Should You Consider PNC Financial (PNC) for Attractive Dividend?

Given the ongoing turmoil in the banking industry and recession fears in the near term, investors are on the lookout for stocks with solid dividend yields. One such stock is The PNC Financial Services Group, Inc. PNC.

This Pittsburgh-headquartered major bank provides consumer and business banking servicesthrough a coast-to-coast branch network, automated telling machines (ATMs), call centers, and online and mobile banking channels.

PNC has been increasing its quarterly dividend on a regular basis, with the last hike of 20% to $1.50 per share announced in April 2022. Over the past five years, the company increased the dividend four times, with an annualized dividend growth rate of 12.13%.

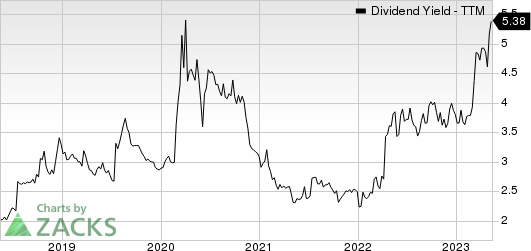

Considering last day’s closing price of $111.58, the company’s dividend yield currently stands at 5.37%. This is impressive compared with the industry average of 4.67% and attractive for income investors as it represents a steady income stream.

The PNC Financial Services Group, Inc Dividend Yield (TTM)

The PNC Financial Services Group, Inc dividend-yield-ttm | The PNC Financial Services Group, Inc Quote

Is the PNC stock worth a look to earn a high dividend yield? Let’s check out the company fundamentals to understand risk and rewards. This will help us make a proper investment decision.

In the first quarter of 2023, the company returned $1 billion of capital to shareholders, comprising $0.6 billion of dividends on common shares. This included a repurchase of 2.4 million common shares worth $0.4 billion. The repurchase was done under a 100-million repurchase plan authorized in second-quarter 2022. Of this, nearly 47% was available for repurchase as of Mar 31, 2023.

However, per management, share repurchase activity is expected to be reduced in second-quarter 2023 due to the recent market volatility and increased economic uncertainty.

PNC Financial has also scaled business through numerous bank and non-bank acquisitions. In September 2022, the company closed the buyout of Linga, a payment solutions firm, in a bid to expand corporate payment capabilities in the hospitality and restaurant industry space.

In June 2021, the company completed the buyout of BBVA USA Bancshares Inc. The acquisition boosted its foothold as a commercial bank in all top 30 markets of the United States, adding$82.2 billion of deposits and $60.5 billion of loans to its balance sheet.

PNC Financial stands solid from the balance-sheet perspective. Total loans and deposits have witnessed a four-year (2018-2022) compound annual growth rate (CAGR) of 9.6% and 13%, respectively. The rising trend continued sequentially in first-quarter 2023 in terms of loans and deposits. With decent pipelines, the company is well-poised for loan balance growth in 2023. The company expects loans to rise 1-3% in 2023.

PNC Financial stands solid from the balance-sheet perspective. Total loans and deposits have witnessed a four-year (2018-2022) compound annual growth rate (CAGR) of 9.6% and 13%, respectively. The rising trend continued in first-quarter 2023. With decent pipelines, the company is well-poised for loan balance growth in 2023. The company expects loans to rise 1-3% in 2023.

It must be noted that during the time when several regional banks, including Signature Bank and Silicon Valley Bank, witnessed deposit flights, leading to their collapse in early March, PNC was able to increase its deposit balance. Both Signature Bank and Silicon Valley Bank were seized by the FDIC and then sold to New York Community Bancorp, Inc. NYCB and First Citizens BancShares, Inc. FCNCA, respectively.

NYCB, through its bank subsidiary, Flagstar Bank, acquired $38 billion in assets (excluding digital asset banking, crypto-related assets or the fund banking business) and assumed $36 billion of liabilities of Signature Bank, while FCNCA assumed Silicon Valley Bank’s assets worth $110 billion, deposits worth $56 billion and loans worth $72 billion.

Therefore, PNC was a beneficiary of the deposits flight from the regional banking crisis. For 2023, period-end loans are expected to rise 1-3%. Despite near-term headwinds like rising expenses and a worsening operating backdrop, PNC stock is fundamentally sound.

Also, the stock has lost 29.4% so far this year and is trading just 1.2% above its 52-week low, making a compelling “buy on the dip” choice.

Therefore, income investors must keep this Zacks Rank #3 (Hold) stock on their radar as this will help generate robust returns over time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report

New York Community Bancorp, Inc. (NYCB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance