Investors aren't sweating US's massive corporate debt pile, but maybe they should

The U.S. economy is decelerating, but corporate America is carrying trillions of dollars in debt on its books. Is that a problem?

It all depends on who’s asking the question, or the metric being used. As of the first quarter of 2019, non-financial corporate businesses held over $9 trillion in debt on their books—a record in dollar terms, according to flow of funds data from the St. Louis Federal Reserve.

Meanwhile, investors are still racking up on corporate debt. During the first quarter, buyers plowed nearly $102 billion into taxable-bond funds, Morningstar data showed in April.

The current slowdown, which some fear could become a full-blown recession, has been characterized by businesses sitting on record levels of investment-grade and high-yield bonds—to the tune of 46% of U.S. gross domestic product and nearly half of all outstanding global corporate debt.

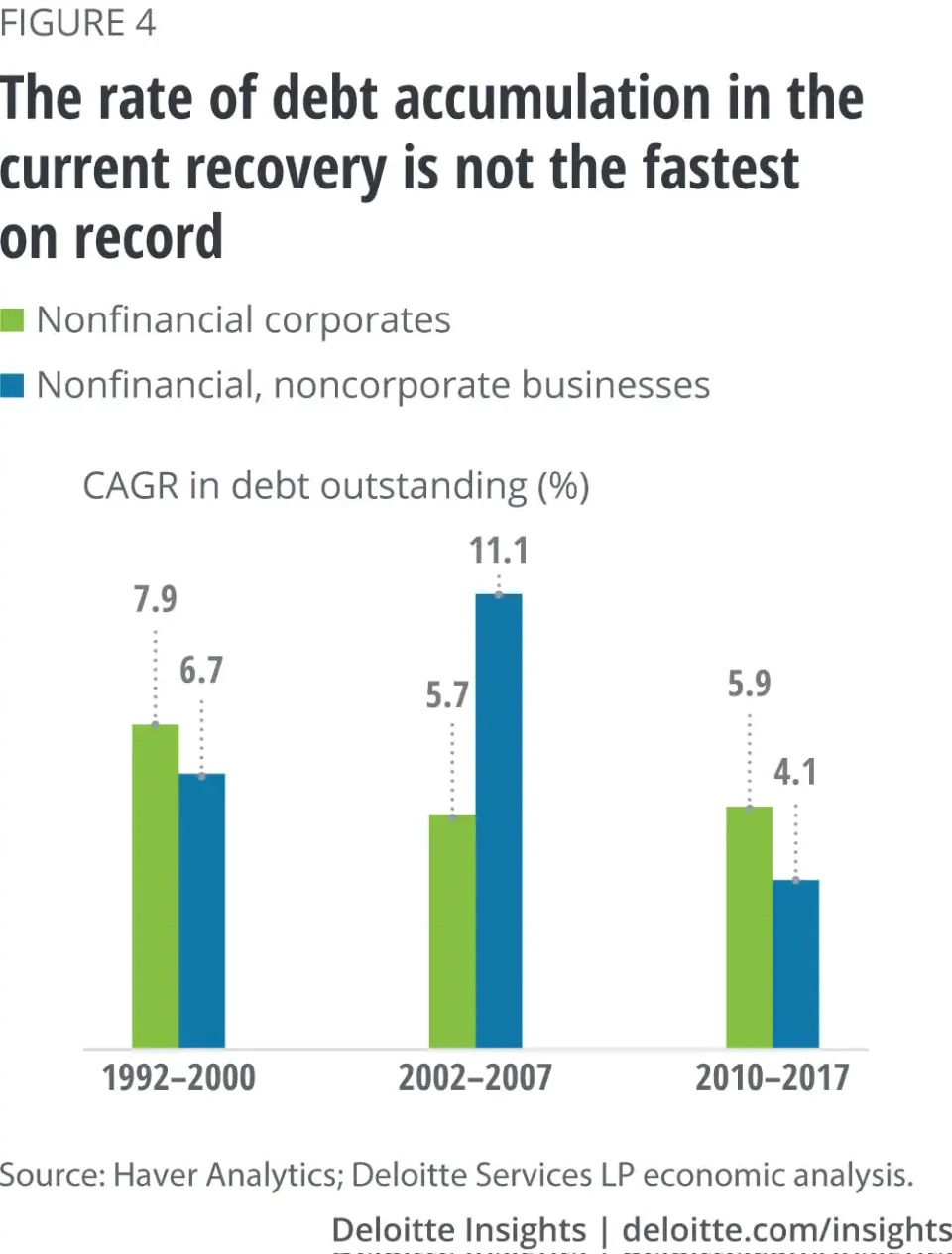

That level is higher than it was before the Great Recession, according to an analysis by Deloitte, which also found that corporate bonds grew by an average of nearly 7% per quarter between 2011 and late 2018.

With leverage at or near all-time highs, Goldman Sachs noted this week that corporate balance sheet fundamentals eroded in Q1. It added to the debate about potential risks to the financial system, at a time when a global slowdown and trade conflicts between major economies have investors taking fright.

Goldman found that on both a gross and net leverage basis, debt levels are above the former peaks hit in 2016.

However, “from a macro perspective, we continue to think historical comparisons that are solely based on leverage metrics overstate the magnitude of the deterioration in credit quality,” analysts wrote in a research note to clients this week.

“In our view, these comparisons give too much weight to the “stock effect” (i.e., debt accumulation on balance sheets) and ignore the structural improvement in the “flow effect” over the past two decades,” the bank added.

Both investment grade and riskier high-yield issuers have seen their funding costs drop, in line with comparable Treasury bond yields that are near historically low levels.

Yet when combined with higher profit margins and coverage ratios, “we don’t think all-time-high leverage implies all-time-low credit quality,” Goldman said.

‘Material deleveraging’

In spite of trade war fears, corporate bond markets yielded positive total returns in the second quarter, beating government bonds, U.K. asset management firm Schroders noted recently. U.S. corporate debt returned over 4% in the three months ended in June, compared with 3.1% in government bonds.

Ironically, the recession that followed the 2008 crisis helped facilitate Corporate America’s relative financial health — along with some help from the Federal Reserve’s unorthodox easing, which has kept interest rates low.

In a recent analysis, bond rating firm DBRS noted that “there was material deleveraging in the wake of the global financial crisis, primarily reflecting the dramatic recovery in operating earnings performance through 2012, albeit from a very weak base.”

Between 2013 and 2016, companies gradually took on more debt as the global economy struggled — a decision that eventually undermined operating earnings and balance, DBRS noted.

During that period, energy, manufacturers and mining companies fared particularly badly, amid a drop in commodities and key metal prices.

“However, debt reduction positioned these manufacturers well to maximize deleveraging benefits from the recovery in operating earnings that began in 2017 and continued into 2018,” the ratings firm said. “As a result, leverage has improved notably over the last two years.”

What could go wrong

A combination of massive bond buying and near-zero interest rates helped fuel the corporate debt boom. With interest rates likely to go lower in the immediate term, Corporate America’s heavy leverage isn’t seen as a risk just yet.

Still, signs have emerged that worry at least a few market observers. Citigroup warned in June that several below-the-radar trends, including slowing profit growth and rising debt loads, suggested credit markets were tightening.

And even as companies like Tesla (TSLA) tap the debt market, bond market stalwarts like Apple (AAPL), Oracle (ORCL) and Cisco (CSCO) have been pulling back for at least a year.

The spread between junk bonds and investment grade paper has narrowed substantially, in part because of high demand for corporate debt.

Given the host of challenges facing the global economy — which include the U.S.-China trade war, geopolitical turmoil and a slowdown in major economies — the risk is rising that credit markets could send borrowing costs soaring.

Speculative bonds, or junk, would most likely bear the immediate brunt of investor jitters.

Deloitte’s economists recently pointed out that the percentage of investment grade bonds is far lower at this stage of the U.S. expansion when compared to previous recoveries.

It underscores how “the share of bonds that are most susceptible to a credit downgrade to junk has gone up,” Deloitte said.

“While short-term concerns about debt may wither if the economic outlook improves quickly and interest rates remain in check, a lack of prudence in using borrowed funds may not augur well for businesses in the medium to long term,” the firm added.

Javier is an editor for Yahoo Finance. Follow Javier on Twitter: @TeflonGeek

Read the latest financial and business news from Yahoo Finance

Read more:

Nagging weaknesses underlie the better-than-expected jobs report

China, Iran, Venezuela are developing crypto in effort to dethrone US: Study

US manufacturing sector shows strength in 'difficult conditions': ISM, IHS

'Quietest in 20 years': Truckers feel chill of slowing US economy

How Trump's 'beautiful' tariffs are casting a shadow over trade policy

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance