The Copper Mountain Mining (TSE:CMMC) Share Price Is Down 56% So Some Shareholders Are Wishing They Sold

Copper Mountain Mining Corporation (TSE:CMMC) shareholders should be happy to see the share price up 21% in the last month. But that is little comfort to those holding over the last half decade, sitting on a big loss. Indeed, the share price is down 56% in the period. So we're hesitant to put much weight behind the short term increase. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

View our latest analysis for Copper Mountain Mining

Because Copper Mountain Mining made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Copper Mountain Mining saw its revenue increase by 4.1% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 15% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

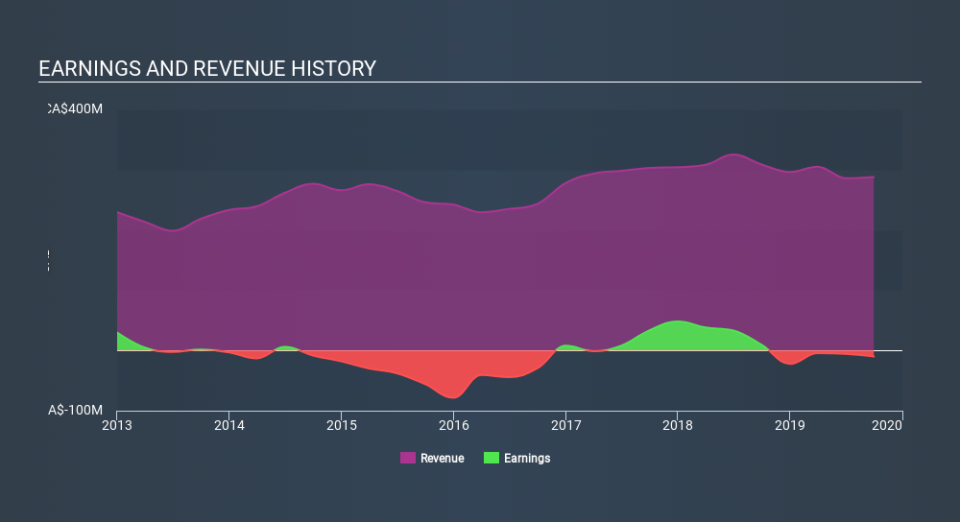

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for Copper Mountain Mining in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 19% in the last year, Copper Mountain Mining shareholders lost 2.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 15% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Copper Mountain Mining is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance