario's prolific Cobalt district, Quantum has the Rabbit Cobalt Project, with historic work returning an assay of 8.76 percent cobalt.

Also nearby, is Quantum's Kahuna Cobalt-Silver property, covering 77 claims over 1,200 hectares. Here, mineralization of cobalt has been discovered in past work.

Right next door is First Cobalt Corp.(CVE:FCC)—a company that pulled out of the DRC to expand in Canada, has past-producing assets and a market capitalization of CAD$39 million, which is expected to reach CAD$156 million pending an acquisition transaction. It all suggests that Quantum, with its three cobalt projects at ground zero--may be undervalued.

The past production on these properties suggests that Quantum has significant exploration and development potential, and it could be coming into this game right at the edge of the cobalt bull-run.

With cobalt at all-time highs, we expect news flow on this one to take quantum leaps. They're putting boots on the ground right now and expect to be drilling at the start of the new year.

#3 Micron Technologies (NYSE:MU)

It's hard to break into cryptocurrency without risking a lot on an ICO (initial coin offering). There's no ETF—yet. So, the best way to gain exposure is through the back door, and more specifically, through one of the best-performing tech companies that is making things like blockchain possible.

Micron markets memory and data storage solutions to computer manufacturing firms, consumer electronics companies and telecommunications powerhouses. It's got so many hot markets to fall back on, and its upwardly mobile share price likes it. Over the past 52 weeks alone, MU share prices have surged 133 percent.

What investors like here is the phenomenal growth ability because it spans multiple sectors—all of them fast-growing.

Q3 earnings scheduled for December 20 will be something to watch.

While market darling Nvidia (NYSE:NVDA) is wildly expensive right now and continues the upward climb (though some say it's close to bulletproof), MU is still relatively cheap, trading as of November 1 at just over $44 per share.

#4 INTEL (NYSE:INTC)

This stellar chipmaker has had yet another good quarter, and they've also raised guidance for the full year. It's facing stiff competition from Advanced Micro Devices (AMD), which just released two new chips, but the INTEL numbers don't show this has had much negative impact. It has had a positive one, though, with INTEL rising to the occasion and keeping pace with the competitive drive. Next quarter's outlook shows a sequential increase in revenue.

And guidance for the full year gets a boost …

The company is also doing some cost-cutting and adopting a more reserved acquisition strategy.

All of this has combined to prompt analysts to raise their price targets on Intel shares. BMO Capital Markets has raised its rating for Intel to outperform, from market perform. They see higher profitability next year and are raising the price target from $37 to $58. As of pre-market on Tuesday, 31 October, Intel was trading at $45.33. We like the fact that shares are trading at a 7 percent discount to Intel's industry peers (on a free cash flow multiple basis, according to BMO).

#5 Scotts Miracle-Gro (NYSE:SMG)

It doesn't sound like a pot stock, we get it. But this is a 'pick and shovel' company for the marijuana industry, and the industry is going to need a lot of them, and is making them a huge market opportunity. SMG is presently trading as a $5.84-billion market cap company, and shares are up nearly 16 percent over the past year.

SMG markets a lot of products, including the Miracle-Gro brand, Scotts grass seeks, pest deterrent Ortho, and weed killer Roundup, among others. But they've also been hungrily eyeing the marijuana market and they are manufacturing a nicely growing collection of products for use in hydroponic growing, which is a huge market for pot.

If you aren't familiar yet with hydroponics, as an investor we recommend a quick education. Hydroponics is the process of growing plants without soil. SMG has a wholly owned subsidiary, Hawthorne Gardening Company, that is focused on hydroponics as 10 percent of its total sales—for now—and has a tantalizing growth rate on that figure. Year-over-year, this segment has organically grown 20 percent--at double digits. But Scotts is also actively acquiring companies in this space.

What SMG offers, then, is a way to gain unique exposure to the marijuana industry, without going all out for direct pot stocks. It's also some form of stability, and that's why it's included in the basket of the first marijuana ETF ever: Horizons Marijuana Life Sciences ETF (TSX:HMMJ), which hit the market on April 4, 2017.

