Cooper Companies (COO) Q4 Earnings Beat, Revenues Rise Y/Y

The Cooper Companies, Inc. COO reported fourth-quarter fiscal 2019 adjusted earnings per share (EPS) of $3.30, which surpassed the Zacks Consensus Estimate of $3.27. The bottom line increased 15% on a year-over-year basis.

Revenues of this Zacks Rank #3 (Hold) company came in at $691.6 million, beating the Zacks Consensus Estimate of $685.4 million. Also, on a year-over-year basis, the top line improved 6.2%.

FY19 at a Glance

For fiscal 2019, Cooper’s revenues were $2.65 billion, in line with the Zacks Consensus Estimate. The figure improved 4.8% from fiscal 2018.

EPS was $12.35, beating the Zacks Consensus Estimate of $12.33. The figure improved 7.4% year over year.

Cooper reports through two major segments — CooperVision (“CVI”) and CooperSurgical (“CSI”).

Revenues at CVI totaled $1.97 billion (74.4% of net sales), while that at CSI were $680.5 million (25.6%).

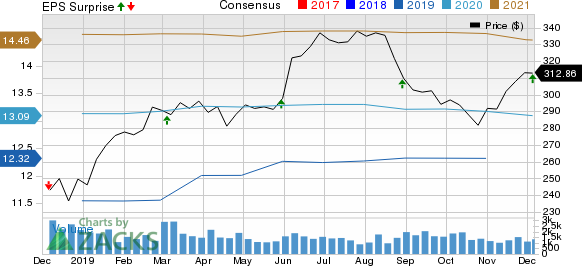

The Cooper Companies, Inc. Price, Consensus and EPS Surprise

The Cooper Companies, Inc. price-consensus-eps-surprise-chart | The Cooper Companies, Inc. Quote

Q4 Segment Details

CVI

This segment’s revenues totaled $509.6 million, up 6% on a pro-forma basis and 7% on a reported basis.

Per management, the segment saw a substantial uptick in revenues from Single-use sphere lenses (30% of CVI), reflecting pro-forma growth of 10% on accelerating growth in both Clariti and MyDay. Single-use sphere lenses revenues totaled $154.5 million.

Toric (31% of CVI) revenues totaled $155.7 million, up 6% on a pro-forma basis.

Multifocal (10% of CVI) generated revenues of $51.8 million, up 10% at pro forma.

Non single-use sphere (29% of CVI) revenues came in at $147.6 million, up 4% at pro forma and 4% from the year-ago quarter.

Geographically, the segment witnessed an improvement in revenues in the Americas (39% of CVI), up 6% at pro forma and 7% year over year to $199.4 million.

EMEA revenues (36% of CVI) totaled $185.1 million, up 5% at pro forma and 1% from the prior-year quarter.

Asia Pacific sales (25% of CVI) rose 11% at pro forma and 13% year over year to $125.1 million.

CSI

This segment posted revenues of $182.1 million, up 7% at pro forma and also year over year.

Sub-segment Office and Surgical products (63% of CSI) accounted for $114.7 million revenues, up 4% at pro forma and on a year-over-year basis.

Fertility (37% of CSI) revenues were $67.4 million, up 11% year over year and 12% at pro forma.

Margin Analysis

In the fiscal fourth quarter, gross profit was $455 million, up 5.8% year over year. Gross margin was 65.8% of net revenues, down 20 basis points (bps) year over year.

On an adjusted basis, gross margin was 67%, up 100 bps year over year.

Operating income in the quarter totaled $146.6 million, up 19.5% year over year. Adjusted operating margin was 28%, up 100 bps from the prior-year quarter.

FY20 View

For fiscal 2020, Cooper expects revenues within $2,767-$2,817 million, suggesting 5-7% growth at constant currency (cc). The Zacks Consensus Estimate for the same is pegged at $2.82 billion, near the high end of the guidance.

CVI revenues are expected between $2,070 million and $2,100 million (5.5-7% at cc).

CSI revenues are estimated in the range of $697-$717 million (3-6% at cc).

Adjusted EPS is projected within $12.60-$13.00. The Zacks Consensus Estimate for the same stands at $13.09, above the guided range.

Fiscal first quarter revenues are expected within $638 million to $653 million (2% to 5% at cc). The Zacks Consensus Estimate is pinned at $667.5 million, above the guided range.

CVI revenues are projected in the range of $480 million to $490 million (3-5% at cc)

CSI revenues are anticipated in the band of $158 million to $163 million (flat to 4% at cc).

First-quarter adjusted EPS is expected between $2.65 and $2.75. The Zacks Consensus Estimate for the same is pegged at $2.96, above the guided range.

Wrapping Up

Cooper exited the fiscal fourth quarter on a strong note. The company saw solid gains from its core CVI unit, which performed impressively in the United States, the EMEA and the Asia Pacific with high pro-forma growth.

Apart from these, Cooper continues to gain from the PARAGARD acquisition, which has been consistently driving CSI performance. Management is also optimistic about the Clarity, MyDay and Biofinity suite of products. The company’s portfolio of daily silicone hydrogel lenses makes it one of the leaders in the soft contact lens market.

On the flip side, the contraction in gross margin raises concern. Moreover, a series of acquisitions pose significant integration risks. Stiff competition in the MedTech space adds to the woes.

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks that reported solid results this earnings season are Edwards Lifesciences EW, CONMED Corporation CNMD and ResMed Inc. RMD. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Edwards Lifesciences delivered third-quarter 2019 adjusted EPS of $1.41, outpacing the Zacks Consensus Estimate by 15.6%. Third-quarter net sales of $1.09 billion surpassed the Zacks Consensus Estimate by 5.5%. The stock carries a Zacks Rank of 2 (Buy).

CONMED reported third-quarter 2019 adjusted earnings per share of 62 cents, which beat the Zacks Consensus Estimate of 56 cents by 10.7%. Revenues totaled $233.6 million and surpassed the Zacks Consensus Estimate of $228.3 million by 2.3%.

ResMed reported third-quarter 2019 adjusted EPS of 93 cents, which beat the Zacks Consensus Estimate of 87 cents by 6.9%. Revenues were $681.1 million, surpassing the consensus estimate by 3.6%. The stock sports a Zacks Rank of 1.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

CONMED Corporation (CNMD) : Free Stock Analysis Report

The Cooper Companies, Inc. (COO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance