Service Corporation (SCI) Q1 Earnings Beat, Sales Fall Y/Y

Service Corporation International SCI posted decent first-quarter 2023 results, with the top and bottom lines beating the Zacks Consensus Estimate. However, metrics declined from the year-ago period’s levels, which was significantly impacted by the pandemic and rising interest rates.

Q1 in Detail

Service Corporation posted adjusted earnings of 93 cents per share, surpassing the Zacks Consensus Estimate of 88 cents. However, the metric fell from $1.34 reported in the year-ago quarter. The downside was caused by softness in gross profit due to lower COVID-19 activity. In addition, a lower number of shares outstanding and lower tax rates more than offset the impact of increased interest expenses.

Total revenues of $1,028.7 million decreased from $1,112.4 million reported in the year-ago quarter. However, the top line came ahead of the Zacks Consensus Estimate of $1,017 million.

The gross profit decreased to $289.1 million from $376.9 million reported in the year-ago quarter. Corporate general and administrative costs were $44.2 million compared with $41.7 million in the year-ago period. The downside was caused by accelerated compensation expenses related to retirement and long-term incentive compensation plan that is linked to growth in total shareholder return.

The operating income of almost $245.6 million decreased from $335.7 million reported in the year-ago quarter.

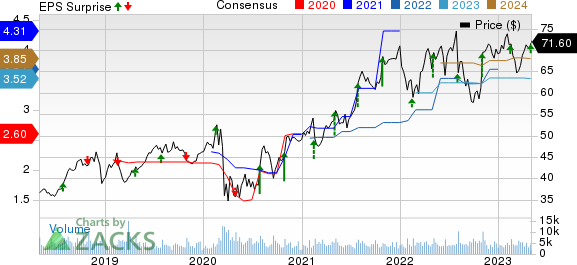

Service Corporation International Price, Consensus and EPS Surprise

Service Corporation International price-consensus-eps-surprise-chart | Service Corporation International Quote

Segment Discussion

Consolidated Funeral revenues came in at $609.7 million, down from $649.7 million reported in the year-ago quarter. Total comparable funeral revenues declined 7.1% due to lower core funeral revenues partially offset by an increase in recognized preneed revenues and other revenues.

Core funeral revenues fell 10%, mainly due to 12.1% lower core funeral services performed (as the year-ago period included the impacts of the pandemic). This was somewhat offset by a 2.4% rise in the core average revenue per service.

Comparable preneed funeral sales production increased by 8.1% as a result of growth in both core and non-funeral preneed sales production. Improved velocity and sales averages were the primary drivers of both of these increases.

Comparable funeral gross profit came in at $148.4 million, down $48 million from the year-ago quarter’s reported figure. The gross profit percentage came in at 24.6%, down from 30.3% reported in the year-ago quarter. The downside was mainly caused by a decline in revenues and rising selling costs on higher preneed insurance sales production.

Consolidated Cemetery revenues came in at $419 million, down from $463.3 million reported in the year-ago quarter. Comparable cemetery revenues dipped 9.7% due to a decline in core revenues and other revenues.

Core revenues fell $42.2 million as a result of the pandemic's impact on total recognized preneed revenues and atneed revenues. Comparable preneed cemetery sales production fell 15.8% due to a decrease in preneed cemetery property sales production.

The comparable cemetery gross profit fell by $40.7 million to $140.3 million. The gross profit percentage contracted from 39.1% to 33.5% in the quarter under review. The decline in metric was due to a fall in revenues combined with higher maintenance costs.

Other Financial Details

Service Corporation ended the quarter with cash and cash equivalents of $157.8 million, long-term debt of $4,327.8 million and total equity of $1,621.7 million.

Net cash from operating activities amounted to $219.6 million during the first quarter. During the same period, the company incurred capital expenditures of $77.9 million.

2023 Guidance

Service Corporation reaffirmed its previously announced guidance. It expects adjusted earnings per share in the range of $3.45-$3.75. We note that the company’s earnings came in at $3.80 per share in 2022.

Net cash provided by operating activities (excluding special items and cash taxes) is anticipated in the range of $910-$960 million. Net cash provided by operating activities (excluding special items) is anticipated in the range of $740-$800 million.

Management expects maintenance capital expenditures in the band of $290-$310 million in 2023.

Shares of this Zacks Rank #3 (Hold) company have fallen 3% in the past three months compared with the industry’s 4.6% decline. We also note that shares of SCI have declined approximately 3.8% after the trading session on May 1, owing to its declining year-over-year results.

3 Key Picks

Some top-ranked stocks are Inter Parfums IPAR, General Mills GIS and Kimberly-Clark Corporation KMB.

IPAR has an expected long-term earnings growth rate of 15% and a trailing four-quarter earnings surprise of 36.2%, on average. Inter Parfums currently sports a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ current financial year sales and earnings suggests growth of 15.2% and 7.3%, respectively, from the year-ago reported numbers.

General Mills is a major designer, marketer and distributor of premium lifestyle products. It currently carries a Zacks Rank of 2 (Buy). GIS has a trailing four-quarter earnings surprise of 8.1%, on average.

The Zacks Consensus Estimate for General Mills’ current financial year sales and earnings suggests growth of 6.3% and 7.4%, respectively, from the year-ago reported numbers.

Kimberly-Clark is engaged in the manufacture and marketing of a wide range of consumer products around the world. It currently has a Zacks Rank of 2. KMB has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for Kimberly-Clark’s current financial year sales and earnings suggests growth of 2.2% and 9.4%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Service Corporation International (SCI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance