Corvus Gold Drills 56.4 Metres @ 1.71 g/t Gold, 55.1 Metres @ 1.40 g/t Gold and 64.9 Metres @ 1.02 g/t Gold, Expands Discoveries at the Mother Lode Deposit, Nevada

Drill plan map of the Mother Lode Project Aug 18, 2020

Drill hole location and plan map of Corvus Gold's Mother Lode project as of Aug 18, 2020

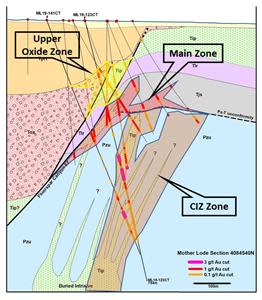

Cross-section for drill hole ML20-141CT

Cross-section for drill hole ML20-141CT at Corvus Gold's Mother Lode project

Core photo of drill hole ML20-149CT of the CIZ zone

Diatreme breccia (6.8m @ 4 g/t Au) from drill hole ML20-149CT at the CIZ zone, Mother Lode project

VANCOUVER, British Columbia, Aug. 18, 2020 (GLOBE NEWSWIRE) -- Corvus Gold Inc. (“Corvus” or the “Company”) – (TSX: KOR, NASDAQ: KOR) announces it has received additional results from its current drill program at the Mother Lode project with a successful expansion of the new Central Intrusive Zone “CIZ”, Upper Oxide and “North” targets. These new results are beginning to define the shape and continuity of the gold mineralization in these important resource expansion areas of the Mother Lode deposit (Figure 1 & Table 1). Key new intercepts include ML20-151CT, with 56.4m @ 1.71 g/t Au and ML20-141CT with 64.9m @ 1.02 g/t Au including 11.7m @ 3.9 g/t Au and ML20-149CT with 55.1m @ 1.40 g/t Au which shows good vertical continuity with the initial CIZ discover hole ML19-123CT (125.5m @ 2.6 g/t Au and 74.7m @ 0.62 g/t Au NR20-06, May 13, 2020).

The CIZ target will be the focus of two of Corvus’ three drill rigs operating in the District with the third rig directed at new discovery drilling at its Lynnda Strip, and other emerging new targets.

CIZ Discovery

The CIZ results have confirmed the direct association of gold mineralization with the north trending intrusive dike swarm as postulated earlier. These latest results indicate this is a broad zone of gold mineralization, varies in width along strike, and remains open at depth. The dominantly oxide nature of the zone to a depth of approximately 600 metres and its high, heap leach grade is positive for driving the pit to capture most of the currently defined mineralization (Figure 2). In addition, new, preliminary cyanide leach results from hole ML19-123CT show the CIZ oxide mineralization appears to have a high gold recovery averaging above 90%, which Corvus believes indicates good heap leach potential.

Drilling at the CIZ target continues in order to determine the development of higher-grade shoots within this new and expanding deposit, which Corvus believes may hold additional potential to develop into an underground deposit. Metallurgical testing of the CIZ has begun to better characterize its processing potential for its future addition to the Mother Lode mine plan.

Central Main Zone

Results from the Central Main Zone sulfide body continue to infill the resource model with higher grade intercepts which are expected to improve the grade and size of the resource as well as its confidence level. These new core-drilling intercepts through the Main Zone at Mother Lode have consistently come in at higher grades than the earlier reverse circulation (RC) drill holes. This positive variance may be reflecting a better sample that more effectively tests the zone (ML20-149CT, 21.5m @ 3.48 g/t Au as compared to holes north and south (NR17-19, Dec 12, 2017, ML17-013, 24.4m @ 1.74 g/t Au and ML17-015, 19.8m @ 1.95 g/t Au). In addition, the core drilling is defining a number of unique breccia zones at the top of the CIZ dike swarm that cut the Central Main Zone and are associated with higher-grade gold mineralization. These unique heterolithic (many different rock types) breccias appear to be diatreme type or associated with explosive activity above the tops of the intrusive dikes and are a good sign of a very dynamic and large gold system (Figure 3).

Upper Oxide Zone

Additional intersection into the Upper Oxide Zone are defining a sizable body of low-grade heap leach mineralization that will be very beneficial to the mining of the deeper, higher-grade deposit at Mother Lode (lowering the strip ratio). This zone of mineralization was previously classified as overburden, thus Corvus believes that the reclassification could add additional ounces to the heap leach mineralization and potentially reduce the overall mining costs.

North Zone

In general, the deep drilling results from the North target have begun to define the northern extent of the surface minable deposit at Mother Lode. The Main zone appears to be thinning and dropping off in grade as the deposit approached the Corvus – Coeur Mining property line although Corvus is seeing silver numbers pick up to the north. This increase in silver is observed in a number of holes as Corvus goes north. In addition, the oxide diatreme breccia mineralization in hole ML19-126CT is an important geologic feature as it is outlining an explosive part of the gold system that could transition to into a large deposit at depth. Further work will be done on the North Zone diatreme to further understand the scattered high-grade intercepts and how they may relate to this potential new intrusive center.

Jeffrey Pontius, President and CEO of Corvus, said, “These new results continue to support the expansion of the Mother Lode deposit and the new CIZ target. The upgrading of the Main Zone with core drilling is intriguing. We believe that these results could lead to an increase in the estimated grade for a future mineral resource estimate. Although most of the CIZ drilling will not be incorporated into the updated Preliminary Economic Assessment, which is expected to be completed in September, this, and ongoing drilling, will be incorporated into a mineral resource estimate update in the new year along with other new discovery drilling at Lynnda Strip. As we proceed with evaluating the economic significances of Mother Lode and North Bullfrog in this unprecedented bull gold market, it has become a moving target as margins increase with the ever-increasing gold price, up over 35% in the last 12 months. It is truly a unique time to have a gold discovery in a mining friendly jurisdiction that is continuing to grow rapidly.”

Table 1

Mother Lode – Mineral Resource Expansion Phase-4 Results

(Reported intercepts are not true widths as there is currently insufficient data to calculate true orientation in space. Mineralized intervals are calculated using a 0.3 g/t cut-off unless otherwise indicated below)

Drill Hole # | from (m) | to (m) | Interval (m) | Gold (g/t) | Silver (g/t) | Comment |

ML20-134CT | 183.58 | 203.61 | 20.03 | 0.41 | 0.32 | Upper Oxide Zone |

217.32 | 234.09 | 16.77 | 0.14 | 1.96 | Upper Oxide Zone | |

246.93 | 269.14 | 22.21 | 0.43 | 0.54 | Upper Oxide Zone | |

273.31 | 287.27 | 13.96 | 2.06 | 3.64 | Main Zone | |

inc | 273.31 | 281.94 | 8.63 | 2.97 | 4.78 | 1 g/t cut |

320.95 | 331.38 | 10.43 | 0.27 | 0.52 | CIZ | |

431.23 | 455.07 | 23.84 | 0.96 | 0.66 | CIZ | |

inc | 444.99 | 453.54 | 8.55 | 2.21 | 1.39 | 1 g/t cut |

468.36 | 497.19 | 28.83 | 2.21 | 1.06 | CIZ | |

inc | 472.08 | 490.52 | 18.44 | 3.01 | 1.54 | 1 g/t cut |

509.12 | 538.89 | 29.77 | 0.25 | 0.38 | CIZ | |

624.23 | 631.53 | 7.30 | 0.40 | 0.77 | CIZ |

ML20-141CT | 341.25 | 363.44 | 22.19 | 2.11 | 2.10 | Main Zone |

inc | 424.28 | 427.55 | 3.27 | 0.18 | 1.25 | 1 g/t cut |

532.16 | 548.00 | 15.84 | 0.41 | 0.13 | CIZ | |

566.01 | 572.11 | 6.10 | 0.57 | 0.18 | CIZ | |

580.10 | 644.97 | 64.87 | 1.02 | 0.91 | CIZ | |

inc | 585.83 | 597.57 | 11.74 | 3.87 | 1.55 | 1 g/t cut |

664.16 | 672.69 | 8.53 | 0.37 | 0.56 | CIZ |

ML20-142CT | 351.28 | 368.35 | 17.07 | 2.05 | n/a | Main Zone |

inc | 352.81 | 366.30 | 13.49 | 2.48 | n/a | 1 g/t cut |

397.92 | 408.89 | 10.97 | 0.11 | n/a | CIZ | |

415.14 | 445.62 | 30.48 | 0.20 | n/a | CIZ | |

451.71 | 459.89 | 8.18 | 0.19 | n/a | CIZ | |

468.48 | 471.53 | 3.05 | 0.16 | n/a | CIZ | |

476.10 | 482.19 | 6.09 | 0.19 | n/a | CIZ | |

529.44 | 538.28 | 8.84 | 0.43 | n/a | CIZ | |

557.72 | 571.80 | 14.08 | 0.49 | n/a | CIZ | |

inc | 567.09 | 570.13 | 3.04 | 1.52 | n/a | 1 g/t cut |

582.15 | 600.98 | 18.83 | 0.91 | n/a | CIZ | |

inc | 585.83 | 589.61 | 3.78 | 3.20 | n/a | 1 g/t cut |

627.75 | 635.66 | 7.91 | 0.42 | n/a | CIZ |

ML20-143CT | 312.27 | 315.23 | 2.96 | 0.58 | 0.70 | Main Zone |

321.44 | 355.93 | 34.49 | 1.63 | 2.01 | Main Zone | |

inc | 322.72 | 351.59 | 28.87 | 1.84 | 1.90 | 1 g/t cut |

357.23 | 359.05 | 1.82 | 0.23 | 0.62 | CIZ | |

374.29 | 378.87 | 4.58 | 0.29 | 0.25 | CIZ | |

406.30 | 454.46 | 48.16 | 1.23 | 2.32 | CIZ | |

inc | 409.04 | 410.71 | 1.67 | 1.10 | 1.41 | 1 g/t cut |

inc | 423.75 | 449.58 | 25.83 | 1.98 | 3.76 | 1 g/t cut |

485.55 | 493.78 | 8.23 | 0.13 | 0.18 | CIZ |

ML20-149CT | 163.89 | 167.00 | 3.11 | 0.18 | 0.15 | Upper Oxide Zone |

198.22 | 202.85 | 4.63 | 0.18 | 0.52 | Upper Oxide Zone | |

205.13 | 212.75 | 7.62 | 0.44 | 0.47 | Upper Oxide Zone | |

221.16 | 227.43 | 6.27 | 0.18 | 0.57 | Upper Oxide Zone | |

236.42 | 249.33 | 12.91 | 0.46 | 2.13 | Main Zone | |

260.11 | 281.57 | 21.46 | 3.48 | 2.30 | Main Zone | |

286.17 | 295.78 | 9.61 | 1.81 | 1.96 | Main Zone | |

inc | 286.71 | 293.62 | 6.91 | 2.36 | 2.30 | 1 g/t cut |

317.91 | 327.05 | 9.14 | 0.15 | 0.50 | CIZ | |

331.62 | 334.67 | 3.05 | 0.26 | 0.67 | CIZ | |

340.77 | 395.83 | 55.06 | 1.40 | CIZ | ||

inc | 340.77 | 360.67 | 19.90 | 1.60 | 0.57 | CIZ |

inc | 346.86 | 353.63 | 6.77 | 4.03 | 1.21 | 1 g/t cut |

inc | 363.02 | 395.83 | 32.81 | 1.34 | 2.01 | CIZ |

inc | 366.16 | 372.19 | 6.03 | 1.91 | 0.60 | 1 g/t cut |

inc | 378.87 | 389.14 | 10.27 | 2.61 | 4.81 | 1 g/t cut |

404.18 | 430.74 | 26.56 | 0.23 | 1.94 | CIZ | |

453.54 | 468.33 | 14.79 | 0.19 | 0.79 | CIZ | |

490.74 | 520.54 | 29.80 | 0.27 | 0.58 | CIZ |

ML20-151CT | 136.55 | 151.51 | 14.96 | 0.48 | 0.56 | Upper Oxide Zone |

211.23 | 267.61 | 56.38 | 1.71 | 1.62 | Main Zone | |

inc | 211.23 | 215.80 | 4.57 | 2.32 | 2.37 | 1 g/t cut |

inc | 218.78 | 264.05 | 45.27 | 1.81 | 1.50 | 1 g/t cut |

340.98 | 346.90 | 5.92 | 0.72 | 0.97 | CIZ Zone | |

inc | 344.45 | 346.90 | 2.45 | 1.30 | 0.73 | 1 g/t cut |

359.29 | 386.49 | 27.20 | 0.89 | 1.54 | ||

inc | 366.82 | 371.33 | 4.51 | 1.32 | 0.48 | 1 g/t cut |

inc | 374.79 | 377.99 | 3.20 | 2.85 | 7.08 | 1 g/t cut |

405.81 | 412.09 | 6.28 | 0.50 | 1.73 | ||

415.88 | 427.33 | 11.45 | 0.67 | 2.77 | ||

inc | 415.88 | 417.49 | 1.61 | 2.01 | 3.20 | 1 g/t cut |

461.83 | 466.80 | 4.97 | 0.28 | 0.72 | Low-grade lower zone | |

545.04 | 555.59 | 10.55 | 0.21 | 0.75 | Low-grade lower zone | |

561.75 | 564.79 | 3.04 | 0.22 | 0.76 | Low-grade lower zone |

ML19-126CT | 480.97 | 525.78 | 44.81 | 0.91 | 1.91 | North - Main Zone |

inc | 503.25 | 520.50 | 17.25 | 1.44 | 2.61 | 1 g/t cut |

681.84 | 689.14 | 7.30 | 0.57 | 0.43 | CIZ (first dike) |

ML19-127CT | 582.26 | 599.55 | 17.29 | 0.80 | 2.64 | North - Main Zone |

| 582.26 | 586.13 | 3.87 | 1.52 | 1.34 | 1 g/t cut |

617.59 | 622.40 | 4.81 | 1.38 | 0.71 | Main Zone | |

669.95 | 681.65 | 11.70 | 0.64 | 0.58 | CIZ | |

701.65 | 706.53 | 4.88 | 0.18 | 0.27 | CIZ |

ML20-136CT | 452.75 | 475.49 | 22.74 | 1.92 | 2.19 | North - Main Zone |

| 453.33 | 467.78 | 14.45 | 2.64 | 2.41 | 1 g/t cut |

483.18 | 488.78 | 5.60 | 0.20 | 0.57 | CIZ | |

494.69 | 515.26 | 20.57 | 0.15 | 0.39 | CIZ | |

521.82 | 565.86 | 44.04 | 0.15 | 0.40 | CIZ | |

576.99 | 587.46 | 10.47 | 0.14 | 0.46 | CIZ | |

621.18 | 631.64 | 10.46 | 0.79 | 0.79 | CIZ | |

| 625.37 | 629.20 | 3.83 | 1.75 | 1.87 | 1 g/t cut |

641.51 | 642.77 | 1.26 | 0.76 | 0.32 | CIZ | |

656.23 | 659.28 | 3.05 | 0.68 | 0.24 | CIZ |

ML20-147CT | 500.48 | 516.33 | 15.85 | 1.15 | 2.98 | North - Main Zone |

518.77 | 521.82 | 3.05 | 0.90 | 13.34 | ||

566.01 | 579.39 | 13.38 | 0.19 | 0.74 | Top of CIZ |

https://www.globenewswire.com/NewsRoom/AttachmentNg/a2f17964-365c-42c2-b643-f440b20d3db1

Figure 1. New drill hole location map, Mother Lode Project, Nevada, New section location

https://www.globenewswire.com/NewsRoom/AttachmentNg/ee2a67f4-d8b2-4083-8698-48568014b16d

Figure 2. Cross-Section showing hole ML20-141CT & 123CT

https://www.globenewswire.com/NewsRoom/AttachmentNg/c3fa8ace-0e4c-4f9f-a2b4-2e97154ece72

Figure 3. Drill Hole ML20-149CT CIZ diatreme breccia (6.8m @ 4 g/t Au & 1.2 g/t Ag)

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), has supervised the preparation of the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO & President and holds common shares and incentive stock options.

Carl E. Brechtel, (Nevada PE 008744 and Registered Member 353000 of SME), a qualified person as defined by NI 43-101, has coordinated execution of the work outlined in this news release and has approved the disclosure herein. Mr. Brechtel is not independent of Corvus, as he is the COO and holds common shares and incentive stock options.

The work program at Mother Lode was designed and supervised by Mark Reischman, Corvus’ Nevada Exploration Manager, who is responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All mineral resource sample shipments are sealed and shipped to American Assay Laboratories (AAL) in Reno, Nevada, for preparation and assaying. AAL is independent of the Company. AAL’s quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to AAL and an ISO compliant third-party laboratory for additional quality control. Mr. Pontius, a qualified person, has verified the data underlying the information disclosed herein, including sampling, analytical and test data underlying the information by reviewing the reports of AAL, methodologies, results and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

Mr. Scott E. Wilson, CPG (10965), Registered Member of SME (4025107) and President of Resource Development Associates Inc., is an independent consulting geologist specializing in Mineral Reserve and Mineral Resource calculation reporting, mining project analysis and due diligence evaluations. He is acting as the Qualified Person, as defined in NI 43-101, and is the primary author of the Technical Report for the Mineral Resource estimate and has reviewed and approved the Mineral Resource estimate and the Preliminary Economic Assessment summarized in this news release. Mr. Wilson has over 29 years of experience in surface mining, mineral resource estimation and strategic mine planning. Mr. Wilson is President of Resource Development Associates Inc. and is independent of the Company under NI 43-101.

Mr. Wilson, a qualified person, has verified the data underlying the information disclosed herein, including sampling, analytical and test data underlying the information by reviewing the reports of AAL, methodologies, results and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

Metallurgical testing on North Bullfrog and Mother Lode samples has been performed by McClelland Analytical Services Laboratories Inc. of Sparks Nevada (“McClelland”), McClelland is an ISO 17025 accredited facility that supplies quantitative chemical analysis in support of metallurgical, exploration and environmental testing using classic methods and modern analytical instrumentation. McClelland has met the requirements of the IAS Accreditations Criteria for Testing Laboratories (AC89), has demonstrated compliance with ANS/ISO/IEC Standard 17025:2005, General requirements for the competence of testing and calibration laboratories, and has been accredited, since November 12, 2012. Hazen Research Inc. (“Hazen”), an independent laboratory, has performed flotation, AAO testing and cyanide leach testing on samples of sulphide mineralization from the YellowJacket zone and Swale area of Sierra Blanca, and roasting tests on Mother Lode flotation concentrate. Hazen holds analytical certificates from state regulatory agencies and the US Environmental Protection Agency (the “EPA”). Hazen participates in performance evaluation studies to demonstrate competence and maintains a large stock of standard reference materials from the National Institute of Standards and Technology (NIST), the Canadian Centre for Mineral and Energy Technology (CANMET), the EPA and other sources. Hazen’s QA program has been developed for conformance to the applicable requirements and standards referenced in 10 CFR 830.120 subpart A, quality assurance requirements, January 1, 2002. Pressure oxidation test work on Mother Lode concentrate samples was performed by Resource Development Inc. of Wheatridge, CO.

For additional details, see technical report entitled “Technical Report and Preliminary Economic Assessment for the Integrated Mother Lode and North Bullfrog Projects, Bullfrog Mining District, Nye County, Nevada”, dated November 1, 2018 and amended on November 8, 2018, with an effective date of September 18, 2018 on the Company’s profile at www.sedar.com.

About the North Bullfrog & Mother Lode Projects, Nevada

Corvus controls 100% of its North Bullfrog Project, which covers approximately 90.5 km2 in southern Nevada. The property package is made up of a number of private mineral leases of patented federal mining claims and 1,134 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor as well as a large water right. The Company also controls 445 federal unpatented mining claims on the Mother Lode project which totals approximately 36.5 km2 which it owns 100%. The total Corvus 100% land ownership now covers over 127 km2, hosting two major new Nevada gold discoveries.

Effective as of September 18, 2018, the combined Mother Lode and North Bullfrog Projects contains a Measured Mineral Resource for the mill of 9.3 Mt at an average grade of 1.59 g/t gold, containing 475 k ounces of gold and Indicated Mineral Resources for the mill of 18.2 Mt at an average grade of 1.68 g/t gold containing 988 k ounces of gold and an Inferred Mineral Resource for the mill of 2.3 Mt at an average grade of 1.61 g/t gold containing 118 k ounces of gold. In addition, effective as of September 18, 2018, the project contains a Measured Mineral Resource for oxide, run of mine, heap leach of 34.6 Mt at an average grade of 0.27 g/t gold containing 305 k ounces of gold and an Indicated Mineral Resource for, oxide, run of mine, heap leach of 149.4 Mt at an average grade of 0.24 g/t gold containing 1,150 k ounces of gold and an Inferred, oxide, run of mine, heap leach Mineral Resource of 78.7 Mt at an average grade of 0.26 g/t gold containing 549 k ounces of gold.

About Corvus Gold Inc.

Corvus Gold Inc. is a North American gold exploration and development company, focused on its near-term gold-silver mining project at the North Bullfrog and Mother Lode Districts in Nevada. Corvus is committed to building shareholder value through new discoveries and the expansion of its projects to maximize share price leverage in an advancing gold and silver market.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

President & Chief Executive Officer

Contact Information: | Ryan Ko |

Investor Relations | |

Email: info@corvusgold.com | |

Phone: 1-844-638-3246 (toll free) or (604) 638-3246 |

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding the anticipated timing of the Preliminary Economic Assessment and updated mineral resource estimate; planned drilling and exploration; expectations regarding exploration results; interpretation of preliminary exploration results; potential increases to grade; anticipated potential future outlook of the gold market; estimates of mineralization; and updates on the development progress at the Mother Lode project; are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as, believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, delays in or failure to execute a definitive layback agreement, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2020 filed with certain securities commissions in Canada and the Company’s most recent filings with the United States Securities and Exchange Commission (the “SEC”). All of the Company’s Canadian public disclosure filings in Canada may be accessed via www.sedar.com and filings with the SEC may be accessed via www.sec.gov and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. Resource estimates contained in this press release are made pursuant to NI 43-101 standards in Canada and do not represent reserves under the standards of the SEC’s Industry Guide 7. Under the currently applicable SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. This press release uses the terms “Measured Resources”, “Indicated Resources”, and “Inferred Resources”. We advise U.S. investors that while these terms are Canadian mining terms as defined in accordance with NI 43-101, such terms are not recognized under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources described in this press release have a great amount of uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade, without reference to unit measures. “Inferred Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that any or all part of an Inferred Resource will ever be upgraded to a higher category. U.S. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves.

Yahoo Finance

Yahoo Finance