Most of SMG's revenue comes from its lawn and garden business, while 10 percent comes from its Hawthorne Gardening Co. subsidiary, which caters to the medical marijuana industry. This subsidiary is growing at a rapid pace, and should see major future growth spurts.

Other companies in fast moving sectors to keep an eye on:

Canopy Growth (TSX:WEED, OTCMKTS:TWMJF) was the first cannabis organization to surpass the $1 billion market cap level, and it is one of the biggest names in the industry. When the upcoming cannabis legislation is passed in Canada, a jump in stock price here is near-inevitable.

The problem with stocks of this size, of course, is that the upside is unlikely to be near the upside of those new and dynamic smaller players in the space – but the downside is far more appealing for a conservative investor.

The stock has been on a steady rise in the second half of 2017, and it is not unreasonable to see this rise continue through the end of the year. It certainly appears to be a safe way to play the coming cannabis boom in Canada.

Aphria Inc (TSX:APH): Aphria Inc is engaged in the production and selling of medicinal marijuana, and while the stock has trended downward since April, the constant profits here suggest there is a lot of upside. The recent pro-marijuana legislation from the Canadian government is sure to boost companies with the reputation of Aphria Inc.

Aphria's $137 million expansion project is well underway to ramp up output to 70,000 kg. If Aphria successfully ramps up production, we believe its share price could go much higher.

Oncolytics Biotech (TSX:ONC): Oncolytics has been testing the potential of its lead product reolysin through various stages of trials battling many types of cancer. Reolysin is the company's cancer therapeutics that has been used alone and in combination with biologics, chemotherapy, and radiotherapy for various cancers. On that note, Oncolytics' currently testing Reolysin treating cancers like pancreatic, breast and lung.

The company saw its share price jump significantly in May and while the share price came down in June, we see upside for this promising biotech firm.

Computer Modelling Group (TSX:CMG) is a software technology company producing reservoir simulation software for oil and gas companies. Computer Modeling Group LTD. Is a tempting trade for investors as it brings together two essential industries - tech and resources- which are going anywhere any time soon. Especially as the need for security grows, a tech company involved in the oil and gas industry has an incredible opportunity to offer other services.

While Computer Modelling Group focuses on the resource industry, its technology is definitely breaking ground. Founded nearly 40 years ago by Khalid Aziz, a renowned simulation developer, the company has proven that it has staying power. As the resource industry meets technology, this will be a stock to pay attention to.

Absolute Software Corporation (TSX:ABT): This Vancouver-based company offers endpoint security and data risk-management solutions, and this year has seen a share price jump of over 27%. Revenues are also up, and it looks like it's on a path of securing strong new customers. The pipeline looks great, and forecasts for next year have been increased.

With strong management and an innovative team, Absolute Software is drawing growing investor attention. Absolute has seen a strong 21% stock growth year to date and is expected to see strong growth as the cyber security market grows at a rampant pace

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This communication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include: that news flows regarding Quantum Cobalt Corp. ("Quantum Cobalt") are expected to take quantum leaps; and that Quantum Cobalt expects to start drilling at the start of the new year. Risks that could change or prevent these statements from coming to fruition include: that news flows regarding Quantum Cobalt will not be forthcoming and that Quantum Cobalt will not start drilling at the start of the new year. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. The forward-looking statements contained in this communication reflect the current expectations, assumptions and/or beliefs of the writer based on information currently available to the writer. In connection with the forward-looking statements contained in this communication, the writer has made assumptions about: Quantum Cobalt's future news flow; and expectations regarding Quantum Cobalt's start of drilling. The writer has also assumed that no significant events will occur outside of Quantum Cobalt's normal course of business. Although the writer believes that the assumptions inherent in the forward-looking statements are reasonable, the forward-looking statements are not a guarantee of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. The forward-looking information contained herein is given as of the date hereof and the writer assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, "we" or the "Company") has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Quantum Cobalt ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is not a recommendation to buy or sell securities. This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have not investigated the background of Quantum Cobalt. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. These non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.

Yahoo Finance

Yahoo Finance