Coinbase Traders Withdraw $600M in a Day Amid SEC Lawsuits

User withdrawals from Coinbase soared on Monday and Tuesday as the U.S. Securities and Exchange Commission (SEC) sued the crypto exchange one day after filing a lawsuit against rival Binance.

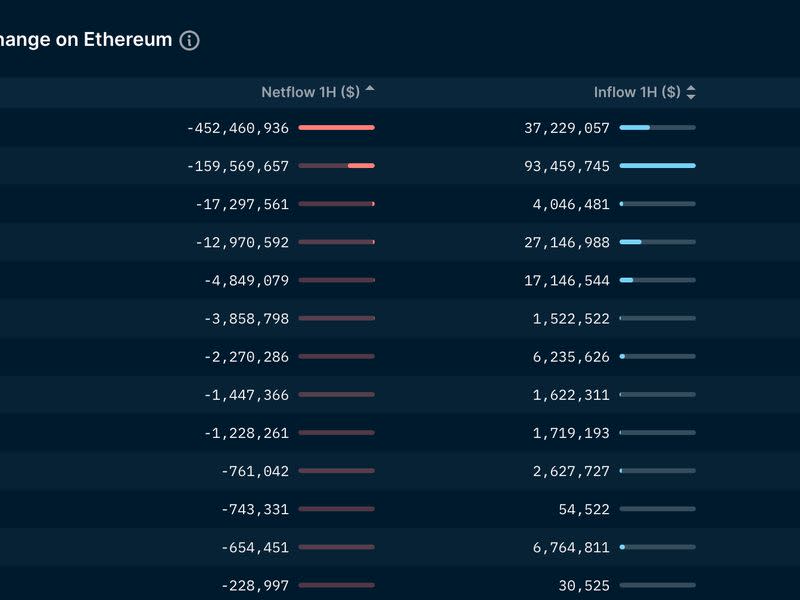

Blockchain data by crypto intelligence firm Nansen shows that Coinbase net outflows over a 24-hour period totaled $600 million. Traders have withdrawn $1.38 billion of cryptocurrencies during this period, compared to $771 million of deposits, per Nansen. The data excludes bitcoin (BTC) transfers.

The outflows happened as the SEC, the top U.S. securities regulator, hit Coinbase with a lawsuit for violating federal securities regulations only a day after suing rivals Binance.US and Binance. Additionally, a slew of U.S. state regulators suspect that Coinbase broke the law by offering staking rewards to users in its “Earn” program.

Read More: Binance Crypto Exchange: Your Questions Answered

Traders have withdrawn funds from Coinbase in two waves, data shows. On Monday, net outflows reached $450 million within an hour following the lawsuit against Binance before stabilizing, according to Nansen data. Withdrawals rose again on Tuesday following the suit against Coinbase, then subsided. At the time of publication, net flows for the past hour turned positive, per Nansen.

The withdrawal surge on Binance has been even larger following the regulatory actions. Net outflows surpassed $700 million on Monday, according to data compiled by 21Shares. It is the largest daily outflow since February, when New York state regulators forced a halt to the issuance of the Binance-related stablecoin BUSD. The trend continued on Tuesday, with net outflows surpassing $1.2 billion over the past 24 hours, according to Nansen data.

The magnitude of the outflows aligns with prior stressful events in the crypto industry, including the crypto banking crisis in March and the collapse of Sam Bankman-Fried’s FTX exchange late last year. The latter shook investor confidence in centralized exchanges.

Real-time blockchain data by Arkham Intelligence suggest that both exchanges process withdrawals in order.

Yahoo Finance

Yahoo Finance