Credit Suisse: Sears REIT Seritage Asset Quality 'Better Than Expected'

Sears Holdings Corp (NASDAQ: SHLD) new REIT Seritage Growth Properties, is anticipated to start trading July 6, on the NYSE under ticker symbol SRG.

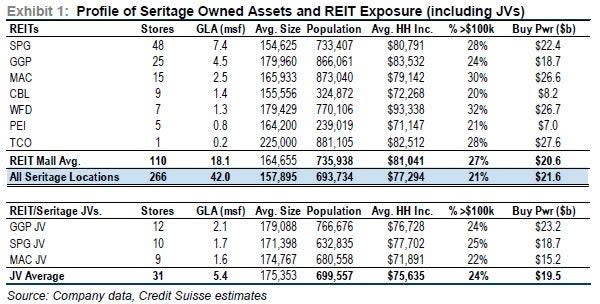

Seritage will initially consist of 266 properties, totaling ~42 million square feet of "boxes," with Sears and Kmart as the primary tenants.

Sears Holdings will receive a much needed cash infusion of $2.67 billion as compensation for the relinquished real estate, for an average cost ~$63 per SF, (excluding additional land).

The 266 total includes 31 properties which were contributed to 50/50 JVs with the three top U.S. mall landlords: Simon Property Group (NYSE: SPG), General Growth Properties (NYSE: GGP) and Macerich Company (NYSE: MAC).

Related Link: How Much Upside Do Sears REIT JVs Really Have?

Tale Of The Tape - Sears Shares June Slide

Not As Bad As It Looks

In early June, Sears released another dreadful quarterly report, racking up losses of $2.85 per share; while reporting declining comparable store sales for Sears and K-mart branded stores of 7 percent and 14.5 percent, respectively.

However, a substantial portion of the drop in SHLD share prices reflects the 1/2:1 SRGRT rights offering to shareholders, (initially valued at $29.58 for each two SHLD shares), for the real estate being transferred to the Seritage REIT.

Credit Suisse - Seritage Portfolio 'Better Than Expected'

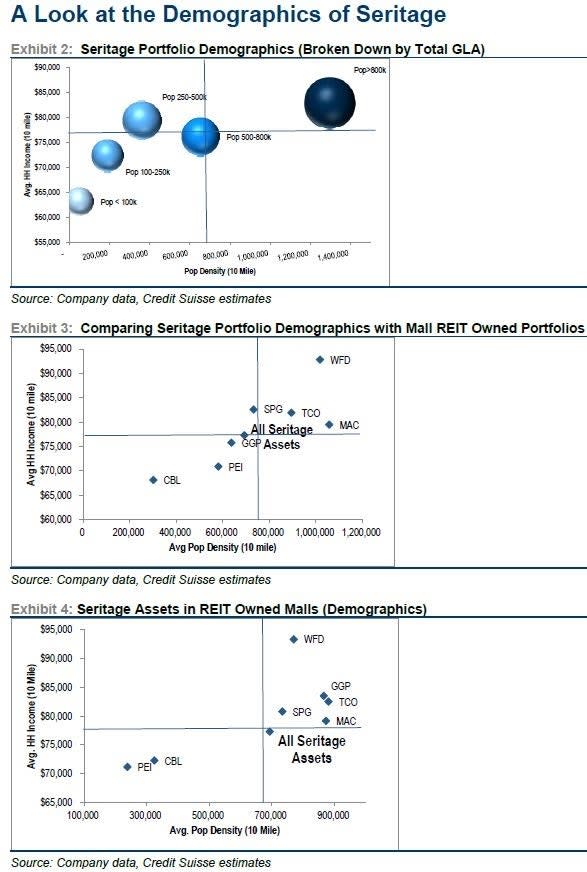

On July 1, Credit Suisse analysts George Auerbach and Ian Weissman published a detailed look at the Seritage real estate portfolio, and came away impressed with the quality of the locations.

According to Credit Suisse, "...80% of the rents are from SHC (Sears) paying $4.16/sf; 20% of the rents are released to 3rd party retailers at average rents of $13.37/sf."

Third-party tenants currently occupy only 6.6 percent of the Seritage gross leasable area (GLA), but account for 10 percent of the rents. Notably, Credit Suisse estimated market rates at $40 per SF.

Credit Suisse - Seritage Mall Locations Have Strong Demographics

Does Sears really need its existing ~160,000 SF average "box" footprint, when it is focused on transitioning to an omnichannel Shop Your Way membership business model?

Arguably, with the right merchandise mix, Sears's mall locations could generate much higher sales per SF from smaller footprints, say 80,000 SF of updated space.

The other 80,000 SF could then be leased to newer retail concepts that do not currently have access to these mall anchor locations; as well as top notch in-line tenants, in a win-win arrangement for all parties.

These new leases will be at much higher rates, and these best in class retailers will generate far more traffic in the existing Sears's wing of the mall.

Credit Suisse - Seritage Has Multi-Tier Leases

While the master lease between Sears and Seritage has a basic structure of 10-year leases with 3 or 4 five year options, they are grouped into "Tiers."

Tier 1 Assets: cover 22 locations containing ~4 million SF of GLA. Notably, "Seritage has the right to recapture all of the space in order to lease to third-parties at higher rents, by paying a lease termination fee to Sears."

Tier 2 Assets: cover 203 locations, containing ~31 million SF of GLA. Credit Suisse noted, "Seritage has the ability to recapture 50% of the square footage to lease to a third party, but importantly can recapture all of any automotive care centers which are free standing or attached... as well as certain portions of parking areas and common areas," according to the SEC filing.

Tier 3 Assets: "...these are spaces which have already been released to 3rd party tenants, including: At Home (5 of 11 locations), Primark, Dicks, Old Time Pottery, [and] Walmart."

JV Assets: total ~5.4 million SF, including: 12 GGP, 10 SGP and 9 MAC mall locations.

Wild Card: Sears has the ability to reject up to 20 percent of leases for unprofitable store locations. Credit Suisse noted that as of April 30, there were 59 such locations as defined by the lease agreements.

Notably, Seritage investors risk getting back locations which are the least desirable.

Credit Suisse - Seritage Location Comparisons

Credit Suisse - Seritage Management Discussions

Key takeaways from recent Credit Suisse conversations with Seritage CEO Ben Schall, included:

There is significant demand from retailers for Sears's space, "...as retailers are not meeting store growth targets because lack of available boxes."

Schall believes, "... there is significant upside opportunity in densifying the Sears site, and building out additional GLA and outparcels."

Investor Takeaway

It will be interesting to see how Seritage shares perform during the initial week of trading; keeping in mind that SHLD CEO Eddie Lampert, (along with his ESL hedge fund), and other hedge funds control the majority of the shares.

Clearly, some investors will view a REIT concentrated in retail bricks and mortar, (and primarily occupied by Sears and K-mart), to be unappealing on the face of it.

However, at the right price, other investors might like the upside potential of the real estate.

See more from Benzinga

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance