Community Health's (CYH) Q3 Loss Narrower Than Expected

Community Health Systems, Inc. CYH incurred adjusted loss of 29 cents per share in third-quarter 2019, narrower than the Zacks Consensus Estimate of a loss of 55 cents. The bottom line also improved from the year-ago quarterly loss of $1.64. The bottom-line result was mainly due to lower admissions in the quarter under review.

Quarterly Operational Update

In the third quarter, net operating revenues were $3.2 billion, surpassing the Zacks Consensus Estimate by 2.9%. However, the top line declined 5.9% year over year due to reduced admissions.

The third quarter witnessed a 9.2% decrease in admissions and an 8.4% fall in adjusted admissions from the respective year-ago figures.

Total operating costs and expenses were $3 billion, down 9.3% year over year owing to lower salaries and benefits plus minimal supplies as well as operating expenses.

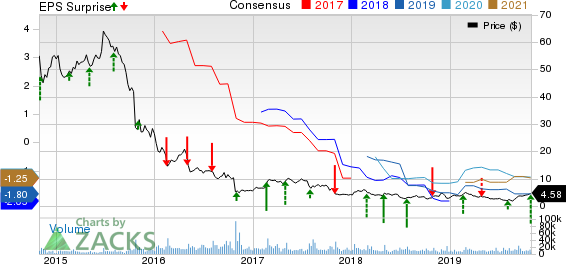

Community Health Systems, Inc. Price, Consensus and EPS Surprise

Community Health Systems, Inc. price-consensus-eps-surprise-chart | Community Health Systems, Inc. Quote

Financial Update

Total assets at third-quarter end were $15.9 billion, up 0.2% from the level at 2018 end.

Cash and cash equivalents were down 19.9% from the level as of 2018 end.

In the third quarter, net cash used in operating activities was $74 million compared with net cash provided by operating activities of $346 million a year ago.

The company has a long-term debt of $13.3 billion as of Sep 30, 2019, down 0.8% from the level as of Dec 31, 2018.

2019 Guidance

Loss per share from continuing operations is now estimated between $1.75 and $1.85 while revenues are projected between $12.9 billion and $13.2 billion. Adjusted EBITDA is predicted in the range of $1.6-$1.65 billion while same store hospital annual adjusted admissions growth is likely to inch up 1.5-2.5%.

Capital expenditure is expected between $425 and $475 million whereas net cash provided by operating activities is projected between $500 and $550 million.

Zacks Rank and Performance of Other Players

Community Health has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other players from the medical sector having already reported third-quarter earnings, the bottom-line results of UnitedHealth Group Incorporated UNH, Anthem Inc. ANTM and Centene Corporation CNC topped the respective Zacks Consensus Estimate.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

Community Health Systems, Inc. (CYH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance