Could the Leasing Industry Survive Another Recession?

Economies tend to move in cycles, with expansions inevitably followed by contractions. The problem is that when expansions last as long as the one we are in today (it's among the longest in recorded history), investors and companies tend to forget just how bad recessions can hurt. That's a problem for any company, but particularly for companies that make a living leasing expensive gear to others, like GATX Corporation (NYSE: GATX) and Aircastle Limited (NYSE: AYR). Here's why you should be worried about these companies today.

Usually a great model

GATX and Aircastle provide an important service. They buy things like train cars and airplanes using long-term debt and then lease them out to companies. These are expensive items into which airlines and railroads would rather not pour capital if that capital could be better used to expand operations in other ways. Moreover, since leasing is cheaper than buying, a company can get access to more of these assets than would be possible via outright purchase, allowing it to better serve end customers. There is material demand throughout the economic cycle for the services that GATX, Aircastle, and Air Lease (NYSE: AL) provide.

Image source: Getty Images.

Leasing can also be an extremely profitable business when demand is strong. As you would expect, demand is strongest during economic expansions. The problem comes when the normal cycle unfolds and economies contract. During these periods, demand softens, lease rates fall, and GATX, Aircastle, and Air Lease are likely to get some of their rail cars and airplanes back from their customers. With the U.S. expansion now ranking among the longest in history and economic growth in countries around the world showing signs of weakening, now is the time to worry about these leasing companies.

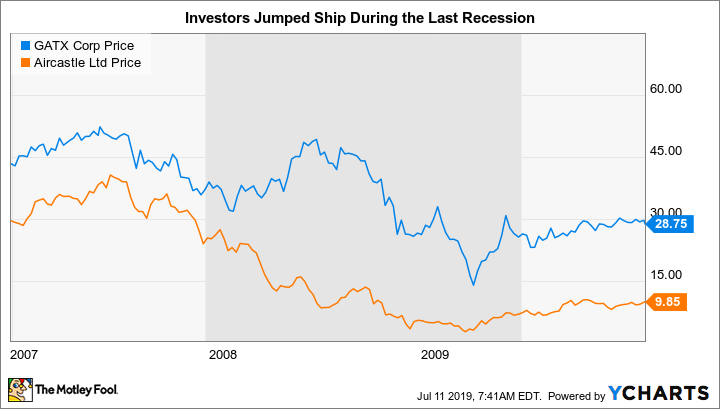

A look back at the 2007 to 2009 recession will help explain why. By the end of 2009, GATX and Aircastle had fallen 45% and 75% from their pre-recession highs in 2007 (Air Lease wasn't public at the time). Earnings in the years following the recession fell 50% at Aircastle and 75% at GATX, partly driven by asset write-offs.

Digging a little into those facts, GATX's railcar leasing rates fell 11% in 2009 and nearly 16% in 2010. Although utilization remained fairly strong, GATX's railcar segment's profits were cut in half between 2008 and 2010. Aircastle, meanwhile, had 11 airplane leases terminated in 2009 and 2010, roughly 8% of its fleet. Those terminations led to an over 50% increase in expected maintenance expenses and $25 million in impairments on the airplanes due to reduced expectations for future earnings. Economic downturns can, indeed, be tough on leasing companies.

Where they stand

A big part of the problem is that leasing companies use debt to buy the assets they own and lease out to others. When times get tough, they still have to pay the interest on that debt, even if lease rates are falling and customers are terminating leases. To put it simply, leverage matters a great deal. Today, both GATX and Aircastle have higher debt-to-equity ratios (which looks at how much debt a company is using) than they did before the last recession. Air Lease's debt-to-equity ratio is in the same general area as its peers'.

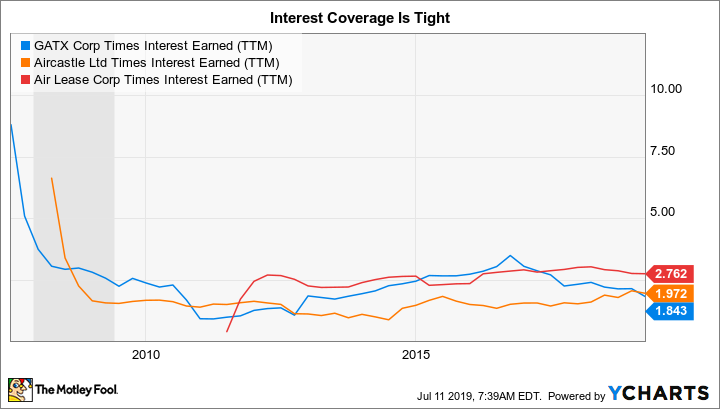

Times interest earned, which measures how well a company can cover its interest expenses, is just 1.8 times at GATX, around 2 times at Aircastle, and a healthier 2.75 times at Air Lease. However, these aren't incredible numbers when you consider that CocaCola covers its trailing 12-month interest costs 35 times over. And both GATX and Aircastle had much higher interest coverage going into the last recession (over 8 times and 6 times, respectively). It wouldn't take much of a financial hit to put these companies in a tough financial position today. Note, too, that Aircastle was forced to trim its dividend following the last downturn.

GATX Times Interest Earned (TTM) data by YCharts

That said, this time around, leasing companies will benefit from the historically low interest rates currently available. For example, in 2010 GATX's most expensive debt was secured and had a 9% interest rate. In 2018, the most expensive debt GATX carried was unsecured and carried a 5.6% rate. The low interest rate environment should soften the blow of a recession, but it won't eliminate the pain these companies are likely to feel from softening lease rates and weakening demand. Also, investors tend to throw the baby out with the bathwater during recessions, and probably won't be paying much attention to this detail when they are running for financial cover.

Take a cautious stance

There's no way to predict when the next recession will hit, but it is likely to be sooner rather than later given the length of the current expansion. Meanwhile, even after a pullback in their share prices, GATX, Aircastle, and Air Lease are still fairly close to their multi-year highs. The leasing business is not going away. But an economic downturn will take a big toll on these companies and, likely, their stocks, noting that GATX and Aircastle appear no better prepared today than they were before the last recession. Most investors should probably avoid this trio today.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance