Corvus Gold (TSE:KOR) Shareholders Have Enjoyed A 65% Share Price Gain

Corvus Gold Inc. (TSE:KOR) shareholders might be concerned after seeing the share price drop 23% in the last quarter. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. In the last three years the share price is up, 65%: better than the market.

See our latest analysis for Corvus Gold

Corvus Gold hasn't yet reported any revenue yet, so it's as much a business idea as an actual business. So it seems that the investors more focused on would could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Corvus Gold will find or develop a valuable new mine before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. The is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Corvus Gold investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital

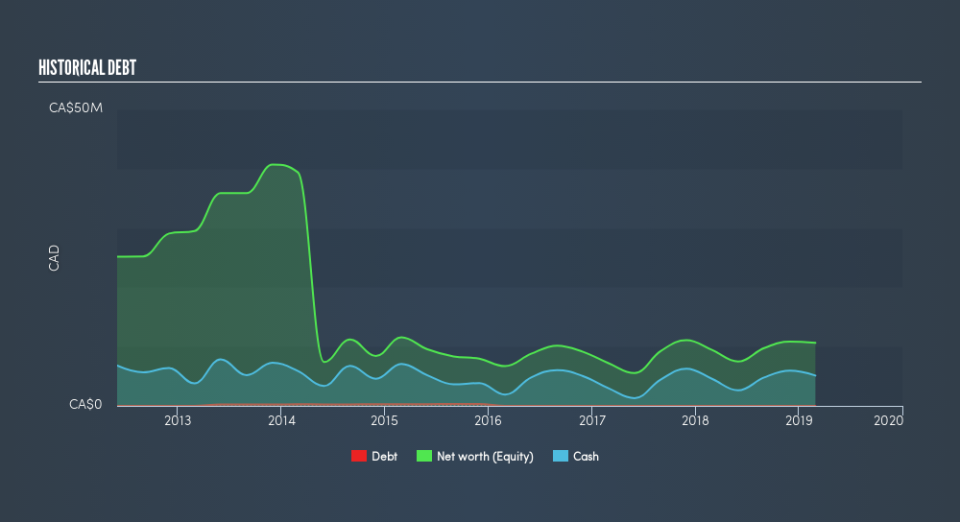

When it reported in February 2019 Corvus Gold had minimal net cash consider its expenditure: just CA$4.7m to be specific. So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. Given how low on cash the it got, investors must really like its potential for the share price to be up 18% per year, over 3 years. The image below shows how Corvus Gold's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

While the broader market gained around 6.0% in the last year, Corvus Gold shareholders lost 33%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 3.0% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Corvus Gold may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance