Coronavirus fears could put a damper on the US housing market

The coronavirus has sent stock markets plummeting and no industry, including housing, is immune.

Mortgage rates are hitting multi-year lows as investors, fearful of a possible coronavirus pandemic, have flocked to safe havens like Treasuries, sending the 10-year Treasury note to a record-low yield. While low rates will give hesitant homebuyers a reason to purchase, the heightened demand for housing could further depress historically low inventory. Additionally, homebuilders rely on China, where the coronavirus or COVID-19 originated, for construction materials and any disruption in the supply chain could impact their ability to deliver much-needed new inventory into the market.

“There’s a lot of uncertainty. It’s a good thing that interest rates are lower, it makes folks afford a home,” said Danielle Hale, chief economist at Realtor.com. “But it depends on which is more important: affordability or future job security.”

There’s no question that fear over a potential global coronavirus pandemic could have a negative impact on consumer confidence and lead potential homebuyers to delay their purchasing decision, since a home is a big ticket purchase. So far, the virus has spread globally with more than 82,000 cases and more than 2,800 deaths. And the World Health Organization just increased its global assessment of the coronavirus to “very high.”

“Uncertainty over the spread, severity, and length of the coronavirus outbreak adds to the challenge of estimating the impact on the housing market,” said Frank Nothaft, chief economist for CoreLogic. “Nonetheless, some economic impacts are clear. Economic growth will likely be slower this year than was previously thought. A recession in 2020 is unlikely but can’t be ruled out. The prospect of weaker economic growth coupled with investor ‘flight to quality’ in global capital markets has pushed long-term interest rates down.”

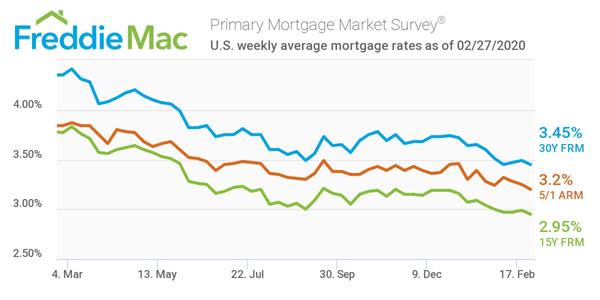

The 30-year fixed mortgage rate averaged 3.45% for the week ending Feb. 27, compared to a year ago at the same time when it averaged 4.35%, according to Freddie Mac. That rate is the lowest in three years.

“I believe the lower interest rates will be too enticing and hence the housing demand will be there,” said Lawrence Yun, chief economist at the National Association of Realtors (NAR), adding that 2020 was “off to a strong start.”

Low interest rates have already fueled sales activity. In January, existing home sales rose 9.6% to a seasonally adjusted 5.46 million from a year ago, the NAR said, and it was the second straight month of year-over-year increased activity. Meanwhile, new home sales reached their highest level since July 2007.

On top of positive sales data, housing starts for December and January were also promising, up from year ago levels. Housing starts jumped 21.4% on an annual basis to 1.425 million units in January and were revised to a pace of 1.626 million units in December — the highest level since December 2006.

Homebuilding at risk

But the coronavirus outbreak could disrupt homebuilding in the U.S. It’s a setback that the market can’t afford considering housing inventory levels for January are at the lowest level since 1999 and unsold inventory sits at a 3.1-month supply at the current sales pace, according to the NAR. The low inventory has also been driving home prices up.

“Every time we get some momentum something comes up and interrupts progress,” said Robert Dietz, chief economist at the National Association of Home Builders, who had forecasted that 2020 would mark the beginning of a reversal in the construction labor shortage, a major contributor to the historically low inventory. Now, he’s not so sure but notes that it’s too early to tell what kind of an impact the coronavirus will have on consumer confidence and the workforce.

The biggest threat to inventory would be to homebuilders’ supply chains. About 30% of building products imported to the U.S. come from China, including both residential and nonresidential construction, according to Richard Branch, chief economist for Dodge Data & Analytics, which tracks the construction industry. The products include wallboard, lighting, and other materials. Branch said in an email that China is the largest single supplier of building products to the U.S., Canada, and Mexico follow supplying about 20% each.

Homebuilder Toll Brothers recently said the coronavirus outbreak in China led to shortages of lighting fixtures and small appliances, forcing it to delay the sales of 11 homes in California. A Toll Brothers spokesperson did not provide further comment.

“It’s just one more negative influence on the U.S. homebuilding industry, which is already being impacted by the lack of skilled labor, higher land costs, higher building material costs,” said Branch in an email, adding that homebuilders are taking a “wait and see” approach but will likely figure out ways to source supplies from countries other than China.

“We have been under building since 2012 so we were moving in the right direction,” said Hale. “It is too soon to know how far off course we will get as a result of the virus.”

Amanda Fung is an editor at Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

Read more

US home price growth picks up for fifth consecutive month

The hottest housing market of 2019

Why mortgage delinquencies are at a 12-year low

Homebuyers think a recession will hit by 2022: survey

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance