With Colorful Ownership, Snowflake's (NYSE:SNOW) Volatility is Likely Remaining Elevated

This article first appeared on Simply Wall St News.

Few industries of the 21st century are as versatile and exciting as data analysis. It is not surprising that the market is engaged in a Gold Rush, with competitors like Snowflake Inc. (NYSE: SNOW) approaching valuations over US$100b without being even close to profitability just yet.

See our latest analysis for Snowflake.

Q3 Earnings Results

GAAP EPS: - US$0.51 (beat by US$0.10)

Revenue: US$334.41M (beat by US$28.28m)

Revenue Growth: +109.5 Y/Y

The company is projecting a full-year product revenue of US$1.126-1.131b) and a non-GAAP operating loss of -4%. The stock surged over 15% on the news, partially reversing the recent sell-off that erased 23% of the company's value.

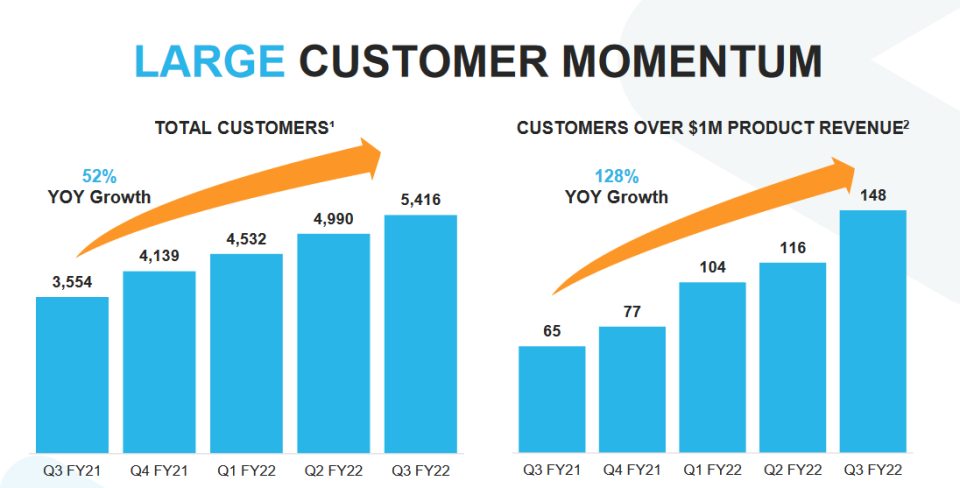

CEO Frank Slootman reflected on the results, pointing out the diverse customer base that includes 223 Fortune 500 companies and growth in new markets like Israel, Korea, and the United Arab Emirates. Furthermore, he announced 148 customers with a trailing 12-month product revenue of over US$1M, showing a persisting large customer momentum.

Who Owns Snowflake?

Snowflake has a market capitalization of US$108b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. In the chart below, we can see that institutional investors have bought into the company.

We can zoom in on the different ownership groups to learn more about Snowflake.

What Does The Institutional Ownership Tell Us About Snowflake?

Institutional investors commonly compare their returns to the returns of a widely followed index. So they generally do consider buying larger companies included in the relevant benchmark index.

Snowflake has a rather hefty stake under the control of institutions. This implies the analysts working for those institutions have looked at the stock, and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock simultaneously, you could see the share price drop fast.

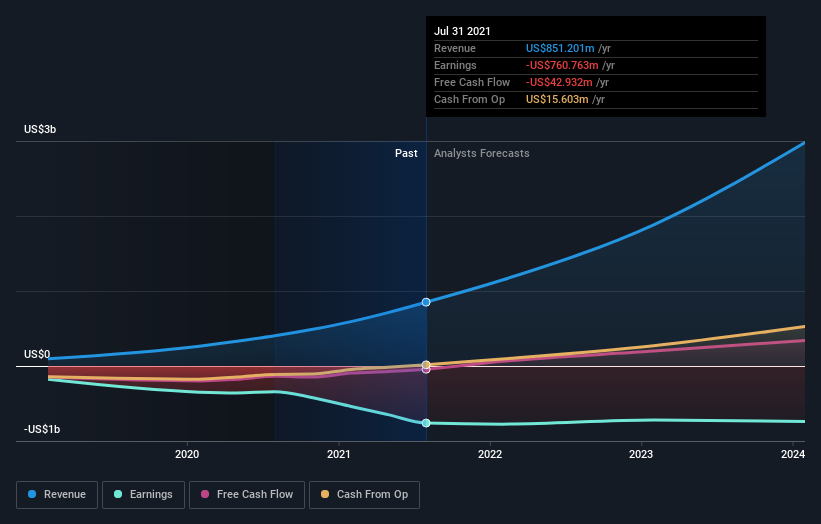

It's, therefore, worth looking at Snowflake's earnings history below.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. It would appear that hedge funds control 7.0% of Snowflake shares. That catches our attention because hedge funds sometimes try to influence management or bring about changes that will create near-term value for shareholders. The company's largest shareholder is ICONIQ Capital, LLC, with ownership of 9.9%. Redpoint Management, LLC is the second-largest shareholder owning 7.3% of common stock, and Altimeter Capital Management, LP, holds about 7.0% of the company stock.

After doing more digging, we found that the top 12 have the combined ownership of 51% in the company, suggesting that no single shareholder has significant control over the company.

While studying institutional ownership for a company can add value to your research, it is also an excellent practice to research analyst recommendations to get a deeper understanding of a stock's expected performance. Quite a few analysts cover the stock so that you could look into forecast growth quite easily.

Insider Ownership Of Snowflake

The definition of an insider can differ slightly between different countries, but members of the board of directors always count.We generally consider insider ownership to be a good thing. However, it makes it more difficult for other shareholders to hold the board accountable for decisions on some occasions.

Our most recent data indicates that insiders own some shares in Snowflake Inc. Insiders own US$10b worth of shares (at current prices). Most would say this shows a good alignment of interests between shareholders and the board. Still, it might be worth checking if those insiders have been selling.

General Public Ownership

With an 11% ownership, the general public, mostly comprised of individual investors, has some degree of sway over Snowflake. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

With ownership of 7.3%, private equity firms can play a role in shaping corporate strategy with a focus on value creation. Some investors might be encouraged by this since private equity can sometimes encourage strategies that help the market see the value in the company.

Alternatively, those holders might be exiting the investment after taking it public.

Public Company Ownership

We can see that public companies hold 3.0% of the Snowflake shares on issue. We can't be sure, but this is possibly a strategic stake. The businesses may be similar or work together.

Next Steps:

With a rather diverse ownership list, the stock's volatility will likely remain elevated in the near future. Short-term speculators should pay attention to hedge funds and VC/PE firms, while long-term investors must keep their eye on individual insiders as an indicator of sentiment.

While it is well worth considering the different groups that own a company, other factors are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Snowflake you should know about. Furthermore, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Yahoo Finance

Yahoo Finance