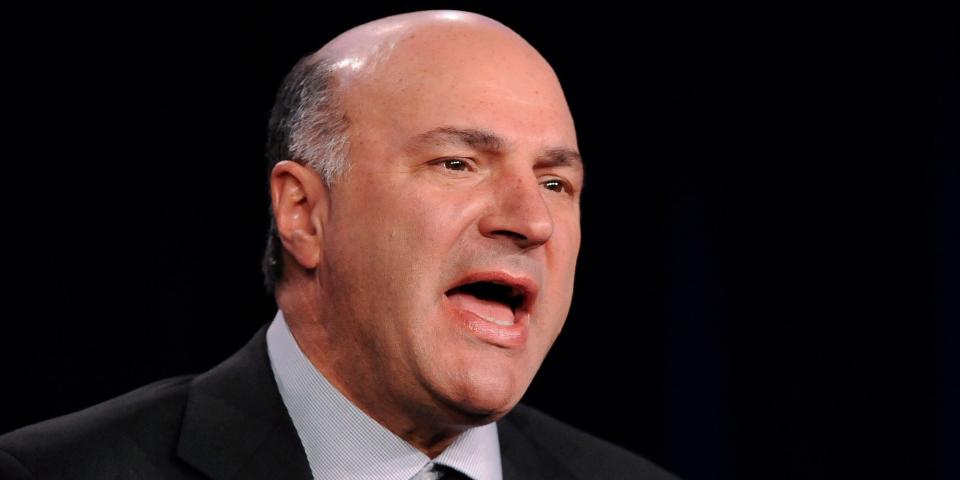

Crypto is 'radioactive waste' for institutional investors until things get resolved, Shark Tank's Kevin O'Leary says

Crypto is 'radioactive waste' for institutional investors, Shark Tank's Kevin O'Leary said.

Following the SEC's crackdown on Binance and Coinbase, O'Leary said the industry won't see any growth until things get resolved.

He called for a leadership change at Coinbase.

Cryptocurrencies are "radioactive waste" for institutional investors until leaders in the digital-asset space come to an agreement with the SEC, Shark Tank star Kevin O'Leary has said.

Following the back-to-back regulatory crackdowns on Binance and then Coinbase by the SEC this week, O'Leary thinks the crypto industry won't see any capital gains until things get resolved.

"I've talked to sovereign wealth, I've talked to institutions in the last 48 hours and they've said this makes this asset class radioactive waste. We are not going to touch this until this thing is resolved," the market veteran and active crypto investor told Fox Business on Wednesday.

On Tuesday, the SEC sued Coinbase, the largest US cryptocurrency exchange, alleging it violated securities rules and has operated as an unregistered broker, exchange, and clearing agency "since at least 2019." The lawsuit comes one day after the regulator sued Binance and its CEO Changpeng Zhao for operating an illegal exchange and violating US regulations related to the offering of unregistered securities.

While the charges against Binance and its CEO CZ are "really, really serious," O'Leary said the situation with Coinbase is a chance for the US crypto exchange to signal that it's ready to operate under an environment the SEC wants.

"This Coinbase situation is interesting for us domestically because they have been actually at war with [the SEC] for over three years. What I've said as an institutional investor now is it's time to lay down the olive branches," he said.

SEC Chair Gary Gensler is 'razor-clear' on what he wants, which is to make bitcoin a security and regulate where it's traded like on a broker dealer exchange, O'Leary said. He called for Coinbase's CEO Brian Armstrong to be replaced with someone more willing to work things out.

"I'd swap leadership. I'd get a new person to run it and go back into the staff and say we've got to work this out because the whole industry has been stymied for three years," O'Leary said.

"You could get a trillion dollars worth of assets for an allocation of just 3% in sovereign wealth. You could open the spigots, you could really make this industry take off and own it domestically. But read the tea leaves, read the room, read Gensler's lips," he added.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance