Coronavirus cure for stocks not yet found — don't rule out 50% of the market being wiped out

The next direction for a more volatile market growing terrified about the economic fallout from the coronavirus is anyone’s guess, which probably explains why investors are so nervous right now.

Talk to anyone on the Street and the views on the market’s short-term direction vary widely. They range from those that think we are witnessing a bottoming process underway to those that believe that now is the ultimate time to buy with the major indices some 10% off the highs (though numerous individual stocks are down way more).

And of course there is an expanding camp of strategists that believe the next move is sharply lower in large part because coronavirus will crush global economic activity. To this group, the Federal Reserve’s emergency rate cut this week is not the equivalent of a cure for coronavirus and therefore isn’t a savior to stocks.

For Hercules Investment CEO James McDonald, the threat of a U.S. recession is by no means priced into stocks. And investors, said McDonald, would be wise to realize that and position their portfolios accordingly.

“A recession is imminent, and it's OK,” McDonald said on Yahoo Finance’s The First Trade. “A 30% correction sounds scary right, but the Dow, S&P 500 and the Nasdaq rallied to nearly 30% in just one year last year. If you look at a 35% to 45% trim from here, it sounds bad but it just takes us back first quarter 2016. Understand that the numbers are relative, it is a good time to anticipate a major pullback and then get back in the market.”

“I think we test the low of the original [low] and then go lower than that. Understand that a 30%, 40%, 50% pullback in this market only means only we are set back two or three years. It's not a panic situation,” McDonald added.

It’s hard to remain calm

While panic selling hasn’t begun to grip the markets, one can’t be encouraged by the action this week.

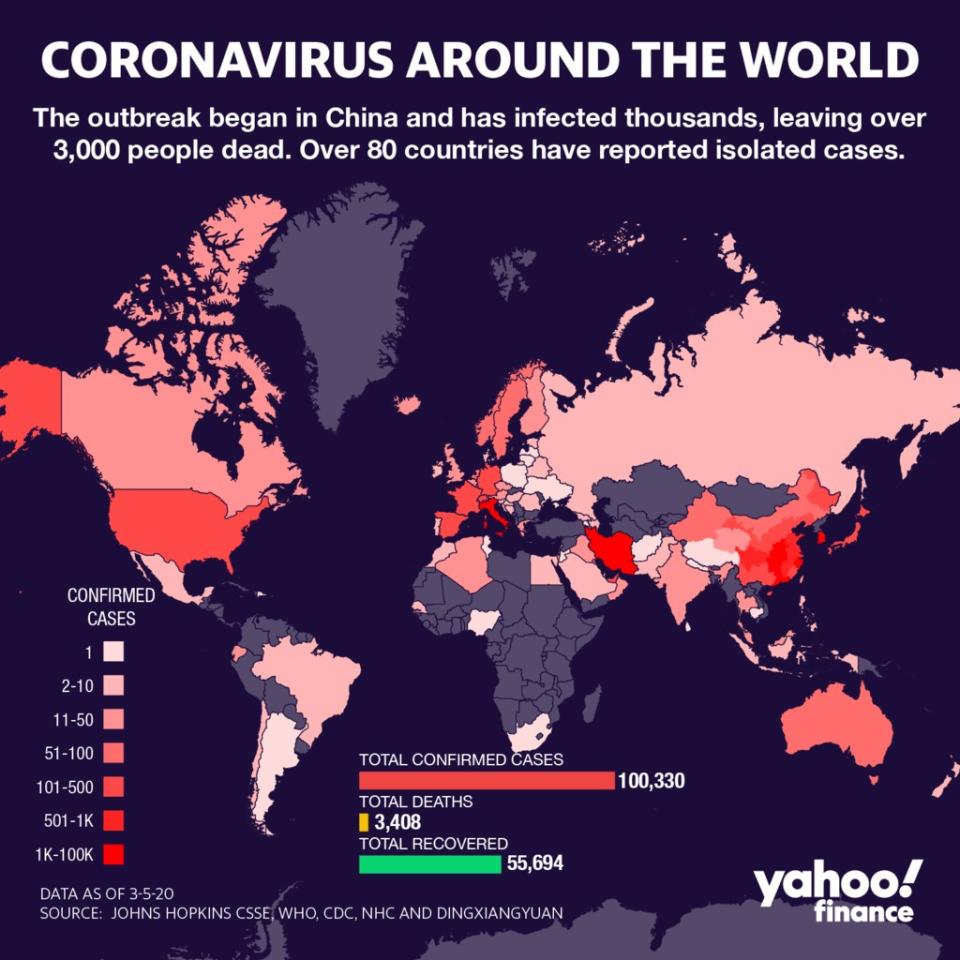

The Dow Jones Industrial Average tanked more than 600 points on Friday (despite a much stronger than expected February employment report...) as COVID-19 infections topped 100,000 globally. Company specific comments on the coronavirus also continue to weigh on sentiment. Starbucks warned Thursday evening that its fiscal second quarter earnings would be drilled by 15 cents to 18 cents a share owing to closed stores in China. That follows Southwest’s warning that canceled flights and routes would hit first quarter sales by $200 million to $300 million.

Not everyone is on board with McDonald’s straight shooting on the markets.

“We do not recommend switching away from a balanced allocation at this stage. Policy makers have clearly entered the race, which should prevent — for now — an extended bear market on risk assets,” said SocGen strategist Alain Bokobza.

As we said, the market’s next move...is truly anyone’s guess.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Read the latest financial and business news from Yahoo Finance

Beyond Meat founder: things are going very well with McDonald’s

Starbucks CEO on what China has in store for the coffee giant

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance