Costco (COST) to Post Q3 Earnings: What's in the Offing?

Costco Wholesale Corporation COST is likely to register an increase in the top line when it reports third-quarter fiscal 2022 results on May 26, after the closing bell. The Zacks Consensus Estimate for revenues is pegged at $51.76 billion, indicating growth of 14.3% from the prior-year reported figure.

The bottom line of this Issaquah, WA-based company, is anticipated to improve year over year. Although the Zacks Consensus Estimate for third-quarter earnings per share has decreased 1% to $3.01 over the past seven days, the figure still suggests an increase of 9.5% from the year-ago period.

Costco has a trailing four-quarter earnings surprise of 13.3%, on average. In the last reported quarter, the company’s bottom line surpassed the Zacks Consensus Estimate by 8.6%.

Key Factors to Note

Costco’s growth strategies, better price management, decent membership trends and increasing penetration of e-commerce business have been contributing to its upbeat performance. In fact, the company’s strategy to sell products at discounted prices has helped attract customers who have been seeking both value and convenience amid the inflationary environment. Cumulatively, these factors have been aiding this operator of membership warehouses in registering an impressive sales run.

The company’s net sales grew 13.9% to $17.33 billion for the retail month of April — the four-week period ended May 1, 2022 — from $15.21 billion in the last year. This followed a net sales increase of 18.7% to $21.61 billion in the month of March — the five-week period ended Apr 3, 2022 — from $18.21 billion last year. Comparable sales increased 12.6% and 17.2% in the retail month of April and March, respectively.

The company has been rapidly adopting the omni-channel mantra to provide a seamless shopping experience, whether online or in stores. We note that e-commerce comparable sales increased 5.7% and 8.9% in April and March, respectively.

While the abovementioned factors raise optimism about the outcome, margins still remain an area to watch. Any deleverage in SG&A rate, higher labor and occupancy costs, and increased marketing and other store-related expenses might have weighed on margins. The impact of incremental wages and sanitation costs due to the ongoing pandemic cannot be ignored as well. Management has acknowledged troubles related to shortages of raw materials, ingredients, and even packaging supplies.

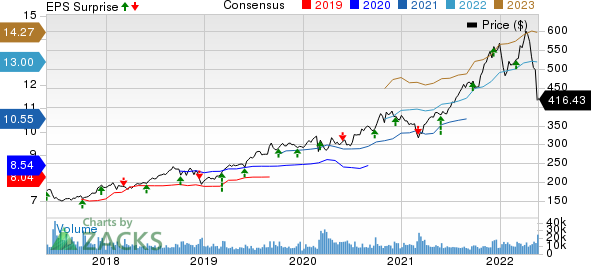

Costco Wholesale Corporation Price, Consensus and EPS Surprise

Costco Wholesale Corporation price-consensus-eps-surprise-chart | Costco Wholesale Corporation Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Costco this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Costco has an Earnings ESP of -0.08% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks With the Favorable Combination

Here are a few companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Kroger KR currently has an Earnings ESP of +2.95% and a Zacks Rank #2. The company is expected to register bottom-line growth when it reports first-quarter fiscal 2022 results. The Zacks Consensus Estimate for quarterly earnings per share of $1.27 suggests growth of 6.7% from the year-ago quarter’s reported figure.

Kroger’s top line is anticipated to rise year over year. The consensus mark for revenues is pegged at $43.22 billion, indicating an increase of 4.7% from the year-ago quarter. KR has a trailing four-quarter earnings surprise of 22.1%, on average.

Casey's General Stores CASY currently has an Earnings ESP of +7.07% and a Zacks Rank #3. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $1.49 suggests an increase of 33% from the year-ago reported number.

Casey's top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $3.44 billion, which suggests an increase of 44.7% from the prior-year quarter. CASY has a trailing four-quarter earnings surprise of 21.6%, on average.

Macy's M currently has an Earnings ESP of +3.12% and a Zacks Rank #3. The company is likely to register an increase in the bottom line when it reports first-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 82 cents suggests an increase of 110.3% from the year-ago reported number.

Macy's top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $5.35 billion, which suggests an increase of 13.6% from the prior-year quarter. Macy’s has a trailing four-quarter earnings surprise of 238.9%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance