Corteva (CTVA) to Post Q4 Earnings: What's in the Cards?

Corteva, Inc. CTVA is slated to report fourth-quarter 2019 results on Jan 30, before the opening bell. The company delivered a positive earnings surprise of 15.2% in the last reported quarter.

The Zacks Consensus Estimate for the fourth quarter is pegged at a loss of 12 cents per share. The consensus mark has remained unchanged over the past 30 days. Further, the Zacks Consensus Estimate for revenues currently stands at $2,834 million.

The Zacks Consensus Estimate for full-year earnings is pegged at $1.23 per share. Further, the Zacks Consensus Estimate for revenues is currently pegged at $13.74 billion.

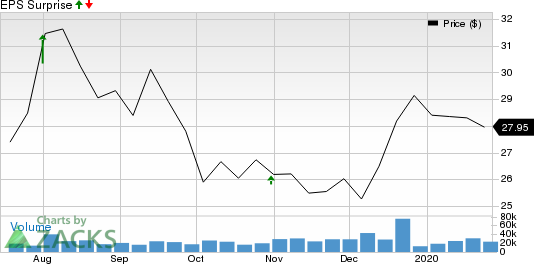

Corteva, Inc. Price and EPS Surprise

Corteva, Inc. price-eps-surprise | Corteva, Inc. Quote

Key Factors to Note

Corteva’s efforts to boost digital capabilities, expedite the process of product launches and cost containment are commendable. The company has been gaining from cost synergies over the last two quarters.

Management had earlier projected cost synergies of about $50 million in the fourth quarter of 2019. In the third quarter, the company generated cost synergies of $100 million.

However, the company has been grappling with soft sales in the North America market. Market disruptions due to weather-related delays and grower incentive discounts primarily hurt volumes and local prices in North America in the first half of 2019. These headwinds have been hurting results at the Crop Protection segment. Nonetheless, the company expects sales at the Crop Protection segment to benefit from a delayed soybean season in Brazil, which shifted sales to the fourth quarter.

Coupled with production disruptions and delays, management expects continued softness in the China purchases due to the trade war, African swine fever and slower growth in other emerging markets to impact the demand for commodity grains and oilseeds. The effects of these are likely to be visible on the top line.

On the last earnings call, management guided earnings per share of $1.20-$1.26 for 2019, while it anticipated decline in sales of around 3% mainly due to currency headwinds. On an organic basis, the company envisioned flat sales year over year while operating EBITDA was expected to be about $1.9 billion.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Corteva this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Corteva carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combinations

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Darling Ingredients Inc. DAR currently has an Earnings ESP of +6.38% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hostess Brands, Inc. TWNK currently has an Earnings ESP of +1.85% and a Zacks Rank #1.

e.l.f. Beauty, Inc. ELF presently has an Earnings ESP of +2.85% and a Zacks Rank #3.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained an impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

e.l.f. Beauty Inc. (ELF) : Free Stock Analysis Report

HOSTESS BRANDS (TWNK) : Free Stock Analysis Report

Darling Ingredients Inc. (DAR) : Free Stock Analysis Report

Corteva, Inc. (CTVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance