Colfax (CFX) to Gain From Demand & Buyouts Amid Cost Woes

Colfax Corporation CFX engages in manufacturing and supplying products and services related to fabrication technology and medical technology. The products are sold to customers in multiple end markets, including mining, power generation, general industrial, petrochemical and marine. It is based in Fulton, MD, and has a $6.7-billion market capitalization.

The company belongs to the Zacks Manufacturing - General Industrial industry, which, in turn, comes under the ambit of the Zacks Industrial Products sector. The industry comes in the top 23% (with the rank of 57) of more than 250 Zacks industries. The company presently carries a Zacks Rank #3 (Hold).

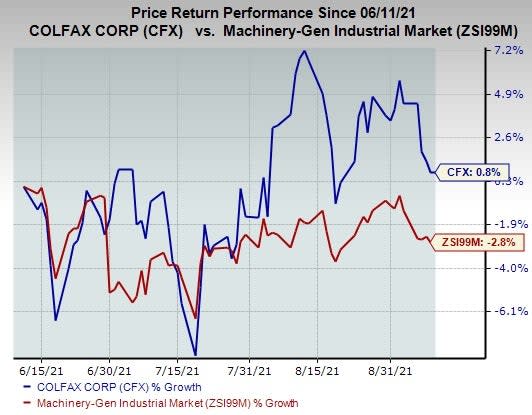

In the past three months, Colfax’s shares have gained 0.8% against the industry’s decline of 2.8%.

Image Source: Zacks Investment Research

There are a number of factors that are influencing the company’s prospects. A brief discussion on important factors and earnings estimates is given below:

Financial Performance and Projections: The company delivered better-than-expected results for the second quarter of 2021. Its earnings surpassed the Zacks Consensus Estimate by 5.66% and sales beat the same by 7.15%. On a year-over-year basis, earnings of 56 cents increased from the year-ago quarter’s 9 cents on the back of strengthening demand and margin generation.

In the quarters ahead, Colfax is poised to gain from its solid product offerings, focus on innovation, strengthening customer demand and a healthy business system. Cost-saving actions are also likely to be advantageous. For 2021, the company anticipates earnings of $2.10-$2.20 per share, up from the previously mentioned $2.05-$2.15. Notably, it reported $1.40 in the prior year. Free cash flow is expected to be $275 million, up from $250 million mentioned earlier.

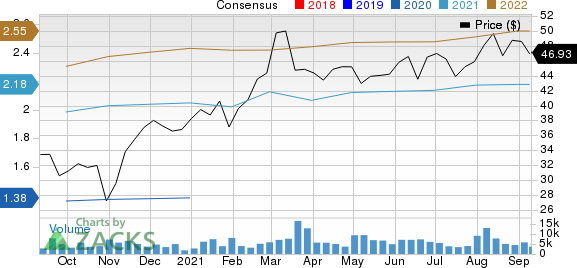

In the past 60 days, the Zacks Consensus Estimate for Colfax’s earnings per share has increased 1.9% to $2.18 for 2021 and 2.8% to $2.55 for 2022.

Colfax Corporation Price and Consensus

Colfax Corporation price-consensus-chart | Colfax Corporation Quote

Segmental Strength and Buyouts: The company’s segments have bright prospects in the quarters ahead, with product innovations and productivity actions playing a key role in it. In the past few quarters, products like AltiVate Anatomic CS Edge, Motion iQ and Robust Feed AVS were introduced by the company.

For 2021, Colfax anticipates year-over-year sales growth of 28-31% for Medical Technology (with organic growth of 14-16%). That for Fabrication Technology is likely to be 21-23% (with organic growth of 19-21%).

Regarding buyouts, Colfax added Trilliant Surgical to its portfolio in January 2021. Since acquired, Trilliant Surgical has been strengthening Colfax’s DJO Global business. Colfax acquired MedShape in April and Mathys AG Bettlach in July 2021. Both acquisitions are aiding Colfax’s reconstructive businesses. Notably, acquisitions boosted Colfax’s sales by 3.8% in the second quarter of 2021.

Cost Woes and Buyout-Related Dilution: The company’s cost of sales increased 49.5% year over year in the second quarter of 2021, while its selling, general and administrative expenses increased 43.2%. Supply-chain-related restrictions inflated costs in the second quarter. In the quarters ahead, cost inflation and restrictions related to supply-chain issues might be concerning.

Also, the acquisition of Mathys is predicted to create an earnings dilution of 3-4 cents per share in the second half of 2021. The buyout was funded through the issuance of 6.5 million shares of Colfax.

International Operations, High Debts & Industry Peers: Colfax carries out its operations in multiple countries, including the United States, Asia, Europe, the Middle East and South America. International diversification has exposed it to unfavorable movements in foreign currencies, geopolitical issues, local competitive pressure and macroeconomic challenges. Also, high debts of $1,576.5 million at the end of second-quarter 2021 might be concerning as it raises risks of a hike in financial obligations. Its cash and cash equivalents were just $62.3 million exiting the quarter.

Three better-ranked companies in the same industry are Nordson Corporation NDSN, Applied Industrial Technologies, Inc. AIT and IDEX Corporation IEX.

All the companies presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, earnings estimates for the companies have improved for the current year. Further, positive earnings surprise for the last four quarters was 17.77% for Nordson, 32.91% for Applied Industrial and 6.73% for IDEX, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Nordson Corporation (NDSN) : Free Stock Analysis Report

Colfax Corporation (CFX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance