Will Cost-Saving Efforts Aid Penn National (PENN) Q3 Earnings?

Penn National Gaming, Inc. PENN is set to release third-quarter 2018 results on Nov 1, before market opens. Notably, the company’s earnings have surpassed the Zacks Consensus Estimate in five out of the trailing seven quarters.

Q3 Expectations

The Zacks Consensus Estimate for third-quarter earnings is pegged at 44 cents, which marks an increase of 62.9% from the year-ago quarter. Revenues are estimated at $807.3 million, reflecting a marginal gain of 0.1% from a year ago.

Let’s delve into the factors that are expected to have had an impact on the company’s Q3 performance.

Factors at Play

Penn National continues to improve its gaming, hotel, and food and beverage offerings in order to drive revenues. Given the increased demand for leisure services and the company’s enormous scale, we believe that the top line will continue to grow. Also, visitation and spend per visit are expected to drive the overall gaming revenues.

The Zacks Consensus Estimate for net revenues at the Northeast segment is pegged at $401 million, indicating a drop of 0.2% from the year-ago quarter and 5.2% from the last reported quarter. The consensus estimate for South/West segment revenues stands at $163 million, reflecting a rise of 1.9% year over year and a decline of 2.4% on a sequential basis. The consensus estimate for the Midwest segment revenues is at $233 million, reflecting a rise of 0.4% year over year and 0.9% on a sequential basis.

Moreover, the company continues to adopt initiatives to improve margin and looks for opportunities to enhance operational efficiency. The company expects $100 million of cost synergies. In fact, the company reported adjusted EBITDA margin growth in the second quarter of 2018 through ongoing refinements in procurement, marketing and labor management. Thus, these cost-saving strategies will reap recurring benefits in the near term.

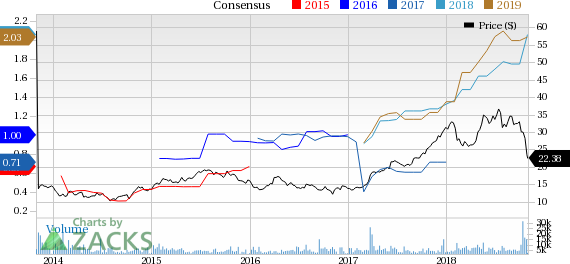

Penn National Gaming, Inc. Price and Consensus

Penn National Gaming, Inc. Price and Consensus | Penn National Gaming, Inc. Quote

What Our Model Indicates

Our proven model does not suggest a beat for Penn National in the quarter to be reported. That is because a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for that to happen. Unfortunately, that is not the case here, as you will see below.

Penn National has an Earnings ESP of -5.47% and a Zacks Rank #3, a combination that reduces the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few stocks from the Consumer Discretionary space that investors may consider as our model shows that these have the right combination of elements to post an earnings beat in their quarterly reports.

Live Nation Entertainment, Inc. LYV has an Earnings ESP of +12.06% and a Zacks Rank #3. The company is expected to report quarterly numbers on Nov 1.

PlayAGS, Inc. AGS has an Earnings ESP of +66.67% and a Zacks Rank #3. The company is slated to report quarterly numbers on Nov 8. You can see the complete list of today’s Zacks #1 Rank stocks here.

WillScot Corporation WSC has an Earnings ESP of +87.3% and a Zacks Rank #3. The company is slated to report quarterly numbers on Nov 8.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Penn National Gaming, Inc. (PENN) : Free Stock Analysis Report

WillScot Corporation (WSC) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance