Coronavirus stimulus: Student loans arise as potential flashpoint of negotiations

The White House and Senate Republicans released their proposal of a stimulus package to help the country recover from the coronavirus-induced recession, and struggling student loan borrowers appear to have been left out.

Read more: How to repay student loans: The full breakdown

The Health, Economic Assistance Liability Protection & Schools Act (HEALS) Act doesn’t extend the interest-free payment pause on federal student loans or halt debt collection on government-held student debt — two forms of relief in the original CARES ACT — and does not provide any new relief like what Democrats proposed in their version of the next stimulus, HEROES Act.

“Not doing anything for borrowers is a major omission,” Ben Miller at the Center for American Progress told Yahoo Finance. “With case rates spiking and unemployment insurance expired, it is a bad idea to make borrowers start paying in two months.”

Without extending the relief Congress first granted to student loan borrowers through the CARES Act, 40 million Americans are likely to have to resume payments on September 30, 2020.

“With the temporary pause on student loan payments for tens of millions of Americans ending on September 30th, an already bleak economic outlook just got even more dire,” Student Debt Crisis Executive Director Natalia Abrams said in a statement. “The Senate plan to end this temporary relief is unconscionable. We need immediate action to end the ever-worsening debt crisis, and we’re disappointed that Mitch McConnell and Senate GOP won’t offer even a small step in the right direction. We will continue to pressure the House and the Senate to do what’s right and offer meaningful, lasting reform.”

Some borrowers are already receiving notices from Federal Student Aid informing them that the 0% interest period and administrative forbearance are “not permanent and will expire” and that they should await “additional communications in the near future.”

Read more: Student loan deferment, forbearance, cancellation, and default: The full breakdown

GOP proposal for student loans

The Senate-GOP bill includes a proposal made by Senator Lamar Alexander (R-TN), who also chairs the Senate Education Committee, to simplify the federal student loan repayment system.

Borrowers with student loans who have no income would not make any student loan repayments, while others would make monthly payments at 10% of their discretionary income (after paying for housing and food). Either group would have their remaining balance forgiven after 20 years for those with undergraduate loans and 25 years for those with graduate student loans.

CAP’s Ben Miller, as well as other experts, have said that this proposal doesn’t do anything new to help borrowers.

Below is the GOP plan on student loans released today as part of their coronavirus relief package. pic.twitter.com/Ut7tT9xOg9

— Jeff Stein (@JStein_WaPo) July 27, 2020

James Kvaal, president of the Institute for College Access & Success and a former deputy domestic adviser in the Obama administration, noted that existing income-driven repayment plans already waive payments for borrowers making less than $19,000. Furthermore, according to Kvaal, the logistics would just make the proposal unfeasible: “It is simply not feasible to establish a new repayment plan and require them all to enroll within two months.”

Miller said that Sen. Alexander’s reform actually cuts $10 billion from existing loan programs, sort of “a backdoor [Higher Education Act] proposal.”

In any case, Democrats panned the Republican proposal.

“Ten weeks after Democrats passed a comprehensive bill through the house, Senate Republicans couldn’t even agree on what to throw on the wall,” Senator Chuck Schumer (D-NY) said on the floor, adding that the proposal was “totally inadequate.”

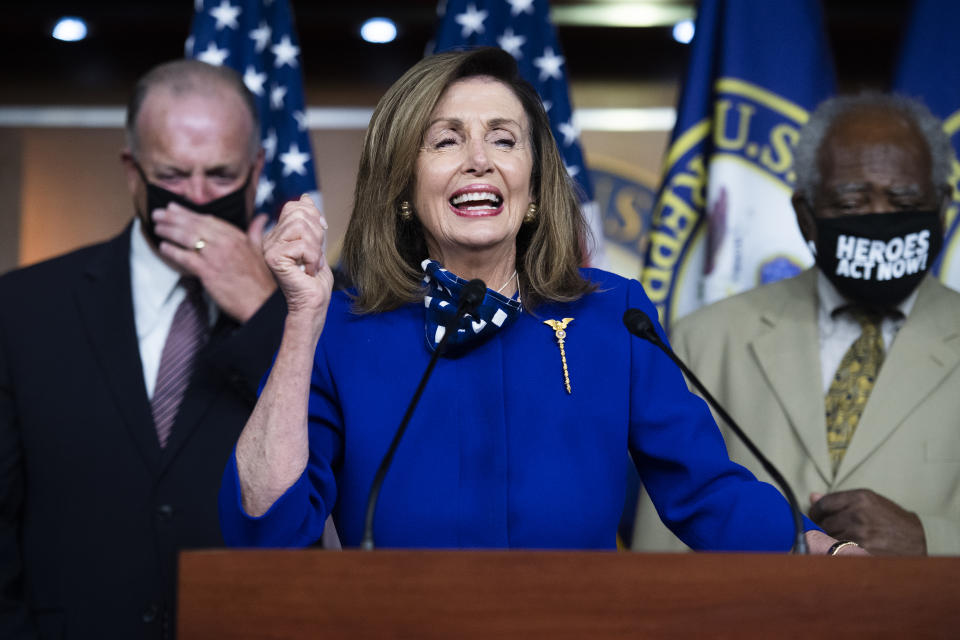

The HEROES Act, passed by the House in May but not taken up by the Senate, included relief for borrowers including $10,000 of student loan forgiveness for those “economically distressed” in addition to an extension of the interest-free payment pause on student loans and the suspension of debt collection.

‘We have to begin facing the reality’

What would a reasonable middle ground be, if there’s such a wide gulf between the two parties’ proposals?

Kvaal said it was simple: “With the economy sputtering, there should be a moratorium on student loan payments and interest for the duration of the recession. Congress should also forgive the loans of struggling borrowers.”

But even if the moratorium (i.e. the payment-pause and other benefits) extends, “it’s unlikely that we’ll see an extension beyond December,” Scott Buchanan, executive director of the Student Loan Servicing Alliance, a nonprofit trade group for loan servicers, told Yahoo Finance.

Read more: Options for repaying student loans

Buchanan noted that while servicers only make little from repayments — through interest and fees such — the government is owed $1.54 trillion in student debt as the first quarter of 2020. Consequently, he added, extending the pause until 2021 would impose too high of a cost to the government.

“At some point, we have to begin facing the reality of putting the economy back together — towards a trajectory of normalcy,” Buchanan said.

What happens if no more relief?

As negotiations continue, states and businesses across the country are still grappling with how to move on in the absence of a COVID-19 vaccine.

The unemployment rate in June was 11.1% and while it declined by 2.2 percentage points from the previous month, the jobless rate is still considered high.

And when the student debt relief ends, experts anticipate a wave of delinquencies and defaults, based on historical trends.

The Student Borrower Protection Center noted that when borrowers are put on mandatory payment pauses as part of disaster relief programs, just like they are right now through CARES, new defaults spiked after they exited the programs.

The group also noted that complaints submitted by borrowers to the Consumer Financial Protection Bureau (CFPB) also show how borrowers struggle to get back on the repayment track due to issues with their loan servicers.

—

Aarthi is a reporter for Yahoo Finance covering consumer finance and education. Follow her on Twitter @aarthiswami. If you are a student loan borrower who is struggling with your debt and would like to share your experience, reach out to her at aarthi@yahoofinance.com

Read more:

'They stole my time’: For-profit college students share horror stories

HEROES Act would cancel $10,000 in student debt for ‘economically distressed’ borrowers

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

Yahoo Finance

Yahoo Finance