Supercar rallies and nurseries on the blockchain: Remnants of crypto boom remain despite bear market

“1,800 miles. 7 nights. 6 parties. 2 conferences. 100 cars. 1 superyacht party. 1 poker tournament. A fashion show. And charity gala.”

That’s the pitch on the flier for the HODL Rally, a £2,995 per person “blockchain networking supercar rally” taking place at the beginning of July. Fliers were scattered about this week’s Paris Blockchain Week summit, a conference showcasing France’s chops as a fintech hub.

The HODL Rally — which takes its name from slang among bitcoin investors for holding onto your investment — was one of the few reminders of the boom times for cryptocurrency, which faded dramatically last year after a surge in popularity that dominated headlines.

While the majority of the projects at the Paris Blockchain Week summit have clearly adjusted to life in the “crypto winter,” there are still some projects that are a reminder of the good times that have gone by.

From bull to bear market

Bitcoin led the entire crypto market on a rapid rise in 2017 as it popped over 1,600% against the dollar. Before the price rise, cryptocurrencies were a niche pursuit for cryptographic geeks. But the price explosion attracted scores of new entrants to the market — not all of them welcome.

The bull market came to be associated with copious spending on parties with the likes of Snoop Dogg, speculators dreaming of new Lamborghinis, dubious projects raising millions by issuing their own cryptocurrencies in so-called initial coin offerings (ICOs), and outright scams.

“Before the crash, all these ICO projects — think about how much money they wasted on all these nonsense expenditures?” Dominik Schiener, the co-founder of crypto platform IOTA, told Yahoo Finance UK. “Throwing these ICO parties, it’s just crazy.”

First class flights around the world and $1m salaries were commonplace two years ago, he said.

However, crypto prices crashed dramatically in 2018 and have largely flatlined so far this year. Industry insiders have dubbed it the “crypto winter.”

“I definitely think most of the insane spending has stopped,” Schiener said.

‘It’s not a week of excess’

Still, it’s hard not to be reminded of the boom times when you see the HODL Rally. The flier boasts pictures of supercars and DJs. The event takes in a crypto poker tournament at the Monte Carlo Casino and ends at the notorious party hotspot Ibiza.

Virtue Nightingale, the man behind the event, insisted this is not another example of wild crypto spending.

“It’s not a week of excess,” Nightingale told Yahoo Finance UK at the Paris Blockchain Week Summit. “I wanted to bring to the industry a fun social element.

“I feel that these conferences are getting pretty repetitive and I wanted to bring a different aspect. I felt the best way to reach a larger demographic, to educate people, and to inspire people, is to appeal to something they’re interested in.”

The event’s price tag suggests the potential pool of attendees is not that large. VIP tickets, which can be paid for with cryptocurrencies, cost £4,500.

Nightingale contrasted the price with that of other rally events, such as the Gumball 3000 where entry costs at least £50,000. Still, most buyers of the 30 tickets sold so far are in the cryptocurrency and blockchain space. There are also some hedge fund owners and car aficionados that have signed up, he said.

“It brings people from different walks of life altogether as one community, participating in this event and then what you do is you take that time, that opportunity to educate and inspire people about the importance of blockchain in their day-to-day lives,” Nightingale said.

Nightingale, who worked in the car industry for a decade before becoming interested in blockchain, added that he hoped the HODL Rally would be the first of many events hosted by his new “lifestyle experience company for the blockchain.”

‘1 SArd=1 sardines Tin’

Elsewhere at the Paris Blockchain Week summit, there were reminders of another aspect of the crypto bull market — eyebrow raising projects.

At one point in the speakers lounge I was chatting to another attendee when we were both approached and handed a mock debit card for “mySardines.com.” We assumed it was a joke but were assured it was a real project. A visit to its website reveals little about the project other than “1 SArd=1 sardines Tin.” Investment in “the disruption of Sardines World” is open now.

Elsewhere, a booth on the main conference floor advertised Montessori Worldwide, a blockchain-based security token offering for a chain of French nurseries. The operator already has around 20 nurseries across France, but wants to go worldwide.

“Holding a Montessori Token offers a fixed rate of return, guaranteed by the blockchain,” the prospectus read. “Invest for a better world for your children!”

The offer document, which carried no obvious risk warnings, promised a “guaranteed return of 8% per year.” Montessori Worldwide, which is registered in Malta, is seeking to raise €100,000 by issuing its new tokens.

A representative at the Montessori Worldwide booth initially said the issuance was regulated, but then clarified he meant regulated by blockchain smart contracts, not any national regulator. He was vague on what would happen to the guaranteed 8% return if Montessori Worldwide’s revenue projections fall short.

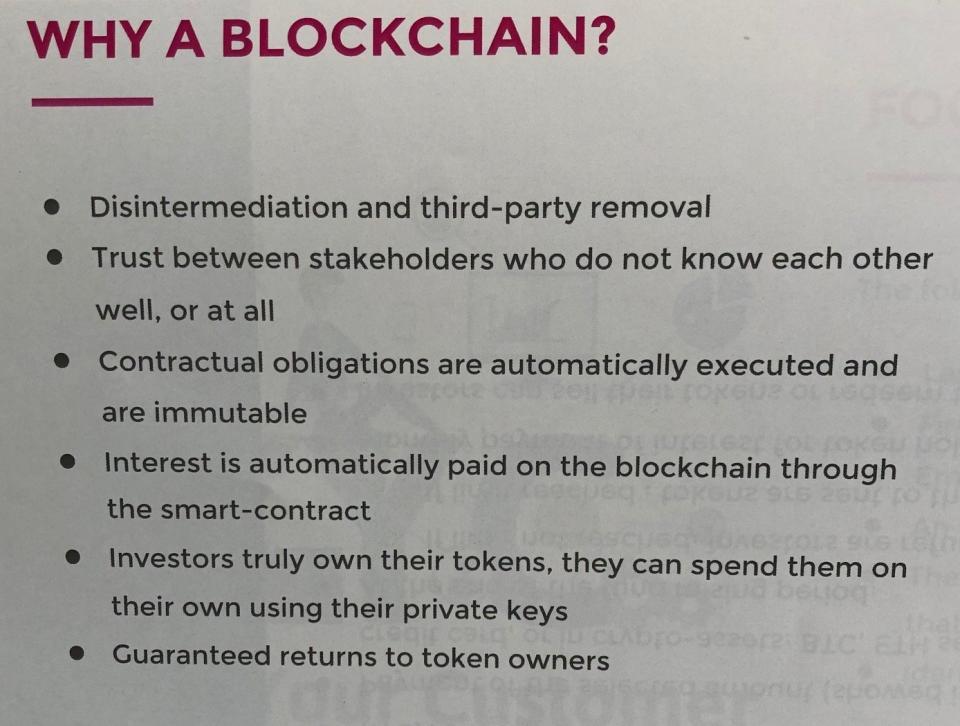

Why exactly a nursery chain needs to turn to blockchain-based smart contracts to raise funds is unclear from the offer document. A page titled “Why a blockchain?” sets out in general terms the benefits of blockchain and smart contract technology.

The offer document also said Montessori Worldwide plans to develop artificial intelligence to help teachers, use facial recognition cameras to “monitor and analyse the activities of every child,” and use “an intelligent voice assistant to answer parents’ questions.” It projects the project will need €30m of funding over three years.

A saner market

Exotic and risky investment opportunities such as these were commonplace during the boom times. The idea of putting everything “on the blockchain” was in vogue. (This week Nestle and French supermarket chain Carrefour announced they were putting mashed potato on the blockchain.)

Now, however, theses projects are fewer and father between. The price crash has brought discipline to the once-hot market and has largely driven out projects that saw it simply as a quick and easy way to raise money.

There were few projects touting for investment in Paris. Most were trying to encourage adoption, build business relationships, or simply spread the world.

Still, if you look hard enough, the remnants of the boom times are there.

More from the Paris Blockchain Week summit:

France pushes to become global hub for blockchain — the tech behind bitcoin

Nordic and Baltic watchdogs plot grand data sharing deal after money laundering scandals

Crypto price crash actually good for business, say entrepreneurs

Notre-Dame Cathedral restoration could accept bitcoin donations

Lithuania 'consulting' UK banking watching about Revolut after press reports

Yahoo Finance

Yahoo Finance