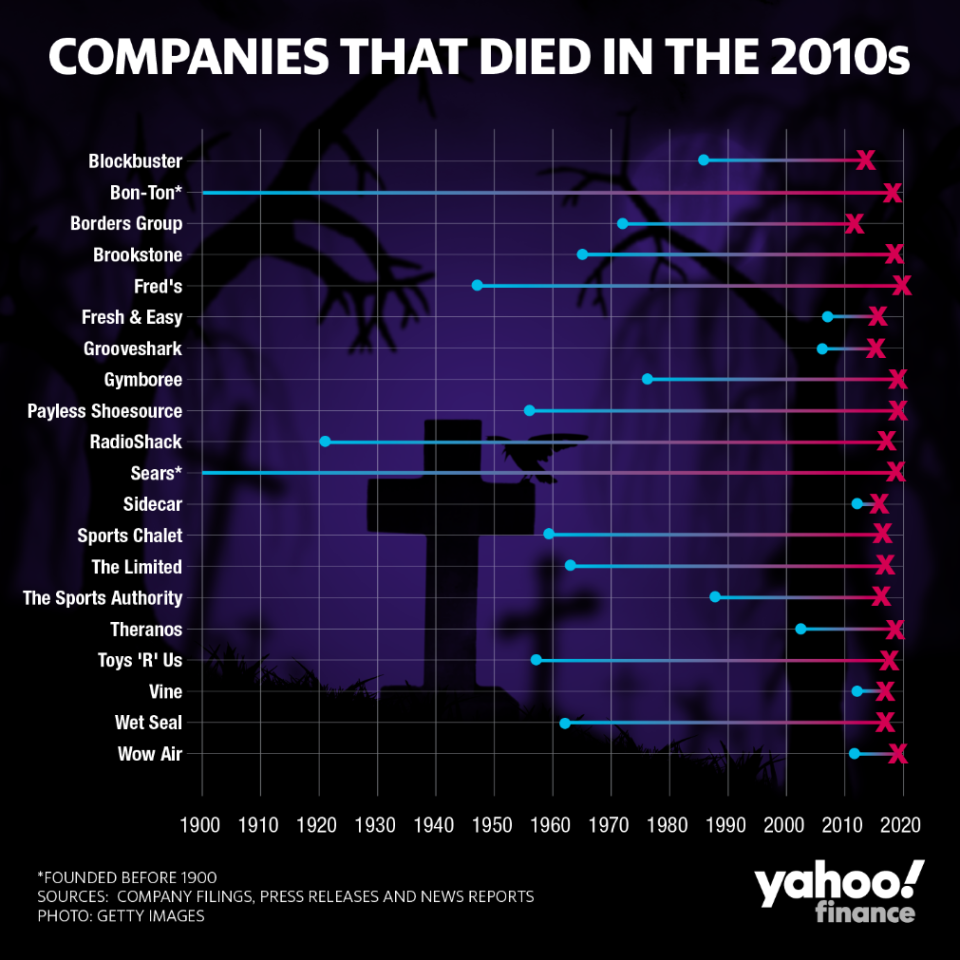

20 businesses that died in the 2010s

The bull market in stocks of the last decade hasn’t been without its headline grabbing downfalls of once formidable corporate titans.

Remember when Sears ruled retail in the 1950s and 1960s? Well by 2018, the company was a shell of its former self as it entered bankruptcy. How about video rental pioneer Blockbuster? Thanks to the rise of streaming movie service Netflix, Blockbuster went belly-up in 2014. Over at one-time leader in Twitter video production Vine, the service was shut down by 2017 amid changes in how Twitter operates, the spread of video on Facebook and the rise of Snapchat.

Sad stuff. But by and large, all are tales of companies that didn’t do enough to stay ahead of competition and adapt to changing market dynamics.

Yahoo Finance took a look back at some of the notable corporate busts from the last decade.

