Cosan's (CZZ) Net Income & Sales Rise Y/Y on Margin Expansion

Cosan Limited’s CZZ adjusted net income totaled R$135.1 million ($22.8 million) in third-quarter 2019 compared with the year-ago tally of R$191.9 million ($48.7 million).The company reported earnings per share of 59 cents in the third quarter, a significant improvement from 19 cents in the prior-year quarter.

Net income significantly surged to R$560.8 million ($94.8 million) from the R$63 million ($16 million) recorded in the year-ago quarter.

Revenues Up Y/Y

In the reported quarter, Cosan’s net revenues came in at R$20,866.2 million ($3,528.2 million), reflecting year-over-year growth of 21.2%.

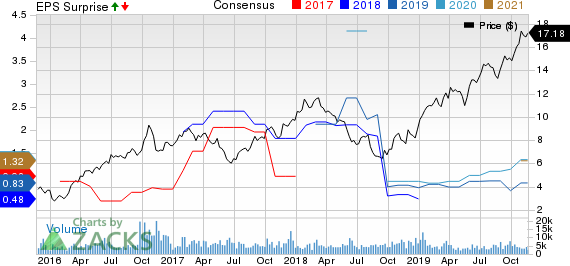

Cosan Limited Price, Consensus and EPS Surprise

Cosan Limited price-consensus-eps-surprise-chart | Cosan Limited Quote

Gross Margin Up Y/Y Amid Higher Costs

Cosan’s cost of sales and services sold in the September-end quarter marked a 18.9% year-over-year rise to R$18,110.4 million ($3,062.3 million). It represents 86.7% of net revenues versus the 88.4% witnessed in the year-ago quarter. Gross profit increased 39% year over year to R$2,755.8 million ($466 million). Gross margin came in at 13.2% compared with the 11.5% witnessed in the comparable period last year.

Selling, general and administrative expenses flared up 27.7% year over year to R$1,187.3 million ($200.7 million), representing 5.7% of net revenues.

Adjusted EBITDA increased 20.6% year over year to R$2,590.2 million ($438 million), driven by better results at Rumo, Comgas and Raizen Energia.

Balance Sheet

Exiting the July-September quarter, Cosan’s cash and cash equivalents were R$8,762 million ($2,105.4 million), up from the R$7,071 million ($1,837.8 million) reported at the end of the second quarter of 2019. At third-quarter 2019 end, loans and borrowings were R$37,274 million ($8,956.5 million), up from R$33,626 million ($8,739.8 million) as of June-quarter end 2019.

Share Price Performance

Over the past year, Cosan has outperformed its industry with respect to price performance. The stock has soared around 120.6%, compared to the industry’s growth of 9.8% during the same time frame.

Zacks Rank & Stocks to Consider

Cosan currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Basic Materials space are Franco-Nevada Corporation FNV, Agnico Eagle Mines Limited AEM and Kinross Gold Corporation KGC. While Franco-Nevada and Agnico Eagle sport a Zacks Rank #1 (Strong Buy), Kinross Gold carries a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Franco-Nevada has a projected earnings growth rate of 39.3% for the ongoing year. The company’s shares have rallied 47.6% in a year’s time.

Agnico Eagle has an outstanding estimated earnings growth rate of 168.6% for the current year. Its shares have appreciated 65.7% over the past year.

Kinross has an expected earnings growth rate of a whopping 210% for 2019. The company’s shares have surged 77.1% in the past year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Cosan Limited (CZZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance