COVID-19 forces Canadians to adjust retirement plans

The pandemic has added new challenges to Canadians’ retirement plans, putting as many as 5.5 million out of work at the peak of job losses, potentially pushing some to dip into their savings or pull back on building their nest egg. The financial shortfall is prompting Canadians to change their own retirement picture.

According to a retirement reality check report from Mackenzie Investments surveying Canadians between 30 and 75, Canadians anticipate needing $878,000 on average for a comfortable retirement. Current retirees have an average savings of $427,000, showing that Canadians expect retirement will be further out of reach than it was for those who have already retired. The report also highlighted that Canadians now expect to retire at the age of 62, compared to a previous average retirement age of 57.

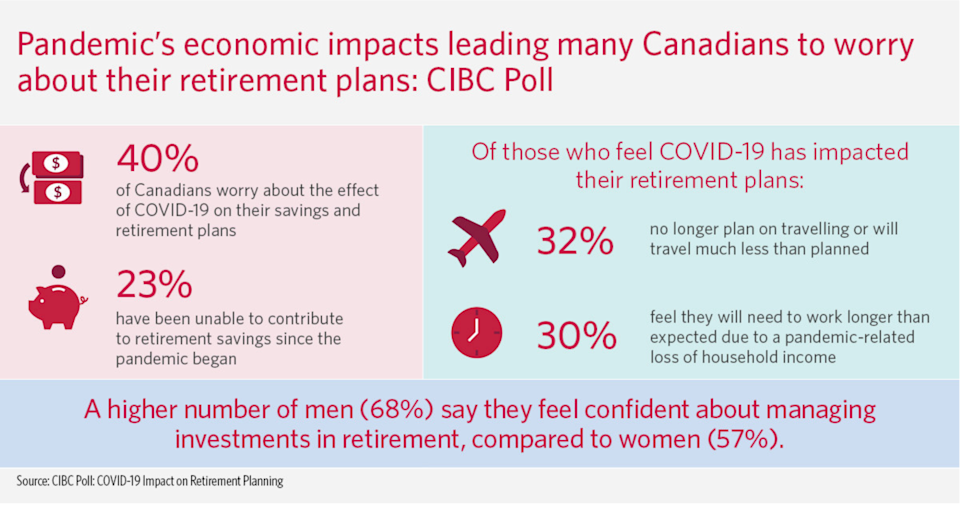

The pandemic has further strained these goals, with 23 per cent of surveyed Canadians admitting they were unable to contribute to their retirement savings since the pandemic began, according to a CIBC poll.

Adjusting Expectations

The pandemic has also forced Canadians to remove some plans from their ‘retirement wishlist’ as 32 per cent say they no longer plan on travelling or will travel much less than planned in their retirement, according to the CIBC poll.

Carol Bezaire, the vice president of tax, estate and strategic philanthropy at Mackenzie Investments, says she has seen similar trends. Bezaire said Canadians need to educate themselves on the savings and investing options available and adjust their expectations for what they will need to spend in retirement. She encourages people to look at their fixed costs and cut out expenses that non-working households no longer need, such as buying suits or travelling for work. “Take a reality check, what is it that you need, what sources of income are coming in and educate yourself as to what's going on.”

Bezaire added that taking stock of your mix of assets is essential and can avoid many common mistakes with retirement. She often sees clients who have over-contributed to their RSP, of which the government could take half in the event of the retiree’s death. “You just can't do this alone,” Bezaire said. “Right now, the markets are volatile, the investment returns are low. It's a very complex financial atmosphere. So, work with a financial adviser and make sure you've got what you need.”

For some Canadians, retirement has come earlier than expected. “We're already seeing severance packages. The companies are going to have to save money and it's going to be expense control for the recovery. So, we see an increase in early retirement.” She added that retirees who went into an early retirement due to job loss often pursue part-time work or volunteering.

Going Digital

Kendra Thompson a partner in consulting at Deloitte, said that this could be the time for more financial technology innovation. “The time is now for innovation in the space and whatever we can do as an industry to push for an efficient and innovative wealth management industry will benefit those Canadians planning to retire.”

Thompson says that a digital model could add more nuanced and catered retirement strategies. Above all, Thompson urges Canadians to get started on their retirement savings plan sooner rather than later and be more deliberate with their saving.

Surveys like the one conducted by CIBC show that the pandemic taught Canadians a few crucial lessons in saving. Twenty per cent of respondents say there’s a need to pay more attention to personal finances and 19 per cent agree it’s important to save for their retirement.

Yahoo Finance

Yahoo Finance