The Borders Group

Founded: 1971

Died: September 2011

It’s easy to dismiss the demise of bookstore chain Borders as yet another casualty of Amazon’s (AMZN) ascent. But to do so would ignore some systemic issues the brick-and-mortar chain faced for years as customers increasingly eschewed the book megastore model.

The original Borders was an 800-square-foot store opened in 1971 in Ann Arbor, Michigan. By 2007, Borders had 567 superstores across the U.S., U.K., and a number of other international locations, averaging 24,800-square-feet each.

Borders invested in its sprawling locations with refurbishments, new physical plants and a dizzying assortment of DVDs, CDs and gifts, just as customers were beginning to shop for all this merchandise online instead. It outsourced e-commerce sales to Amazon, redirecting online customers to Amazon.com in a move that ultimately diluted the customer base and Borders’ ability to catch up in direct online purchases. It never created an e-reading device, as Amazon did with the Kindle and Barnes & Noble did with the Nook. And by December 2010, it was crippled with debt, listing $1.29 billion in liabilities and $1.27 billion in assets.

The company ultimately filed for bankruptcy protection in February 2011. It later held a going-out-of-business sale at all of its 399 remaining locations in July that year.

Blockbuster

Founded: 1985

Died: January 2014

Before viewers were scrolling through Netflix (NFLX) looking for the latest TV show or movie to watch, they were perusing the aisles of their local Blockbuster.

Ultimately, Blockbuster’s business model was disrupted by a number of tech developments, as much from new hardware developments as from competition. Blockbuster launched and proliferated in the era of VHS cassettes, which were typically rented, and wallowed after studios began rolling out DVDs as retail products for direct consumer purchases. As former Blockbuster CEO John Antioco wrote later wrote in a Harvard Business Review essay, “the adoption rate soared,” and also enabled Netflix’s rise since these could be mailed easily.

In 2000, Antioco spoke with Netflix co-founders Reed Hastings and Marc Randolph and then-CFO Barry McCarthy and turned down a $50 million deal to buy Netflix, which at the time was struggling to right itself in the wake of the dot-com bust. The startup eventually went public in 2002.

Antioco later tried to play catch-up to Netflix’s model by launching an online business and eliminating late fees, a key revenue source for the retailer, versus Netflix’s subscription model. But these efforts to keep up with the times were later unwound after Antioco was pushed out amid activist investor pressure. His successor, John Keyes, focused more heavily on boosting the brick-and-mortar business, which was quickly falling out of vogue among consumers.

Blockbuster operated more than 9,000 stores at its peak, according to The New York Times. In 2010, Blockbuster filed for Chapter 11 bankruptcy protection, plagued with hundreds of millions of dollars in debt amid competition from Netflix and other nascent video services. Dish Network (DISH) acquired Blockbuster in 2011 and announced it would be closing its remaining 300 retail locations and mail DVD operations in January 2014. As of 2019, a single Blockbuster location remained open in Bend, Oregon as a privately owned franchise.

Grooveshark

Founded: 2006

Died: April 2015

Grooveshark, the brainchild of three University of Florida undergraduates, was an online service letting listeners sift through thousands of songs on-demand, for free.

That is, until it got embroiled in a host of copyright lawsuits that ultimately brought it down.

Owned by parent company Escape Media Group, Grooveshark at one time had some 35 million users (or about 14% the size of Spotify’s user base of 248 million monthly active users in 2019). The service was aimed at improving discoverability and access to new music, but its actual strategy to achieve this fell in a legal grey area by allowing users to upload copyrighted music onto the platform.

Grooveshark was sued for copyright violations by EMI Music Publishing, Sony Music Entertainment and Warner Music Group, and was ultimately shut down as a settlement between each of these firms. In a parting letter to users, Grooveshark admitted to failing to “secure licenses from rights holders for the vast amount of music on the service,” adding “that was wrong.” Grooveshark urged users to instead turn to licensed services including Spotify (SPOT) and Google Play (GOOG, GOOGL).

Sidecar

Founded: 2011

Died: December 2015

The duopoly Uber (UBER) and Lyft (LYFT) has a command over the U.S. ride-hailing industry that belies a string of smaller competitors left in the dust as the on-demand economy picked its winners and losers over the past decade.

Sidecar was one loser. Founded in San Francisco in 2011, the firm failed to scale to the size and scope of its now household-name competitors, which launched around the same time. Sidecar was only ever available in 10 domestic cities, and many of these were clustered in California.

At risk of being outrun by the competition, Sidecar made an early pivot to deploy its drivers to make last-mile deliveries of packages and groceries, outside of a peer-to-peer ride-hailing business. But even this strategy proved unsustainable, especially given the capital discrepancy between Sidecar and its peers.

By 2015, Sidecar had raised about $39 million in financing, while Uber had at the time raised more than $12 billion in debt and equity and Lyft had raised nearly a billion. And many of Sidecar’s investors — including Google Ventures and Richard Branson — hedged their bets with investments in other ride-hailing companies.

Sidecar ultimately ceased operations at 2 p.m. on December 30, 2015. In early 2016, General Motors (GM) announced it had acquired select assets of Sidecar — just after the Detroit-based automaker made a $500 million investment in Lyft.

Fresh & Easy

Founded: 2007

Died: October 2015

Fresh & Easy’s European-style grocery concept never quite picked up steam in the U.S.

The chain was a subsidiary of Tesco, one of the world’s largest retailers and the first stateside endeavor for the U.K.-based firm. But its strategies for selling groceries — such as plastic-wrapped vegetables — failed to resonate with consumers. Fresh & Easy mostly shirked coupons, a mainstay for U.S. shoppers. And many retail locations were located near competitors like Target (TGT) or Costco (COST), diluting the customer base.

Private equity firm Yucaipa Companies bought Fresh & Easy from Tesco in September 2013, and the company filed for Chapter 11 bankruptcy a month later. By mid-2015, Fresh & Easy’s retail locations had halved from their peak to 97 stores in California, Nevada and Arizona, with many of these concentrated in the Los Angeles area. Yucaipa announced in October 2015 it would shutter all of Fresh & Easy’s locations.

The Sports Authority

Founded: 1987

Died: March 2016

The Sports Authority was the destination for sporting goods and workout gear throughout the 1990s. The stores offered everything from Little League bats to a Nike workout t-shirt all under one roof. In the pre-internet era, it was a good business to be in.

At its height, The Sports Authority operated 460 stores spanning 45 states.

But after years of mismanagement and heated competition from the better run Dick’s Sporting Goods, The Sports Authority filed for Chapter 11 bankruptcy in March 2016. All the stores were closed. Dick’s Sporting Goods purchased several sites and turned them into Dick’s locations.

Sports Chalet

Founded: 1959

Died: June 2016

Many of the same competitive issues plaguing Sports Authority also brought down peer retailer Sports Chalet within the same three-month window of 2016.

Sports Chalet launched after two German immigrants spun a ski shop in La Cañada Flintridge, California, into a publicly-traded sporting goods chain. Connecticut holding company Vestis Retail Group bought the chain in 2014.

By 2016, Eastern Mountain Sports and Bob’s Stores — other outdoor and sportswear apparel companies in the Vestis portfolio — were outperforming Sports Chalet, which was losing customers to big box merchandisers like Target. And Sports Chalet had already had more than $52 million in debt in 2014, when Vestis bought it for $17 million.

Sports Chalet held a going-out-of-business sale in April 2016, closing both its 47 retail locations and online operations. Two days after the store closings began, Vestis Retail Group filed for Chapter 11 bankruptcy protection and later sold off Eastern Mountain Sports and Bob’s Stores to private equity firm Versa Capital Management.

Vine

Founded: 2012

Died: January 2017

Vine’s lifespan as a leading video-sharing platform among teens and young adults was about as fleeting as its six-second clips.

When Vine officially launched for users in 2013, it was already part of micro-blogging company Twitter (TWTR), which had bought the company for a reported $30 million in 2012. While Vine saw strong initial adoption in the creative community, it ultimately failed to keep pace with the competition as other social media platforms began offering their own bite-sized video services. Snapchat introduced video to its existing user base of around 10 million in late 2012, and Instagram launched 15-second video sharing capabilities less than a year later.

And as part of the newly public Twitter, Vine took a backseat to the broader company — although Twitter did acquire ad-tech startup Niche to try and monetize the platform by helping advertisers work with Vine influencers. Vine’s co-founder Dom Hofmann left in 2014 to work on new projects.

Twitter announced in October 2016 that it would end uploads to Vine, but would continue allowing views and downloads. In January 2017, it posted an internet archive of all Vine videos. Hofmann launched a limited beta test of a new app called Byte in April 2019, which is supposed to be a successor to the original Vine service.

Wet Seal

Founded: 1962

Died: January 2017

What teen girl didn’t spend all of her weekly allowance at Wet Seal in the mid to late 1990s? The company was an early leader in the fast-fashion space, offering trendy styles at prices that undercut those of department stores. Sure the clothing quality was terrible, but it was too cool for shoppers to ignore.

The good times for Wet Seal ended in the late 2000s, however. In came ruthless fast-fashion companies such as Forever 21, Zara and H&M. Mall traffic began to wane amid increasing online shopping. And clothing production costs out of China were on the rise.

Wet Seal succumbed to the inevitable when it filed for bankruptcy in January 2017. The company’s bankruptcy saw it move quickly to close 330 of its 500-plus mall-based stores. It tried to mount a comeback after emerging from bankruptcy in March, but it didn’t work.

The chain has since been liquidated.

The Limited

Founded: 1963

Died: January 2017

It was shocking to see The Limited hold on for as long as it did.

The Limited was the brainchild of Victoria’s Secret and Bath & Body Works founder Les Wexner. Hip with teens wandering the mall in the 1980s, The Limited was known for its attainable prices on semi-cool apparel and accessories. The Limited’s name also served as the holding company name for Wexner’s aforementioned brands — and it still does to this day.

in 2010, Wexner sold the then-struggling retail chain to private equity firm Sun Capital Partners. The brand continued to have troubles on Sun Capital’s watch, completely losing its identity by the time it filed for bankruptcy in January 2017.

All of 250 stores have subsequently been liquidated.

RadioShack

Founded: 1921

Died: March 2017

Before there was Best Buy and Amazon, RadioShack was the undisputed electronics leader. The retailer made its name selling Walkmans, boomboxes, batteries and transistors. You needed a new phone cord? RadioShack had your back. It was the place to get knowledgeable service on emerging technology.

At its height, RadioShack operated an astounding 4,500-plus stores across the country.

It all began to go downhill for RadioShack in the 2000s. Big-box stores offered all sorts of electronics under one roof. Amazon undercut RadioShack on prices for low-end tech gear and shipped it straight to your home. As the company was facing all these new pressures, it was horribly mismanaged. The chain over-expanded, and by March 2017 it entered bankruptcy for the second time in a little over two years.

Today, a couple hundred RadioShack stores exist under a license agreement with General Wireless Operations.

Toys ‘R’ Us

Founded: 1957

Died: September 2017

Toys ‘R’ Us was the toy capital of the United States for decades. For most children born before the year 2000, a trip to Toys ‘R’ Us on the weekend was akin to going to an amusement park.

By the early 2000s though, Walmart and Target were becoming serious competitors in the toy business. Amazon turned into the toy selling leader. And the playing habits of children started to change amid the onset of smartphones.

With the writing on the wall, Toys ‘R’ Us inked a $6.6 billion leveraged buyout deal by KKR, Bain Capital and Vornado in 2005. The deal saddled the retailer with enormous debt in the face of slowing sales and profits — not a recipe for financial success.

Toys ‘R’ filed for Chapter 11 bankruptcy in Sept. 2017. After failing to find a buyer, the retailer liquidated all its stores by the end of 2018. The retailer’s demise hit Hasbro and Mattel especially hard.

Interestingly, Toys ‘R’ Us long-time chief merchant Richard Barry purchased the rights to the company’s name. Barry opened his first reimagined Toys ‘R’ Us store ahead of the 2019 Black Friday shopping period.

Bon-Ton

Founded: 1898

Died: February 2018

Bon-Ton was a very early player in the department store space. The retailer was mostly a Midwestern operation and became known for its affordable prices for apparel and housewares.

But the chain never truly gained the scale it needed to stay alive in an evolving retail landscape. Macy’s became a tougher national competitor in 1994 with Federated Department Stores. Kohl’s came hot on the scene in the 2000s, and Target was gobbling up major market share in apparel. Amazon’s ascent in apparel was also becoming more formidable.

At the time of its bankruptcy filing in February 2018, Bon-Ton had 250 or so stores. All the stores were liquidated.

Brookstone

Founded: 1965

Died: August 2018

Brookstone was one of the cooler places to visit in the mall in the 1990s and early 2000s. The retailer always had some new gadget you’d probably never seen before. It was like a Toys ‘R’ Us for adults. The prices were often high, but the merchandise was so out there you couldn’t help plunking down the credit card.

The chain went public in the mid-1990s by Bain Capital. It remained a public company until 2005 when it was sold to a U.S. private equity firm and Chinese retailer.

But similar to most retailers in the 2000s, weakening mall traffic as more people shopped online severely harmed Brookstone. Amazon, Walmart and Target began offering Brookstone-like gadgets online at cheaper prices.

In short, Brookstone lost its magic.

The company filed for bankruptcy in August 2018 with about 250 stores in operation. It subsequently closed all its stores.

Theranos

Founded: 2003

Died: September 2018

Theranos began with a noble goal — to make blood-testing more convenient, inexpensive and painless for patients. By the time it shuttered in 2018, however, it had become a poster child for massive failure by way of poor corporate governance.

Elizabeth Holmes founded Theranos at age 19 in 2003, dropping out of Stanford to run a company promising a procedure that could identify health problems with just a finger prick and a few drops of blood. The company landed hundreds of millions in funding from investors from Rupert Murdoch to Tim Draper and Larry Ellison. By 2015, it had raised more than $400 million in equity at an around $9 billion valuation and had inked a deal to sell Theranos tests at Walgreens.

The company’s luck began to turn after John Carreyrou of the Wall Street Journal posted a multi-part exposé about the company in late 2015, citing employees who claimed the company was deceiving the public about its technological capabilities. The company’s death spiral accelerated over the next three years, with the Securities and Exchange Commission charging Holmes and former Theranos president Ramesh Balwani with “raising more than $700 million from investors in an elaborate, years-long fraud in which they exaggerated or made false statements about the company’s technology, business, and financial performance.” A federal grand jury in 2018 indicted Holmes and Balwani on two counts of conspiracy and nine counts of wire fraud. Theranos shuttered in September that year.

As of early 2019, the Justice Department was reviewing some 17 million pages of documents around the Theranos case, and could potentially add more charges against Holmes, Balwani and others.

Sears

Founded: 1893

Died: October 2018

A true corporate disaster story.

Sears was the Amazon before there was Amazon. But a disastrous 2005 merger with discounter Kmart — led by billionaire investor Eddie Lampert — marked the start of the chain’s slow death.

Lampert was clueless as a retail executive and as CEO of the combined company. He badly under-invested in stores, while rivals Walmart and Target did the complete opposite. Sears stores simply fell apart. Merchandise assortments were third-rate at best, especially in its one-time leadership category of tools. The delivery experience for consumers — a one-time hallmark of Sears — became terrible.

By October 2018, the former retail icon filed for Chapter 11 bankruptcy protection, crippled from years of losses and mounting debt. The company had 700 stores open at the time, down from the thousands it once operated.

Today, Lampert has stepped in to buy a chunk of Sears and Kmart stores. But he continues to shutter locations as sales and profits continue to decline. The zombie company owned by Lampert now has about 200 stores left open across the country.

Gymboree

Founded: 1976

Died: January 2019

Apparel from children’s clothing retailer Gymboree stopped resonating with parents.

Founded in the 1970s, Gymboree entered the 2010s saddled with debt from a leveraged buyout and waning consumer interest in shopping for children’s clothes in brick-and-mortar locations.

Bain Capital acquired Gymboree via a leveraged buyout for about $1.8 billion in 2010, leaving the company under a crippling debt-load that it couldn’t address as children’s apparel store sales broadly declined. Competition from other companies, including the Children’s Place, the largest pure-play children’s apparel seller in North America, as well as Gap and Amazon, weighed on the company further.

At the time of its bankruptcy in January — its second in two years — Gymboree operated more than 800 Gymboree and Crazy 8-branded stores, all of which were subsequently closed. The company sold its Gymboree and Crazy 8 assets to The Children’s Place (PLCE) for $76 million in cash. Gap (GAP) took up its high-end Janie and Jack brand.

Payless Shoesource

Founded: 1956

Died: February 2019

Payless was once among the largest shoe retailers in the U.S, synonymous with selling inexpensive footwear and blanketing lower-tier shopping centers with stores. But the company became unglued at the seams in the late 2000s as people shopped for shoes online. Target became a key destination for affordable footwear and sneaker production costs rose. Not helping the company was that it had hundreds of stores in weak malls amid the shift to online shopping.

Payless filed for bankruptcy in February 2019. It went on to close all of its 2,500-plus remaining stores over the ensuing months.

Wow Air

Founded: 2011

Died: March 2019

Wow Air was the latest in a series of European airlines to end operations amid a crushing race to the bottom in airline pricing.

Started by former tech mogul Skuli Mogensen in 2011, Wow Air’s ascent was poised to disrupt transatlantic travel with ultra low-cost fares and help boost Iceland’s economy through tourism at the tail end of the global financial crisis. It carried 3.5 million passengers in 2018 — from just 110,000 in its first year of operation — after enticing them with base fares that could fall under $200 for long-haul flights.

The combination of fast growth, razor-thin margins, rising competition from other discount airlines like Ryanair (RYAAY) and volatile oil prices left Wow Air cash-strapped and debt-laden, and ultimately unable to raise the capital it needed for a turnaround. Competitor Icelandair backed out of a potential acquisition of Wow Air — twice.

In late March, Wow went bankrupt. It posted a notice on its website that it was canceling all flights, stranding thousands of passengers and urging them to instead search for “rescue fares” with other airlines.

Fred’s

Founded: 1947

Died: September 2019

Chalk up the death of Fred’s in the not-surprising column.

The mostly Midwest discounter was mostly known for its pharmacy operations. That left it vulnerable to Target and Walmart’s aggressive rollouts of pharmacies inside stores that offered one-stop shopping to consumers. Fred’s stores were too small to even try to compete with that model.

Moreover, dollar store chains Dollar Tree and Dollar General have opened thousands of stores the past decade. That caused an exodus of shoppers from Fred’s, which never really embraced the concept of fast expansion.

By September 2019, Fred’s entered bankruptcy with 568 stores across 15 states. All the stores have since been shuttered.

Read the latest financial and business news from Yahoo Finance

Stock Market 2020: BMO’s bull is reminded of Notorious B.I.G., Tupac and Snoop

NBA Legend Magic Johnson: here is my biggest investing regret

Beyond Meat founder: things are going very well with McDonald’s

Starbucks CEO on what China has in store for the coffee giant

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance