Would Constellation Brands, Inc. (NYSE:STZ) Be Valuable To Income Investors?

Could Constellation Brands, Inc. (NYSE:STZ) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

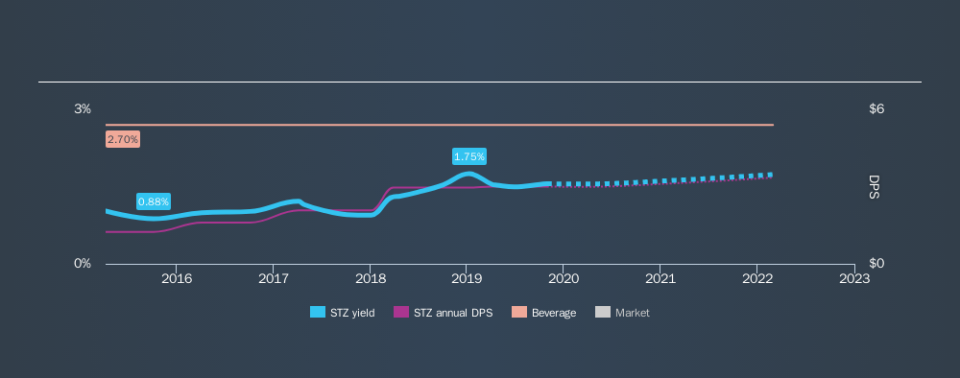

Investors might not know much about Constellation Brands's dividend prospects, even though it has been paying dividends for the last five years and offers a 1.6% yield. A 1.6% yield is not inspiring, but the longer payment history has some appeal. Some simple research can reduce the risk of buying Constellation Brands for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Constellation Brands paid out 74% of its profit as dividends, over the trailing twelve month period. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Constellation Brands's cash payout ratio in the last year was 39%, which suggests dividends were well covered by cash generated by the business. It's positive to see that Constellation Brands's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Is Constellation Brands's Balance Sheet Risky?

As Constellation Brands has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. Constellation Brands is carrying net debt of 4.31 times its EBITDA, which is getting towards the upper limit of our comfort range on a dividend stock that the investor hopes will endure a wide range of economic circumstances.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. Constellation Brands has EBIT of 6.35 times its interest expense, which we think is adequate.

We update our data on Constellation Brands every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the data, we can see that Constellation Brands has been paying a dividend for the past five years. During the past five-year period, the first annual payment was US$1.24 in 2014, compared to US$3.00 last year. This works out to be a compound annual growth rate (CAGR) of approximately 19% a year over that time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Constellation Brands's earnings per share have shrunk at 17% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Constellation Brands's payout ratios are within a normal range for the average corporation, and we like that its cashflow was stronger than reported profits. Earnings per share are down, and to our mind Constellation Brands has not been paying a dividend long enough to demonstrate its resilience across economic cycles. In sum, we find it hard to get excited about Constellation Brands from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from costs or inflation. Businesses can change though, and we think it would make sense to see what analysts are forecasting for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance