Covid-19 deaths cut state pension spending and push up inheritance tax receipts

Excess deaths as a result of coronavirus will reduce spending on the state pension and increase inheritance tax receipts, according to analysis of Budget data.

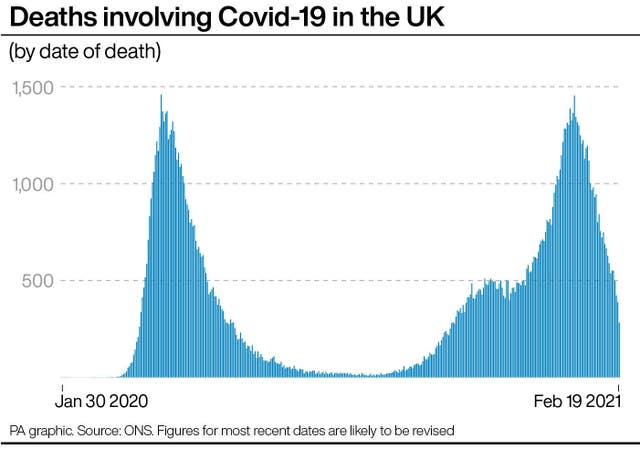

More than 144,000 deaths involving Covid-19 have occurred in the UK since the start of the pandemic, figures published by the UK’s statistics agencies show.

Most coronavirus deaths have been in people aged over 65, many of whom will have been receiving the state pension.

The Office for Budget Responsibility (OBR) estimated that will partly cause the Government’s pensioner spending to fall by £600 million in 2020/21 and £900 million in 2021/22, relative to its March 2020 forecast.

While the fiscal watchdog said the “primary driver of lower spending is the weaker outlook for average earnings growth”, excess coronavirus deaths have also reduced the number of people receiving pensions relative to previous assumptions.

“Indeed, with virus-related deaths rising sharply again in recent months, we have revised up the number of excess pensioner-age deaths in 2020-21 from 90,000 in our November forecast to around 100,000 in this one,” the OBR said in its report alongside the Budget.

“This revision may appear small given the severity of the current wave, but the lockdown brought in to control the coronavirus has also dramatically reduced the number of influenza deaths this winter relative to a normal year.

“Our forecast now also assumes some excess deaths in 2021-22, drawing on academic modelling published alongside the Government’s road map.

“Excess deaths lower pensioner spending by £0.6 billion in 2020-21 and by £0.9 billion in 2021-22 relative to our March 2020 forecast.”

The unpredictability of the virus means the outlook is very uncertain. Imperial College modelling published with the Roadmap shows the sensitivities of hospitalisations and deaths to key epidemiological assumptions.

Read more in Box 2.1 of our EFO#Budget2021 pic.twitter.com/u3AlD3cqEC

— Office for Budget Responsibility (@OBR_UK) March 3, 2021

On inheritance tax, the Treasury forecasts that receipts will increase from £5.1 billion in 2019/20 to £6 billion in 2021/22, before falling to £5.8 billion the following year.

While the rise is attributed to the freeze of inheritance tax thresholds until April 2026 and the growth in the value of estates, higher Covid-19 deaths will also contribute.

The OBR said it had “revised up our assumption for excess deaths this year and next relative to November”.

It said that “higher virus-related deaths in the current wave of the virus have outweighed the effect of lockdown reducing deaths from other causes, particularly from influenza and other respiratory diseases”.

However, the OBR said receipts have been “revised down substantially relative to our pre-pandemic forecast thanks to lower equity prices and lower house prices”.

“The effect of these on growth in the value of estates more than offsets the small lift to receipts due to the increase in deaths this year,” the watchdog said.

Yahoo Finance

Yahoo Finance