Crypto Exchanges See Big Drop in Volumes as Bitcoin Volatility Approaches 2020 Low

Exchange volumes are at rock bottom as traders turn away from sluggish bitcoin markets.

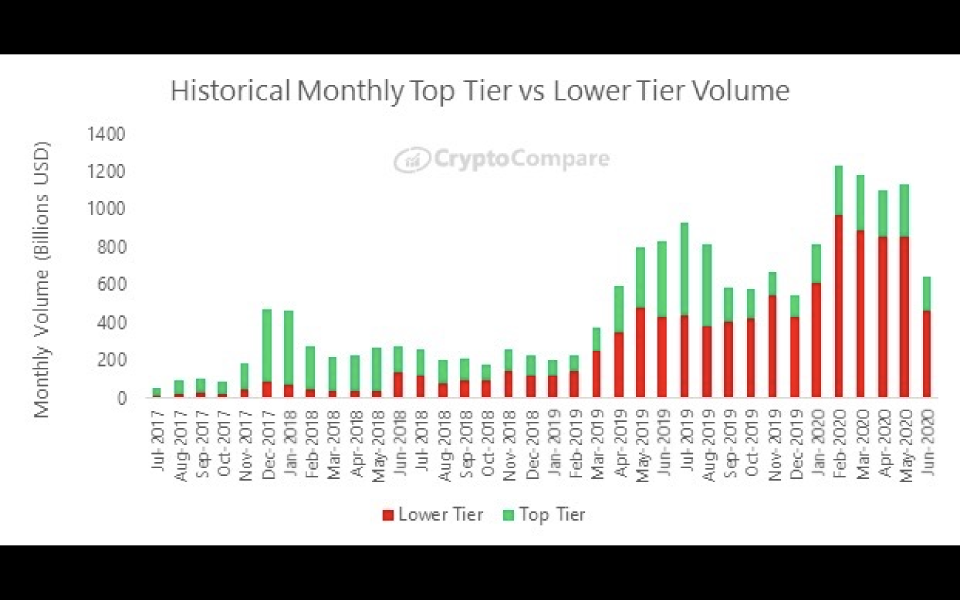

Trading volumes on “top tier” spot exchanges fell by 36% in June, according to a report from London-based data provider CryptoCompare.

Similarly, crypto derivatives exchanges experienced a 35.7% drop in volume to $393 billion, the lowest monthly volumes since the start of 2020.

Bitcoin’s ATR range – a volatility metric – has nearly halved since the start of June. At press time, it was just 20 points above its 2020 low.

CryptoCompare CEO Charles Hayter said June’s spot prices had been flat compared to previous months and the lack of price volatility likely explained the drop in trade volumes.

In theory, exchange volumes could continue tracking downwards should volatility remain at low levels, he said.

Volumes across the entire crypto spot market – both “top tier” and “lower tier” exchanges – fell nearly 50% in June, meaning the market share for crypto derivatives has increased 5% to 37%.

Also read: Binance Ordered to Halt Offering Derivatives Trading in Brazil

Related Stories

Crypto Exchanges See Big Drop in Volumes as Bitcoin Volatility Approaches 2020 Low

Crypto Exchanges See Big Drop in Volumes as Bitcoin Volatility Approaches 2020 Low

Crypto Exchanges See Big Drop in Volumes as Bitcoin Volatility Approaches 2020 Low

Crypto Exchanges See Big Drop in Volumes as Bitcoin Volatility Approaches 2020 Low

Yahoo Finance

Yahoo Finance