From fruit-flavored Coke to Hershey Kisses: The reason behind the flavor variety boom

Kerri Kopp is an admitted Diet Coke fan. But even she has begun to dabble in something new from her team at Coca-Cola (KO).

“I am a Diet Coke loyalist, and have been for many, many years. But when I reach for a flavor variety, I like the strawberry guava right now,” Kopp, group director of Diet Coke, told Yahoo Finance in an interview.

Kopp is referring to Coke’s new popular flavored Diet Coke line in sleek slim cans that were released in January 2018. And to be sure, that Diet Coke strawberry guava sheds light into one powerful trend in consumer products land at the moment.

Welcome to the Golden Age of the SKU, or more formally known among grocery store managers as stock-keeping units. SKUs are used for inventory purposes and to identify products being sold in stores. For instance, Coca-Cola Classic is one thing, but the 12 oz can and the 16 oz can would be considered two separate SKUs. Then add a 12 oz Coke Zero and a 16 oz Coke Zero and now we’re up to four SKUs.

Tasked with boosting sales and profits, executives at America’s biggest consumer packaged goods brands have begun inundating supermarket aisles and online shops with new products to satisfy needs that many people didn’t even realize they had. Some of the snazzy new products are pretty impressive, and of course more often than not targeted to growing millennial families, folks that are environmentally conscious, workout enthusiasts and a yawning nation of snackers.

How about Kimberly-Clark’s Huggies Special Delivery diaper? Dubbed the “perfect diaper,” the product is partially made out of plant-based materials and sugar cane. What millennial family isn’t going to bite on that marketing hook going down the aisle, even if the diaper sells at a premium price to run of the mill doody rags? A one-month supply box of the Huggies Special Delivery diapers costs about $43.99 on Amazon and Walmart. It’s one of Kimberly-Clark’s most lucrative new products in years, CEO Mike Hsu recently hinted to Yahoo Finance. Kimberly-Clark (KMB) did not return a request to be interviewed for this story.

Or, take a gander—or sip—of PepsiCo (PEP) Gatorade’s recent release of Bolt24. It promises “advanced 24/7 hydration,” has no artificial sweeteners or flavors and fewer carbs than standard Gatorade. It’s targeted to workout buffs that aren’t keen on traditional Gatorade’s high carb count and artificial sweeteners and colors.

In 2020, Gatorade will debut its first-ever caffeinated drink to capitalize on the surging market for energy enhancing products, Gatorade Senior Vice President Brett O’Brien told Yahoo Finance on Friday.

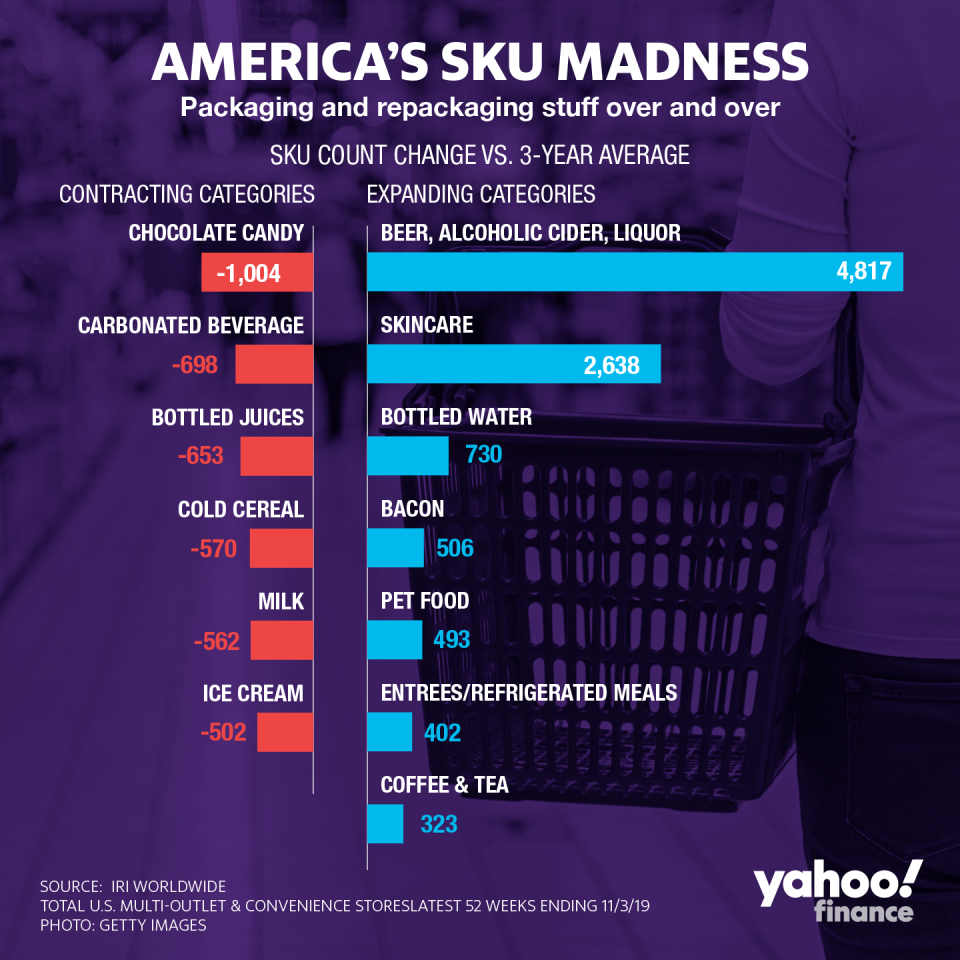

Again, SKU madness.

Swinging for home runs

SKU madness has been a 2019 thing as the consumer economy has held strong. Consumers are armed with more cash, and consumer companies are coming up with new flavors and products to get people to spend.

But this wasn’t the case in 2018. Last year, the Food Retailing Industry Speaks study reported a noticeably large dip in SKU counts. This year’s survey showed a slight uptick from that level, to 33,055. The Speaks study is a comprehensive annual research report that analyzes the state of the food retail industry.

According to data compiled by the Food Marketing Institute (FMI) and Nielsen, overall SKU counts at retailers actually declined in 2018 compared to a few years ago, as retailers moved to cut underperforming products from shelves. However, SKU counts are back on the rise.

“The continued growth of omni-channel strategies and the popularity of smaller format stores appears to be having an impact on the average number of SKUs offered in typical food retail formats. These SKU counts have been on a general decline for the past decade, as assortments are optimized,” according to The Food Retailing Industry Speaks 2019 study. “However, the picture is not one of a straight year-by-year decline.”

While companies like Coca-Cola and PepsiCo have added SKUs where it makes sense—see Gatorade and Diet Coke—some categories have seen a reduction in SKU counts. Big brands are more about swinging for home-runs in an emerging consumer case than blanketing aisles with products that are only slight upgrades.

“It varies by category and some household categories have definitely contracted as a result. You just don’t need that many flavors of bleach,” Mark Baum, FMI’s chief collaboration officer, told Yahoo Finance in an interview. “Think about the chip aisle. We all love the chip aisle, and that’s why that’s an expandable category. So, we’ve gone from let’s say a traditionally an end cap [the end of grocery aisles or edge of a display], to more than an entire aisle [at the store]. This is a really expandable category, again driven by consumer preferences.”

Case in point of innovation down the chip aisle: a barrage of “protein chips” from upstart brands such as Protes and Quest. PepsiCo’s Frito-Lay is one of the bigger potato chip brands that is constantly releasing new seasonal chip flavors. In late August, a limited-edition “Grilled Cheese & Tomato Soup” Lays flavor hit store shelves.

You can think about swinging for home runs down the candy aisle, too.

Candy giant Hershey (HSY) has been one of the more aggressive consumer products companies this year to bring new innovation to market. Or, in other words, clever and well-thought out new SKUs. Introductions have included Reese’s Thins that target calorie counting snackers and Hershey Kisses with pretzels, because who isn’t bullish on crunch nowadays.

“One of the things we start off with is to look at the portfolio we have. We have a company that has been around for 125 years with iconic brands, and we continue to believe that the core of our portfolio really can continue on for that next 125 years if we find new ways to take our core and connect it with consumer needs,” explains Hershey Vice President and General Manager of U.S. confection Chuck Raup. “Reese’s Thins fulfills what we call off the clock me time. What that really is at the end of the day a consumer has all their jobs done, there is this off the clock me time where I get to enjoy. That’s an underdeveloped opportunity for us.”

Food innovation fuels bottom lines

From what consumer brands are reporting in their quarterly results this year, the proliferation of SKUs has helped the top and bottom lines. Coca-Cola’s third quarter sales and earnings beat Wall Street estimates on the back of new flavor variations of Diet Coke, smaller can sizes and zero sugar options.

Coke Zero Sugar’s volume alone is up 14% year-to-date through the third quarter.

Coca-Cola CEO James Quincey told analysts that product innovation has played a major role in helping the legacy Coke brand stay relevant among consumers.

“Consumer-centric innovation has been a key factor, especially over the last few years. This includes smaller packaging such as mini cans, which are growing at a rate of more than 15% year-to-date in the U.S.,” Quincey said.

Coke Energy is yet another new SKU for Coke. After successful tests in Europe this year, it will hit U.S. shelves in 2020. The goal: give someone more of a caffeine kick than a traditional can of Coke.

Over at PepsiCo, it highlighted mid-single digit revenue growth and improved market share trends for Gatorade in the third quarter. Innovation was the big reason why.

“We’re very happy with Gatorade. And with the performance of Gatorade in the sports drinks category, this quarter reflects both the additional investment we’ve made on core Gatorade, the great innovation behind Zero, which is really a very well received incremental innovation to the category, and now we’re starting to make some additional investments in that category with Bolt24. We’re testing and learning and there will be a bigger roll out of that brand next year,” PepsiCo CEO Ramon Laguarta told analysts.

Laguarta noted sales of Gatorade Zero have topped $500 million since its launch in May 2018.

As for Hershey, retail sales of Reese’s—a $2 billion a year plus business—saw sales rise more than 6% in the quarter. In a nation of calorie cutters, that’s impressive growth for good old fashioned chocolate.

Catering to consumers’ tastes

The explosion of new products and flavors is unlikely to slow down anytime soon.

Consumer products companies are sitting on an ever rising amount of data on shopper habits, which is in large part fueling the introduction of, say, a seltzer with caffeine meant to be a zero calorie morning pick-me-up. More data, the easier it becomes to anticipate new consumer needs.

The needs of consumers also continue to evolve as they work longer hours to support growing families or near retirement.

“Athletes’ needs are evolving so our portfolio needs look different from how it did 10 to 15 years ago,” Gatorade Chief Marketing Officer Andrew Hartshorn told Yahoo Finance in an interview. “There are so many micro needs of various athletes. That’s our job, we’re constantly talking to athletes about how we can serve them.”

In other words, expect more Gatorade flavors, more currently unforeseen profits from consumer products companies and who knows, maybe even higher stock prices.

—

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow him on Twitter @BrianSozzi

More from Brian:

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

McDonald's could be the key to $1 billion in sales for Beyond Meat, UBS says

The stock market's biggest winners and losers of the past decade

New NYC coffee chain aims to undercut Starbucks with China-inspired model

Find live stock market quotes and the latest business and finance news

Yahoo Finance

Yahoo Finance